Through all of this volatility, I think we will see a shift higher in the brent price range as we move into February and into Q2. February is likely to see a price range $71-$76/$78 depending on when the U.S. and how they respond to the death of several soldiers. If Iran sovereignty isn’t hit, I would expect to see a $3 drop from the current levels. There was a quick spike lower on the Israel/Hamas ceasefire rumor, which gives an indication of how much geopolitical risk sits in the market. Demand isn’t doing the crude markets any favors as more data supports rates staying higher for longer.

Geopolitical risk always fades once the market “bakes it in” and gets “comfortable” with the risk. The crude markets dipped following a false headline, and it still hasn’t recovered the pricing as prices softened in the physical market, negative data came out of China, and the Fed rate cut in March is “officially?” dead. In my opinion, a March rate cut was never an option, but the market didn’t truly agree until Feb 2nd.

SONANGOL SPOT OFFER:

- 1m bbl of Girassol for March 17-18 offered at Dated +$2.40/bbl

- Cut from +$2.60 on Jan. 25, +$2.80 on Jan. 22

- NOTE: IOC purchased a spot cargo of Dalia crude from Sonangol last week

45 cargoes of crude are due to load for Asia in January, equating to 1.31m b/d, according to Bloomberg estimates compiled from a survey of traders, loading programs and vessel-tracking

- Decreased from revised 1.57m b/d in December which comprised 52 shipments

- Shipments to China are set to dip to 939k b/d in January from 964k b/d in December

- Unipec, Sinochem are the main buyers

- Shipments to India are to decline to 155k b/d, the lowest since April, from 310k b/d in December

- Five cargoes to India, down from ten a month earlier; IOC was the sole buyer for January

- Exports to Indonesia decreased to 95k b/d from 268k b/d previously

PLATTS:

- Gunvor sold 88k tons of CPC Blend for Feb. 23-27 to Eni at Dated -$4.25/bbl, CIF Augusta: trader monitoring Platts window

- That’s the lowest price in almost a year in data compiled by Bloomberg

- Johan Sverdrup, CIF Rotterdam:

- Total bought from Equinor for Feb. 25-29 at Dated +55c/bbl: trader monitoring Platts window

- Equinor previously offered the grade at +$1.20 on Feb. 1

- Equinor also offered cargoes at same price for Feb. 15-19 or Feb. 20-24

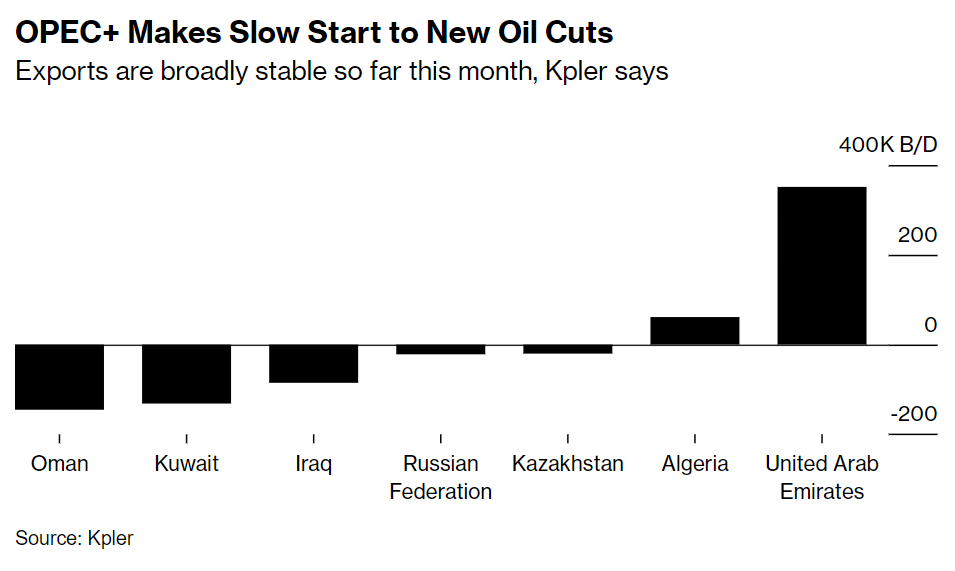

- OPEC Cuts Oil Production as Coalition Begins New Supply Pact

- Output declined by 490,000 barrels a day, survey shows

- Iraq and United Arab Emirates remain above production quotas

Even though things have softened, they are still stronger than Dec/Jan and will likely remain better given the geopolitical risk that remains in the market. The additional shipping time/cost and refiners preparing for the Spring ramp. U.S. crude still remains very competitive in the global market supporting exports into Europe and now Africa. Iraq still can’t ship crude through the Ceyhan pipeline, which is limiting total exports. Iran is producing at multi-year records, but based on recent events in the Red Sea- we have seen India pull back hard on purchases.

The crude markets caught momentum following an increase in Red Sea attacks and strikes on land. In the water, an anti-ship missile struck the vessel Marlin Luanda in the Guld of Aden. Trafigura was the operator of the vessel that was said to be carrying naphtha, The INS Visakhapatnam was the first to make it to the vessel and provided support to the crew and efforts to put out the blaze. The USS Carney and FN Alsace were quick to follow and were able to provide air cover while putting out the fire. I think it’s important to recognize the role that India is playing on a global scale, as they look to get more involved abroad and establish themselves on the world stage. Following the attack, the U.S. and U.K. struck several areas within Yemen against the Houthis. This will continue to take time to shrink the capabilities of the Houthis in the region.

The crude markets dropped today when there was a false announcement of a cease fire between Hamas and Israel. Israel has carried out several strategic attacks in Lebanon, Syria, and the West Bank taking out high level IRGC Quds and Hezbollah officers. There have been continued launches of suicide-drones into U.S. bases as well as Houthis launching missiles/drones into the Red Sea.

On the ground, the Iran backed militias in Syria and Iraq sent a suicide drone into a training outpost on the Jordan-Syria border resulting in the death of three U.S. troops and wounding about 34. The base called “Tower 22” is just within the Jordan border, and we have seen the U.S. “adjusting” assets around the world to create a direct strike in response. There are several options on the table that will happen following the death of U.S. soldiers.

- A coordinated air offensive across Syria, Iraq, and Yemen to reduce the capabilities in the region.

- A more pointed strike in only Syria and Iraq to limit the abilities to carry out similar attacks

- The sinking of an Iranian spy ship stationed in the Red Sea sending intelligence back to the Houthis.

- Another (less likely) option is to directly hit Iranian coastal assets. This would be a clear escalation, so the closest we would get to a direct hit on Iran would be their naval assets in the Red Sea.

The U.S. has “approved” a prolonged campaign against attacks following the death of several soldiers. The new normal has been a delayed response to maximize the impact of the response. There were several measured strikes in Yemen to take out assets that were set for “imminent” launch.

There is a view that the sinking of this vessel and two of her support vessels would be an escalation and not a retaliation. The U.S. has moved around several B-2s, B-52s, and Pegasus refueling planes since the attack in Jordan, which signifies an extended/ coordinated attack. There was a recent announcement “Kataib Hezbollah, the Iran-backed militia blamed for deadly drone attack in Jordan, says it’s “suspending military operations” against U.S. forces.” There is likely a lot happening behind the scenes, but it’s unlikely to stop the response going forward. This has only been confirmed by a resumption of attacks against U.S. forward operations in the region.

All of these unknowns and potential increases in geopolitical risk have taken crude prices higher. Depending on the U.S. response, crude prices will fluctuate but likely head lower given Biden’s stance of not “escalating.” There was already about $5 of geopolitical risk in brent prices at $77, with another $5 added in following the attack and confirmed death of U.S. soldiers. Once the U.S. responds, I expect a “quick” reduction of $3 but some stickiness in the remaining premiums.

There has been some tightness in the physical market as customers rushed to lock-up “local” crudes to help avoid issues in the Red Sea. As more crude goes around Africa, it adds about 4k nautical miles, which has pulled forward some buying to ensure the crude arrives on time. Many refiners are already purchasing for the “spring ramp,” and the issues in the Red Sea have helped pull some of that buying forward. It has also left some barrels stranded, which has also helped to tighten prices in the near term. “The number of tankers diverting on longer voyages around the Cape of Good Hope has increased to 100 from last week, according to a report from Oil Brokerage. That’s a jump of about 45% from the firm’s count of 69 on Jan. 24. The vessels are carrying about 56 million barrels of crude and petroleum products, according to the report. Shipments of clean petroleum products — such as diesel-type fuel — via the Bab el-Mandeb Strait at the southern end of the Red Sea fell to 625,000 barrels-a-day last week, versus a “usual” two million, the report added. Many vessels are avoiding the Red Sea route because of attacks by Houthi militants on merchant shipping, instead sailing around South Africa’s Cape of Good Hope.”[1] This has cooled off a bit as we discuss above, but some of the risk premiums and costs will remain throughout Feb.

The additional cost and rush has helped support differentials and spreads, but as buying slows- there should be some slack in differentials as we head into February. “West Africa’s overall crude oil exports to Asia this month are set to drop the lowest since November, on weaker flows to India and Indonesia.” There has been a slowdown of flows from WAF into Asia, which has helped push some additional volume into Europe and the U.S.

When you look at OPEC+ cuts, there has been a very slow start to the cuts- just as we expected. “Key coalition members pledged to reduce supplies by a further 900,000 barrels a day this month to stave off a global surplus. Oil exports are one indicator of these countries’ progress in implementing their cuts, and so far in January overall shipments have remained broadly unchanged, according to data from the Vienna-based market-intelligence firm.” My view was that you would actually see a small decline or small build as the UAE’s “cut” was actually an increase as they push their volumes higher with an adjusted flow rate.

“Exports from the seven OPEC+ members engaged in new cuts have averaged about 15.4 million barrels a day so far this month, barely changed from December, Kpler estimates. It’s a similar picture from the wider alliance, with shipments steady at roughly 28.1 million barrels a day.” Kuwait and Oman cut exports significantly in January, yet Russia, Kazakhstan and Iraq made only modest reductions, according to Kpler’s estimates. Moscow has had more crude available for sale overseas as a result of disruptions at several domestic refineries, the firm said. The United Arab Emirates, which was permitted a slight production increase under the terms of the latest OPEC+ agreement, bolstered shipments considerably, according to Kpler. Flows have climbed by about 350,000 barrels a day to average 3.1 million a day. Saudi Arabia, the largest crude producer in OPEC+, isn’t required to make any additional cuts in January as part of the group’s agreement.

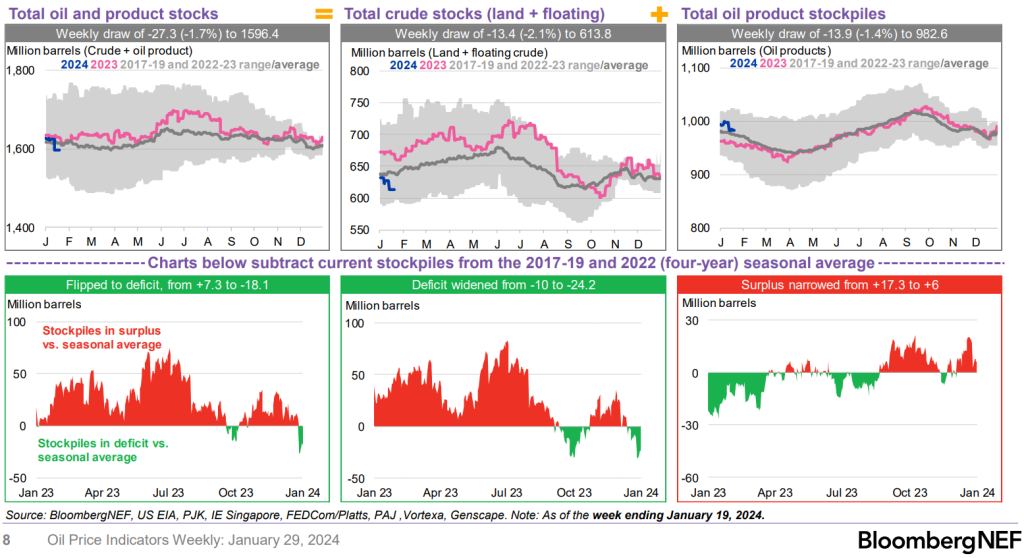

We are seeing more crude in transit, which is helping to show some drops in the land storage market. A large part of this is timing delays and weather impacts on production (in the U.S.) that led to some of the larger drops. The builds in products still remains above seasonal norms, but we should see some of that balance out over the next few weeks.

The floating storage market has seen reductions as delays kept crude from reaching areas on time, and more crude went into transit from the floating storage market. This is something that should adjust over the next few weeks, but stay fairly reduced compared to last year.

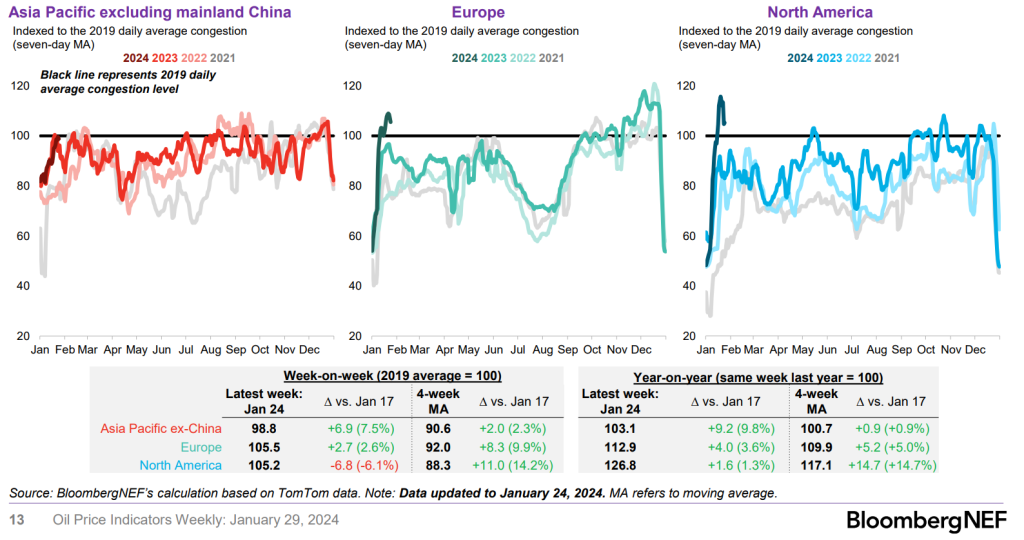

Congestion saw an increase, but a lot of that was caused by weather in the U.S. as broad gasoline demand is well below seasonal norms. I expect to see a sizeable drop next week when the new data gets embedded. Gasoline demand in the U.S. remains depressed with more builds coming over the next week.

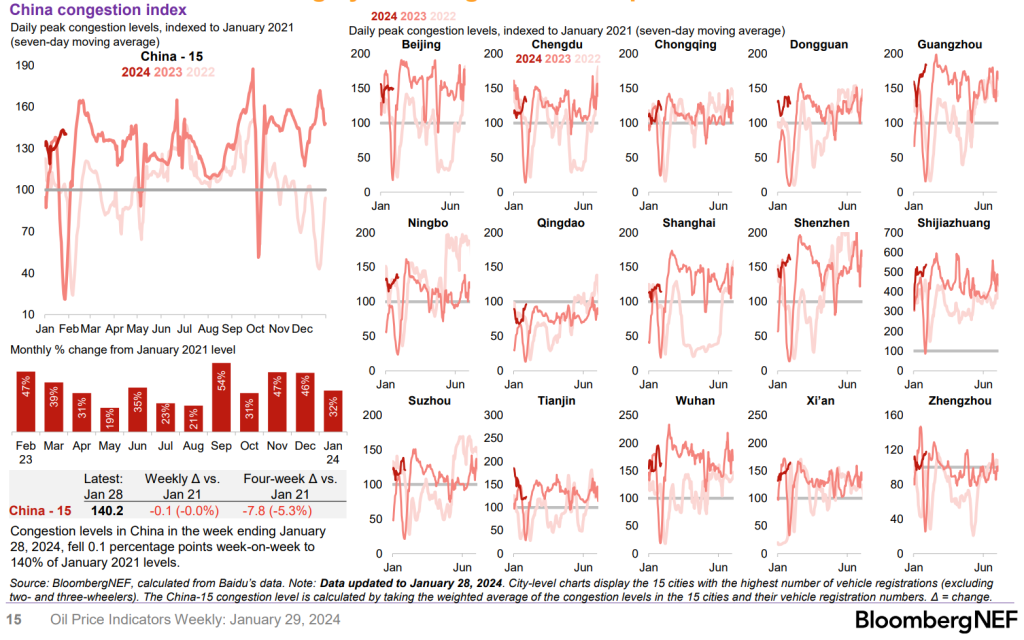

China has been fairly flat at the current levels, but we should see a nice spike next week with the kick off of their holiday. This will help send demand higher, but it will be short lived, and look similar to what we saw last year.

Chinese refiners remain mostly inline with seasonal norms, and we should see a drop along seasonal norms with the weeklong holiday kicking off on Feb 6th.

What is happening in the market is right inline with our expectations as we came into 2024. This is why we believe a large part of the recent increase in brent pricing is driven by geopolitical matters and less about demand.

There were some other key updates this week with “adjustments” made to Saudi Aramco’s MSC or maximum sustainable capacity. In 2020, they guided to an increase of the MSC from 12M barrels per day to 13M. There is a key “caveat” in the number when you look at the projects that are already underway: “Yet much of the buildup underpinning the increase in production capacity was already underway, including the expansion of several oil fields: Dammam (set to add 75,000 barrels a day starting this year), Berri (250,000 barrels from 2025), Marjan (300,000 barrels from 2025) and Zuluf (600,000 barrels from 2026). Only the expansion of the Safaniya oil field, slated for 2027 with 700,000 barrels a day extra, hasn’t started. Currently, Aramco plans to continue to build the four projects it had already started, thus avoiding a write-down. The projects would add 1.25 million barrels a day of additional potential. But Aramco can offset the increase and keep its maximum capacity unchanged by letting output in other more mature fields decline more quickly than it had previously planned.”[2]

We will see more of this production come online, but there is no need for them to “announce” an increase to the MSC. When I was in Ras Al Khair, the expansion of petrochemicals was happening without a hitch with the 400k barrel a day facility under construction. KSA is actively looking to expand their downstream capacity, and at their peak power burn consumed a total of 700k barrels a day of crude and fuel oil. It wouldn’t take much for KSA to convert the power to run on NG, but there won’t be any near-term shift in the strategy. KSA can say a lot of things or make whatever adjustments they want, but I can guarantee the “cancelled” project will still go ahead at some point in time.

On the flip side, the KPC (Kuwait state owned oil company) is investing heavily in expanding their total production capacity. As I highlighted above, even with the change in the KSA “strategy,” they will be maintaining many of these projects. While Iraq, UAE, and Kuwait continue to deploy capital to expand capacity and grow total production levels. Last year, I broke down the full expansion of the UAE, and this year it will be Kuwait’s turn to take a step higher. Kuwait’s goal is to hit 3.2M barrels a day next year with more expansion coming over the next decade. They will also follow a similar track as KSA with the expansion of their downstream assets across petrochemicals/ refining.

“You have a plan to reach 4mn b/d capacity by 2035 and maintain that through 2040. How are things moving towards that goal?

Our strategy to 2040 and beyond is predicated on there being a greater demand on our crude, and it also means that we will have to invest to reach that capacity. Our interim goal will be to reach 3.2mn b/d next year and we are well on target to reach that. Our current capacity is about 2.9mn b/d [including Kuwait’s share of the Neutral Zone] although our Opec+ allocation is lower than that. That is why I say we do have some spare capacity to bring online if the markets demand it.

Already in the last year and a half, since I came to this position, we were able to unlock quite a bit of capacity increase. We were about 2.6mn b/d when I came in and we have quickly reached 2.9mn b/d. And a lot of that has been just from unlocking capacity that we had that was held up in the supply chain.”

Where will the capacity additions come from?

We identified several new fields in Kuwait that we have never touched before. Those I would call additional unlocked potential. We are increasing our production of heavy oil from Ratga. We are also going offshore now — 85 years of production in Kuwait has been onshore and we have never gone to produce offshore. So we now have our first new exploration well offshore and we just spudded a second one. The virtue of Kuwait’s geology is that our reservoirs are stacked, so we have only targeted a certain number of layers. New production will come from additional layers from pretty much the same geographical location, so that is a third option. And a fourth one, we do have new discoveries that we had left behind, did not want to touch now, and leave for the future. And those are going to be part of what will take us to 4mn b/d.

So, we have a very rich resource base. The burden on us now going forward is to bring forward that resource base through the facilities we are going to have to build. That is why we say we have an aggressive campaign to move our production capacity up. And while it is costly — it is going to cost about $300bn through 2035. Over the next five years, we anticipate around $8bn-10bn/yr of investments on the upstream to get us to our capacity numbers.”[3]

Between LatAm and OPEC, it’s very unlikely we see a supply issue in the foreseeable future. OPEC+ has also announced a “review” of the voluntary cuts given the ongoing cheating by many of the countries.

The voluntary cuts and geopolitical risk are the reason we are still seeing brent prices sitting at the current levels. The demand side of the equation is the largest overhang as China struggles, and the U.S. economy tracks sideways. Europe is already in a recession with some of the periphery countries saving from “officially” being in a recession. In the U.S., we have a BUNCH of conflicting data as small/medium banks renew their drop following New York Community Bank dropping like a rock. On the flip side, some of the recent PMI and productivity data has surprised to the upside, but we also saw a big increase in “prices paid” which is an important leading indicator for inflation. Inflation is reigniting in the U.S., and it will keep the Fed from cutting in March with Q3 the most likely period of a cut.

There’s been a bunch of data that has come out over the last few weeks showing how inflation in the U.S. is turning higher once again. “January average hourly earnings +0.6% month/month vs. +0.3% est. & +0.4% prior.”

January average hourly earnings +4.5% year/year vs. +4.1% est. & +4.3% prior (rev up from +4.1%).

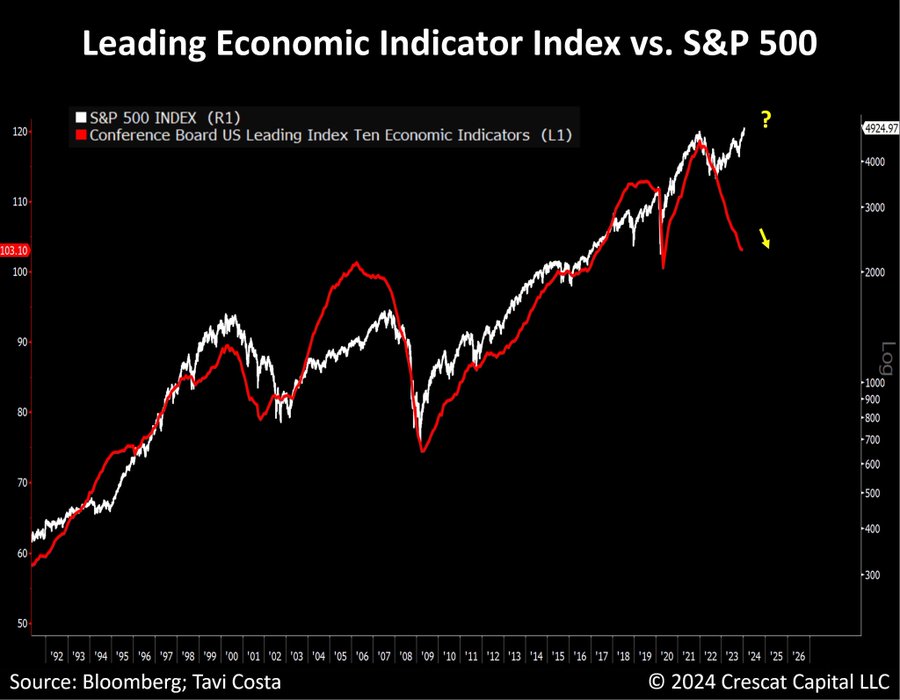

We are seeing a big pick-up in wages, which is a problem for the Fed. Back in the 70’s, the Fed believed they “got in front of inflation” and began cutting rates far too soon that fueled a wage price spiral. It wasn’t stopped until Volcker came in and pushed Fed fund rates over 20%. There are a ton of similarities to the late 70’s in today’s market- obviously with MUCH bigger numbers. Many of the leading indicators have picked back up, and we will see more pressure on inflation/wages.

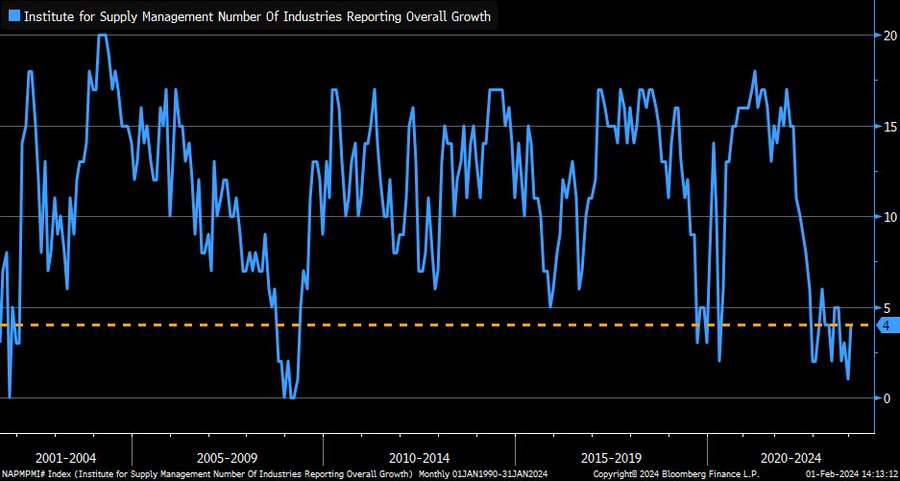

The U.S. economy continues to move sideways, which gives rise to a stagflationary backdrop; “Only 4 industries reported growth in January per ISM Manufacturing PMI … not a strong print relative to history, but off recent low.” Breadth in the market has weakened further, which is why I believe we get more of a sideways move.

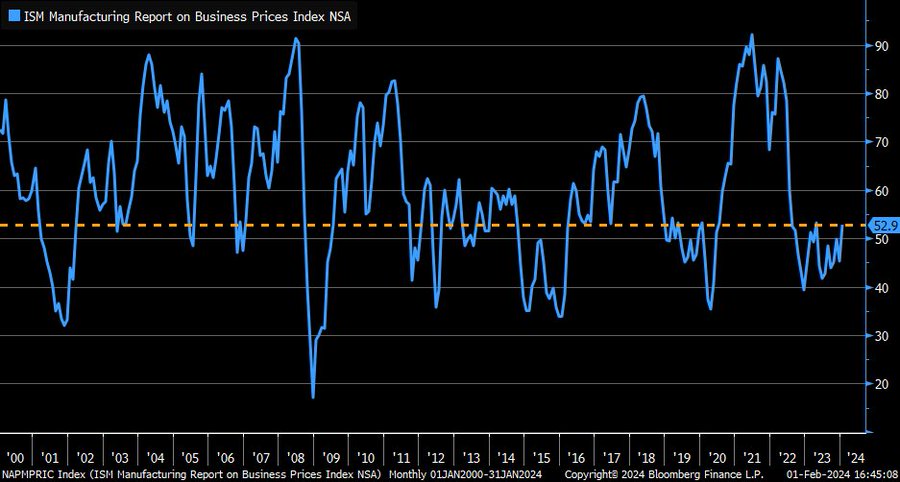

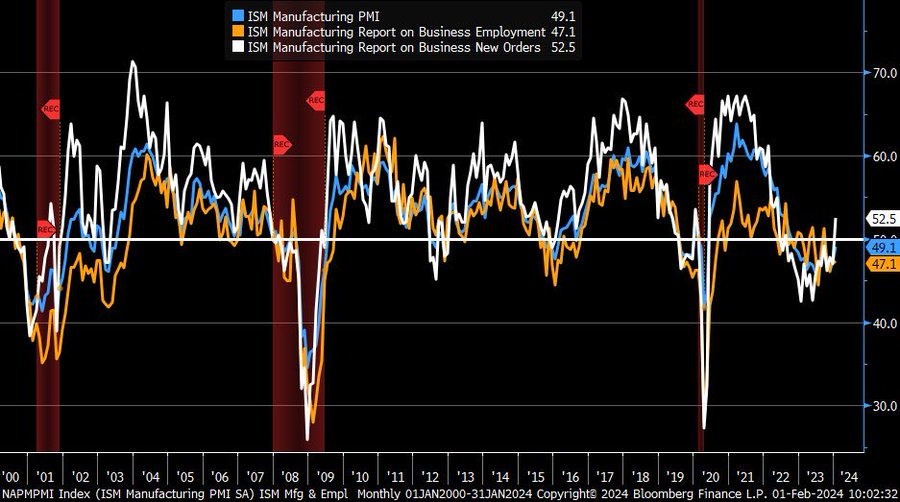

The PMI Manufacturing number still remained in contraction, but jumped much closer to 50. The bigger issue is the strong bounce in prices paid- which jumped back into expansion. This comes as we saw another step higher in services, which never went negative.

January ISM Manufacturing PMI at 49.1 vs. 47.2 est. & 47.1 prior (rev down from 47.4); new orders jumped to 52.9 vs. 45.2 prior; prices paid jumped to 52.5 vs. 47 prior … employment stayed in contraction at 47.1 vs. 47.5 prior.

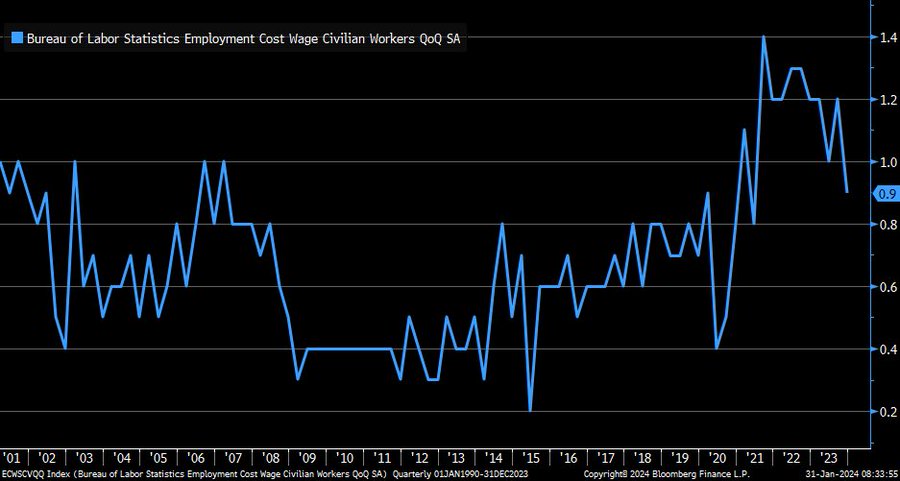

Wage growth expectations have moderated, but they haven’t seen the sizeable drop that the Fed wants to see- especially as loan conditions improved at banks. “Wage portion of Employment Cost Index grew by 0.9% in 4Q2023 … well off peak but not yet in line with pre-pandemic average.”

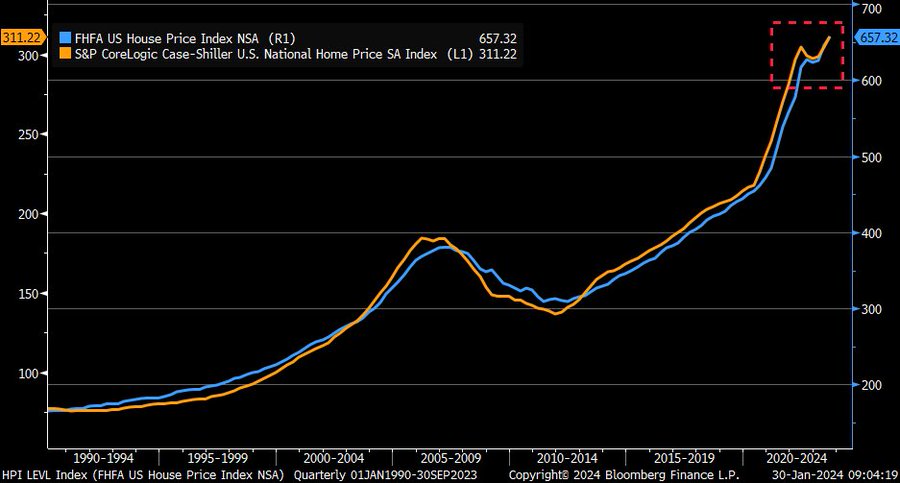

Another piece of concern for the Fed are home prices moving higher once again: “3-month annualized % change in existing home prices (using S&P CoreLogic CS data) held up at +8.7% in November … still in faster zone relative to history.” This kind of acceleration isn’t what the Fed needs to see to cut rates… all the more reason they stay higher.

“Both home price indexes from FHFA (blue) and S&P CoreLogic CS (orange) have made new all-time highs … recent dip was short and shallow.”

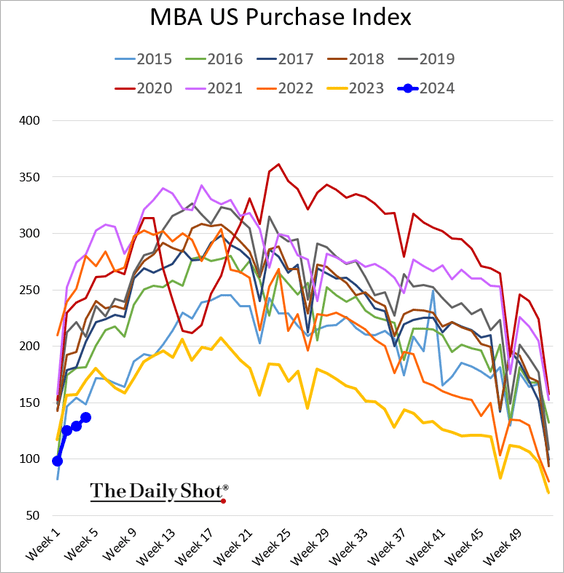

Tis also comes as MBA purchase index stays at a multi-year low as many remaining buyers utilize “all cash deals.” We are moving firmly into the last leg of the expansion of pricing in the U.S.

There hasn’t been a single regional Fed print that has shown positive growth, but they have all shown rapid expansion on Prices Paid… more pain to come!

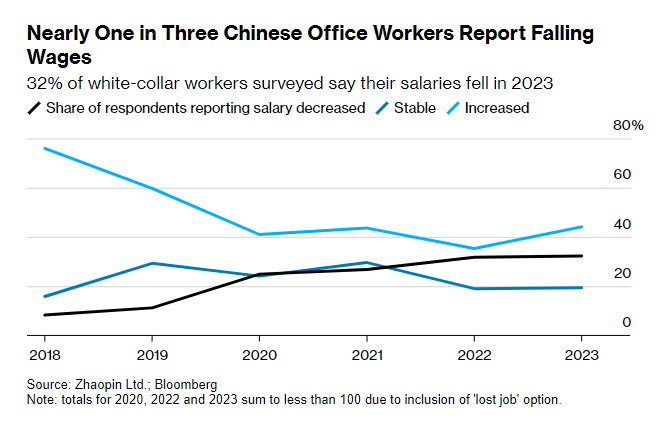

I will briefly touch on the Chinese situation, but it’s more of the same regarding what I have highlighted over the last few years. Growth remains stagnate with the consumer getting hit on all fronts. Chinese PMI data and underlying data is still showing no growth or slight expansion, but nothing that shows they will hit 5% growth rates. It could easily push out 1%-1.5% growth, but a big pivot is impossible without structural reform. The same could easily be said about the U.S., and the ballooning deficit, but this is more about the many structural breakdowns in China. The consumer is stuck with real estate assets that don’t physically exist while wages are falling across the board. “Nearly a third of Chinese office workers reported falling salaries last year, the highest share in at least six years, underscoring persistent deflationary pressures in the world’s second-largest economy. About 32% of white-collar workers in China surveyed by the online recruitment platform Zhaopin Ltd said their wages dropped last year. That’s the largest proportion going back to at least 2018, according to data compiled by Bloomberg.”[4]

It doesn’t matter how much the PBoC ties to cut rates- there is no demand for additional leverage! Businesses and consumers a like don’t want any additional leverage. This is putting a hard stop on new loans and the movement of capital throughout the banking system.

#China January official #PMI Manufacturing PMI 49.2 [Est.49.1 Prev.49.0] Non-Manufacturing PMI 50.7 [Est.50.6 Prev.50.4] Composite PMI 50.9 [Prev.50.3]- this type of “growth” won’t be enough to offset the pain at the consumer level and slowing exports.

Both the U.S. and China need fresh cash injections, but there is no longer a “lender of last resort.” This is leaving them to cycle through the same cash without seeing a meaningful increase in GDP growth. The 2020’s are firmly in position to be the decade of no growth. On a global level, we have seen a gross misallocation of capital that isn’t going to correct itself any time soon. The U.S. markets are ignoring the very real problems we face, while the Chinese markets have continued to fall DESPITE all of the talk around stimulus. With every failed stimulus attempt in China, the CCP is losing credibility as they don’t have the tools to fight the Law of Diminishing returns.

The leading data is troubling for everyone- the U.S. is no different- the below chart helps to summarize the issues in a single point in time.

China’s stock market is going from bad to worse, and the State Council isn’t going to take it anymore.

The latest: On Monday, following a Premier Li Qiang-chaired executive meeting, the State Council issued a call to action:

- “We must take more powerful and effective measures to stabilize the market and confidence.”

- “It is necessary to enhance the consistency of macro policy, strengthen policy coordination, consolidate and enhance the economic recovery, and promote the stable and healthy development of the capital market.”

To that end, the State Council said officials must:

- “Greatly enhance the quality and investment value of listed companies”

- “Increase the influx of medium and long-term funds into the market”

- “Enhance the market’s inherent stability”

Some context: In July, the Politburo vowed to boost the “vitality” of capital markets.

- Soon after, regulators started rolling out measures designed to push up stock prices.

More context: Those measures haven’t worked.

- The CSI 300 Index is down almost 20% from end-July.

- On Monday, the index declined 1.6%.

Get smart: The central government needs share prices to rise to realize critical goals.

- China’s underfunded pension system needs rising equity valuations to support an aging population.

- Rising stock prices are vital to funding innovative firms.

- Higher valuations would boost household wealth that’s been eroded by declining home prices.

Our take: Regulators will intensify their efforts to prop up the market, potentially roping in the National Team to buy shares.

- That didn’t take long: The latest reporting from Bloomberg this morning indicates that officials are “seeking to mobilize about RMB 2 trillion (USD 278 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link.”

- That would be a big shot in the arm for domestic shares.

What else to watch: Additionally, we expect monetary easing in Q1 and additional fiscal support during the legislature’s annual plenary meeting in March to help boost confidence.

For both pivotal countries- the short answer to all of the above- it isn’t different this time… there is more pain ahead!.

- https://www.bloomberg.com/news/articles/2024-01-30/red-sea-chaos-sends-100-tankers-round-africa-oil-brokerage-says?sref=9yOLp5hz

- https://www.bloomberg.com/opinion/articles/2024-01-30/big-oil-the-world-is-transitioning-to-american-crude-from-saudi-output?sref=9yOLp5hz

- https://www.argusmedia.com/en//news/2531918-qa-kpc-investing-to-meet-future-oil-demand?backToResults=true

- https://www.bloomberg.com/news/articles/2024-01-30/more-of-china-s-white-collar-workers-say-their-wages-are-falling?sref=9yOLp5hz