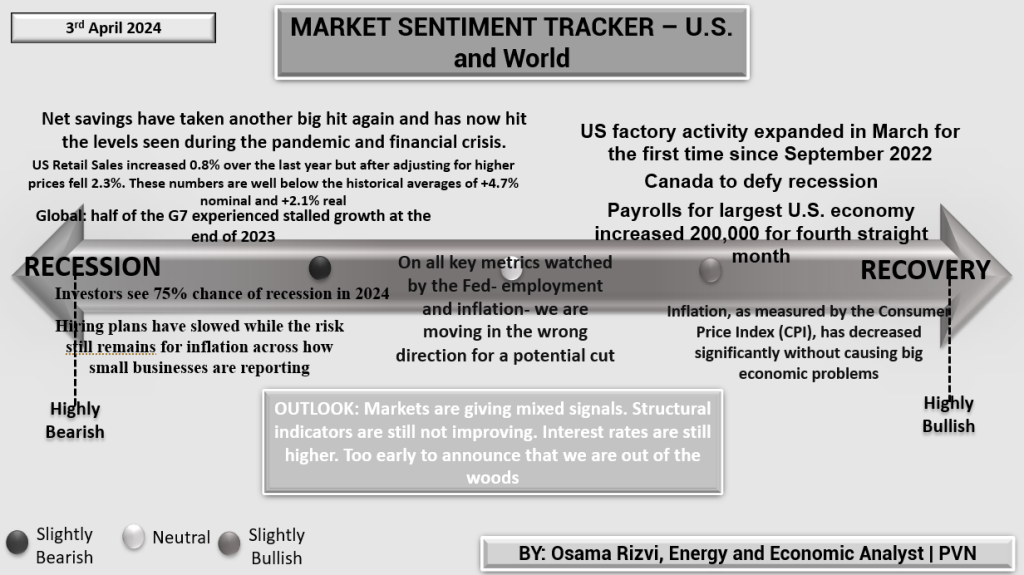

In the United States, economic indicators present a dichotomy between expansion and caution. Factory activity has surged, marking a rebound for the first time since September 2022, while payroll numbers bolster confidence with a 200,000 increase for the fourth consecutive month. However, the landscape isn’t without its challenges. Net savings are diminishing, and retail sales growth, up by 0.8%, struggles to keep pace with historical averages after accounting for inflation. The Federal Reserve’s stringent focus on employment and inflation metrics keeps the possibility of rate adjustments alive, as markets reflect a mixed response.

Europe’s narrative is shaped by both adversity and resilience. Manufacturing output has seen a twelfth consecutive month of decline, with the Purchasing Managers’ Index (PMI) indicating continued contraction at 46.1. Yet, there’s a spark of recovery in the services sector, with flash PMI readings suggesting stabilization. This dichotomy extends to labor markets, where German consumer sentiment sees a modest lift, despite broader manufacturing woes. It’s a complex picture, with growth forecasts remaining tentative amid energy crisis risks and supply chain disruptions.

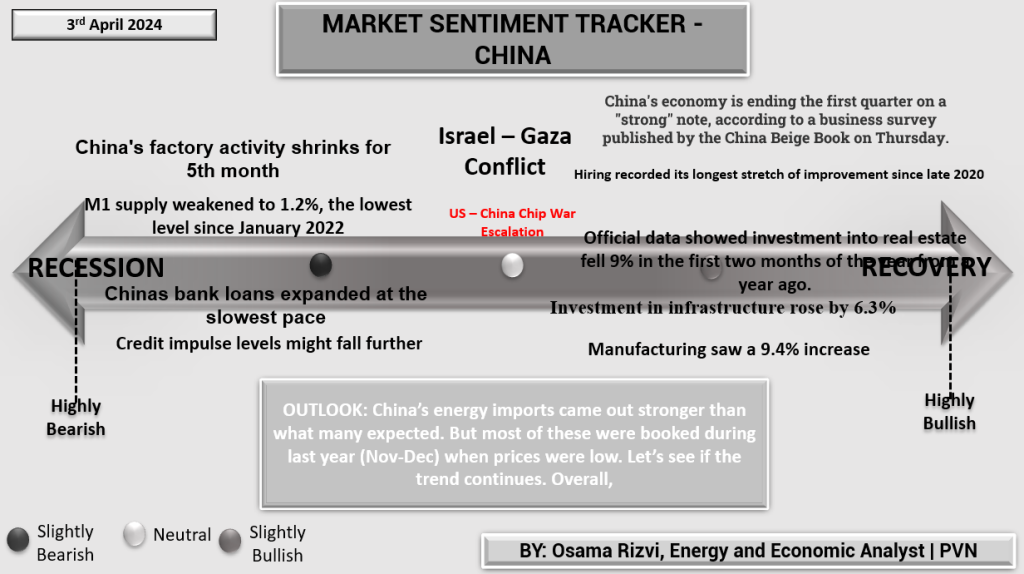

China’s economic conditions signal cautious optimism, despite persistent headwinds. The manufacturing sector continues to contract, yet infrastructure investments, up by 6.3%, and a notable 9.4% rise in manufacturing output suggest targeted policy interventions are gaining traction. Real estate remains a concern with a 9% investment drop in the early months of the year. However, robust trade performance, especially with BRI countries, underscores China’s integral role in global supply chains. China’s composite outlook reflects a strategic rebalancing, seeking stable growth while navigating internal and external pressures.

Integrating these insights, the global market sentiment is cautiously optimistic. Structural headwinds remain, notably in inflation management and supply chain integrity. Yet, economic actors across these regions demonstrate adaptability, suggesting that while the road to full recovery may be uneven, progress is tangible.