As we step into 2024, the global economy confronts a new challenge with the escalating crisis in the Red Sea. This week’s Monday Macro View delves into the economic repercussions of this geopolitical tension, highlighting key data and statistics that underline its potential impact on global trade and economic stability.

The crisis was triggered by US strikes against Houthi targets in Yemen, responding to the group’s aggressive actions in the Red Sea. The Houthis, supported by Iran, have disrupted one of the world’s most critical maritime channels, raising fears of increased fuel prices and supply chain disruptions. This situation has led to a significant military response from the US and its allies, further escalating tensions.

The World Bank has expressed concerns about the crisis’s potential to reignite inflation and disrupt energy supplies. The conflict, along with the ongoing war in Ukraine, is contributing to a complex global economic scenario, characterized by higher interest rates, slower growth, and persistent inflation. The World Bank’s report warns of the possibility of surging energy prices and the impact on global activity and inflation.

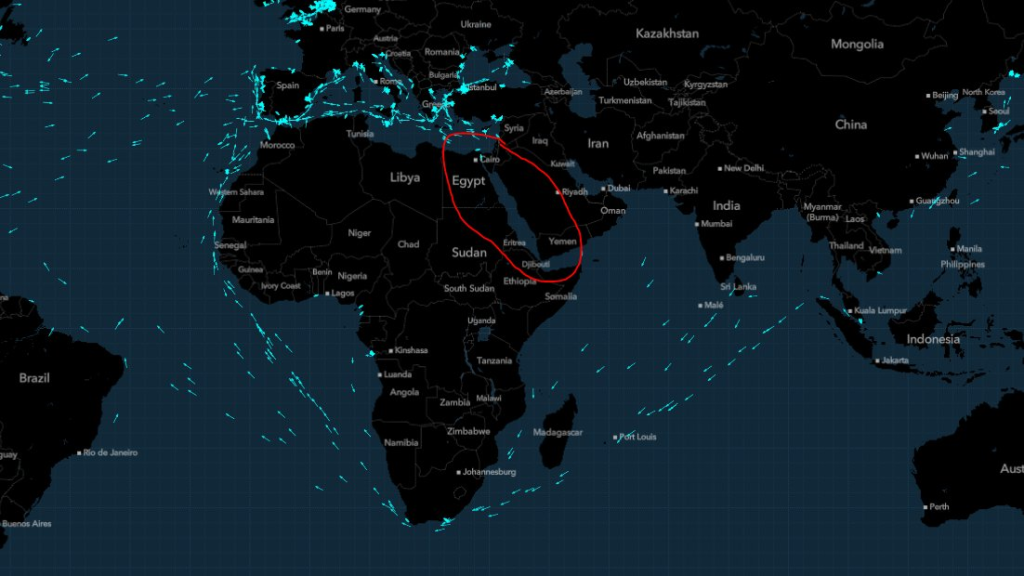

The closure of the Red Sea route, crucial for connecting to the Suez Canal, is already having a tangible impact. Major shipping companies are rerouting their vessels, leading to delays and increased costs. The Suez Canal is responsible for 10-15% of world trade and 30% of global container shipping volumes. The prolonged closure could severely disrupt global supply chains, pushing up the prices of manufactured goods and challenging efforts to combat inflation.

Oil prices have seen a rise due to the crisis, with Brent and US crude gaining about 3% on fears of a wider regional conflict. The World Bank’s report highlights the risk of a spike in energy prices, which could lead to significant spillovers to other commodity prices and heightened geopolitical and economic uncertainty.

In terms of trade, the crisis has led to a 1.3% drop in global trade from November to December, as reported by Germany’s Kiel Institute for the World Economy. Container shipping costs have surged, with rates for major trade routes originating in Asia estimated at $5,000-$8,000 per container,2.5 to 4 times the normal levels for this time of year, according to Judah Levine, head of research at logistics firm Freightos. However, these rates are still 45%-75% below their pandemic peak in late 2021.

Image: Javier Blas, X: Container ship traffic – with all avoiding Red Sea

The crisis’s impact extends beyond shipping costs to broader economic concerns. Economists attending the World Economic Forum in Davos are increasingly worried about potential recessions in major economies. They fear that central banks might maintain high interest rates for longer than expected, adding to the cost of living crisis faced by millions of households. The possibility of higher oil prices could further compel central banks to sustain elevated interest rates.

The Red Sea conflict’s escalation has prompted warnings from various economic experts about the potential for a renewed inflationary burst. The World Bank emphasizes the need for governments to avoid fiscal consolidations and instead provide financial support to stimulate economic growth. Additionally, there’s a call for a massive scale-up in global climate finance, highlighting the importance of reducing fossil fuel subsidies and fulfilling international financing commitments.

In conclusion, the Red Sea crisis presents a critical challenge to the global economy in 2024. Its resolution or further escalation will significantly influence economic growth, inflation rates, and the stability of international trade. The decisions made by world leaders and economists in response to this crisis will be crucial in shaping the economic landscape for the year ahead and beyond.