A Strategy Analysis

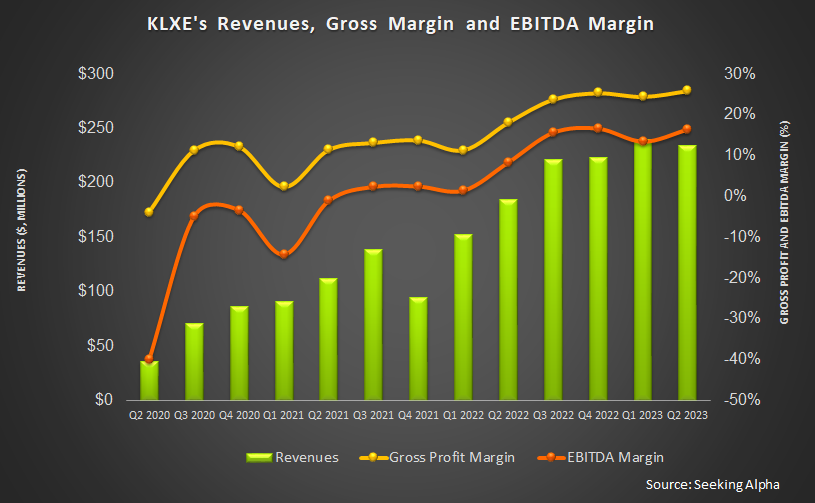

Our short article discussed our initial thoughts about KLX Energy Services’ (KLXE) Q2 2023 performance a few weeks ago. This article will dive deeper into the industry and its current outlook. KLXE follows a strategy of having a presence in the major US basins with a portfolio of well life-cycle products and services. In Q2, its completion, production, and intervention businesses were relatively resilient despite the rig count fall. It has built strength in the fishing business and Tubing technologies. The Greens acquisition and market penetration in the Rockies has benefited the frack rental business. Although revenues declined modestly in Q2, they shifted to higher-margin product and service lines to increase margins.

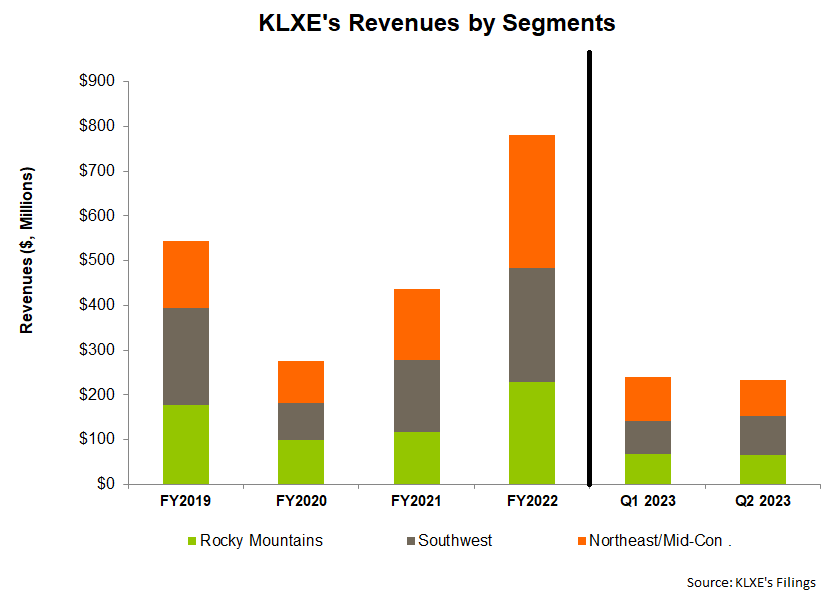

The Southwest region was the highest revenue contributor in Q2, accounting for 37% of its sales, followed by Mid-Con (35%). The Southwest benefited from increased directional drilling, frac rentals, and coiled tubing. Also, there was a shift toward the Southwest following the addition of the Greens business in Q2. KLXE acquired Greens in March. Greens provides wellhead protection, flowback, and well-testing services. In the Permian and Eagle Ford, its services will complement KLXE’s frac rental and flowback offering.

Pricing Strategy

In the pricing strategy, KLXE chose to keep the pricing level steady. It resulted in lower utilization, which translated into lower revenues. The policy also allowed it to reallocate assets to more attractive basins. However, buckling the pricing trend may not be possible if the entire industry witnesses long-term price cuts. The energy services industry remains fragmented as many smaller players give pricing discounts to improve utilization. The market also saw drilling and completion delays in Q2 following lower frac count and drilling activity.

Q3 Outlook

The company faces headwinds in the tubular, mud motor steel products category in the rentals business. The fracking side of the business, including frac pumps, pump-down, and coiled tubing units, also slowed down. So, the company deferred several projects, which resulted in a $15 million capex reduction for FY2023. The energy prices, on the other hand, are strengthening in Q3. In this circumstance, KLXE’s management expects crew utilization and pricing to improve while revenues can fall. It will continue to rotate assets among the basins to mitigate commodity price volatility and increase margin.

In Q3, its revenues can decline by 5% (at the guidance mid-point), while its adjusted EBITDA margin can deflate by 200 basis points. In FY2023, it can generate $900 million-$950 million in revenues, which would be an 18% hike compared to FY2022. Its adjusted EBITDA margin can expand by 360 basis points (at the guidance midpoint) versus a year ago.

Q2 Performance Drivers

Our short article discussed KLXE’s year-over-year topline decrease in Q2 2023. Despite the US rig count’s fall during the quarter, the Technical Services business saw revenue rising modestly due to a stronger fishing business and advances in Tubing technologies. Green’s activity and the market penetration in the Rockies boosted its frac rentals business. This also helped it expand the adjusted margin in Q2 compared to Q1.

Cash Flows And Debt

KLXE’s cash flow from operations turned significantly positive in 1H 2023 compared to a negative CFO a year ago. Although capex increased, its FCF also turned positive. The cash flow improvement reflects higher revenues and robust working capital management. It reduced its FY2023 capex target by 20% from its previous guidance. Although it reduced net debt by 17% from Q1, as of June 30, 2023, KLXE’s leverage (debt-to-equity) was very high, at 7.1x, due to low shareholders’ equity.

Relative Valuation

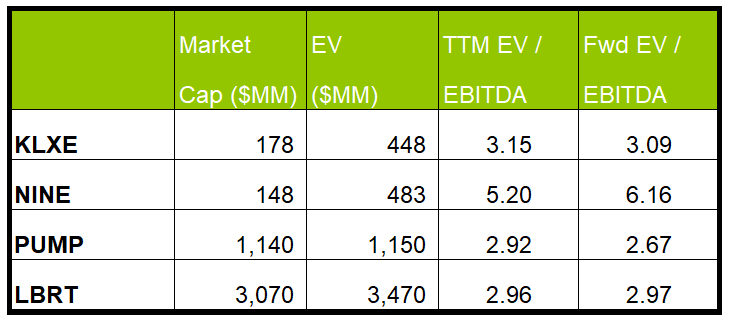

KLXE is currently trading at an EV/EBITDA multiple of 3.2x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is lower.

KLXE’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA contrasts with its peers because its EBITDA is expected to increase versus a fall in EBITDA for its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (NINE, NEX, and LBRT) average. So, the stock is undervalued versus its peers.

Final Commentary

In Q2, drilling activity slowed in the US while completion, production, and intervention activity plateaued. It kept the pricing level steady, which resulted in lower utilization. This adversely affected KLXE’s topline. So, the company pursued a policy of going after the higher-margin products and services. It built strength in the fishing business and Tubing technologies. Geographically, it shifted toward the Southwest following the addition of the Greens business in Q2.

In Q3, lower fracking activity can result in lower revenues, although pricing can strengthen. The company will rotate assets among the basins to mitigate commodity price volatility and increase margin. In 1H 2023, its cash flows improved tremendously, which helped it deleverage. However, the company’s low shareholders’ equity will continue to make its balance sheet inherently risky. The stock is relatively undervalued versus its peers.