Market Outlook

Our recent article has discussed Liberty Energy’s (LBRT) Q4 2023 financial performance. Here is an outline of its strategies and outlook. LBRT has a “stable” outlook for the fracking industry. Pricing will likely remain steady as lower supply will match lower completion activity. Engineering and designs have improved substantially. These factors led to higher frac intensity, offsetting the decline in average reservoir quality. More frac activity will likely be required to offset production declines.

The recent review of US LNG exports and a temporary ban on exports can, however, adversely affect the company’s revenues from natural gas-related services. Nonetheless, the company believes in a “durable multiyear cycle” as demand for affordable energy rises.

Frac Spread Count And Strategies

LBRT aims to maximize efficiency, reduce emissions, and lower fuel costs by deploying innovative pump technology, mobile power generation, and CNG fuel supply. By 2024, it expects to convert 90% of its pressure pumps to be powered by natural gas through Liberty Power Innovations. To that effect, it plans to double LPI’s capacity in 2024. To achieve a competitive advantage in the industry, LBRT follows a strategy different from its peers who lease technology and contract power generation and gas supply. Because of the rising demand to power frac fleets with natural gas, the company aims to build all its natural gas-powered frac spreads consistent with digiFleets fit (digiFleets offer compressed natural gas delivered by Liberty Power Innovation’s Division). It also helps operators develop a microgrid to augment their oilfield operations. By combining digiFleets with its innovative and capital-efficient solution, the company has carved out a competitive edge.

LBRT has also introduced digiPower mobile generators, which are scalable. digiPower brings thermal efficiency and low emissions modular solutions. LPI’s solution has seen increasing demand because of the lack of logistics infrastructure in natural gas-powered fracs. In 2023, the matching of digiTechnologies and LPI turned things around for LBRT. It has four digiFleets deployed in two basins. The company plans to roll out two more. As we discussed above, digiFleets and dual-fuel fleets will account for 90% of its total frac spread composition by the end of 2024. Our recent article here shows you more about LBRT’s take on the energy industry.

LBRT’s Outlook

In 2024, the drilling and completion industry will go through an early slowdown due to the typical seasonality and E&P companies’ cautious capex. LBRT expects its Q1 2024 revenues and adjusted EBITDA to remain flat, followed by a modest increase in subsequent quarters. The company will invest in digiTechnologies and the LPI business, generating strong free cash flow.

LBRT plans to invest in Liberty Design next-generation frac technology, particularly in natural gas fuel supply, that will drive efficiencies over the next decade. Also, LPI caters to various businesses that will potentially diversify its revenue base. Its management believes its investment in low-emission and highly efficient solutions will significantly improve its free cash flows.

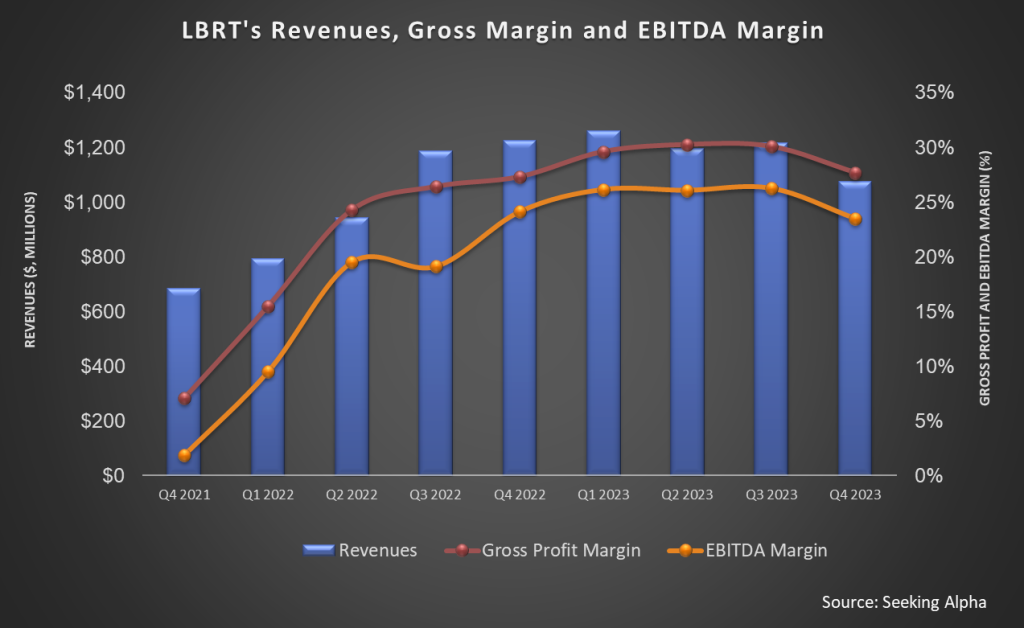

LBRT’s revenues decreased by 11.6% in Q4 quarter-over-quarter, while its adjusted EBITDA recorded a 21% fall. In Q4, its frac spread count declined by one. Its net income also decreased by 37% in Q4 from Q3.

Cash Flow & Balance Sheet

Continuing its share repurchase plans since July 2022, which was later upsized to a share buyback plan of $500 million, LBRT repurchased 13.7 million shares in FY2023 for $203.1 million or $14.82 average price per share. LBRT’s current stock price ($19.54) exceeds the average repurchase price.

In FY2023, led by higher revenues, Liberty’s cash flow from operations increased by 91% compared to a year ago. Its free cash flow also increased tremendously (by 4.2x). Net debt decreased by $72 million in FY2024 from the prior year. As of December 31, 2023, its total liquidity was $314 million. Following strong cash flows, in Q4, it increased share repurchase authorization to $750 million through July 2026.

Relative Valuation

Liberty is currently trading at an EV/EBITDA multiple of 3.1x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is higher, implying a lower EBITDA in the next four quarters. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of ~17x.

LBRT’s forward EV/EBITDA multiple versus the current EV/EBITDA is expected to expand more sharply than its peers because the company’s EBITDA will fall more steeply than its peers in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is marginally lower than its peers’ (NINE, PUMP, and ACDC) average. So, the stock appears to be slightly undervalued compared to its peers.

Final Commentary

LBRT is positioned distinctly in the fracking industry due to its deployment of innovative pump technology, mobile power generation, and CNG fuel supply. By 2024, it expects that 90% of its pressure pumps will be powered by natural gas. The company plans to add two more digiFleets in 2024. Among recent innovations, it has introduced digiPower mobile generators, which are scalable. Combining digiTechnologies and LPI can diversify its revenue base, while investment in low-emission and highly efficient pressure pumping solutions can lead to strong free cash flow generation.

Despite the long-term growth drivers, LBRT can see its topline and EBITDA decline in Q1 due to the typical seasonality and E&P companies’ cautious capex. Based on its ability to generate strong free cash flow through the cycles, it has recently increased its share repurchase program. The stock is slightly undervalued versus its peers at this level.