Janet Yellen’s recent remarks in China spotlighted a growing concern among global economists: China’s vast manufacturing capabilities are not just an internal matter but have ramifications for the global economy. China, with its ambitious 5% economic growth target for 2024, faces the task of rebalancing its growth model towards domestic consumption while managing the side effects of its industrial policies on global markets.

In the realm of oil, OPEC+ has maintained its output policy, with voluntary production cuts totaling approximately 2.2 million barrels per day (bpd), in addition to existing cuts of 3.66 million bpd agreed upon in 2022. These decisions are pivotal in the context of oil prices, which have seen Brent crude rally to a six-month high, nearly reaching $90 a barrel. This pricing strategy is crucial for OPEC+ nations, aiming to stabilize the market around this price point while avoiding spikes that could lead back towards the $100 a barrel mark, potentially inflaming inflationary pressures and affecting global demand.

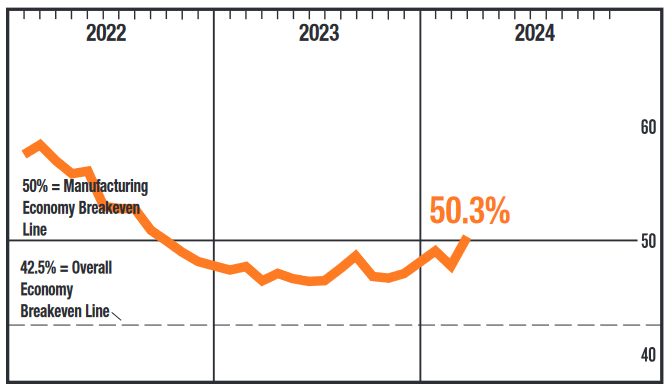

JPMorgan’s note on the delayed U.S. recession prospects, buoyed by a significant uptick in ISM manufacturing activity above the 50-point threshold for the first time since September 2022, presents a more optimistic view of the economic outlook. This recovery in manufacturing, indicative of robust demand and production rebound, suggests a potential shift in recession forecasts, pushing the anticipated economic downturn to 2025.

Contrasting these optimistic projections, David Rosenberg warns of underlying economic vulnerabilities. He urges caution, suggesting that the signs of stability might be deceptive, and the economic resilience seen may not ward off a future downturn. His perspective is grounded in a critical analysis of current market trends and historical economic cycles, emphasizing the importance of vigilance in the face of apparent economic growth.

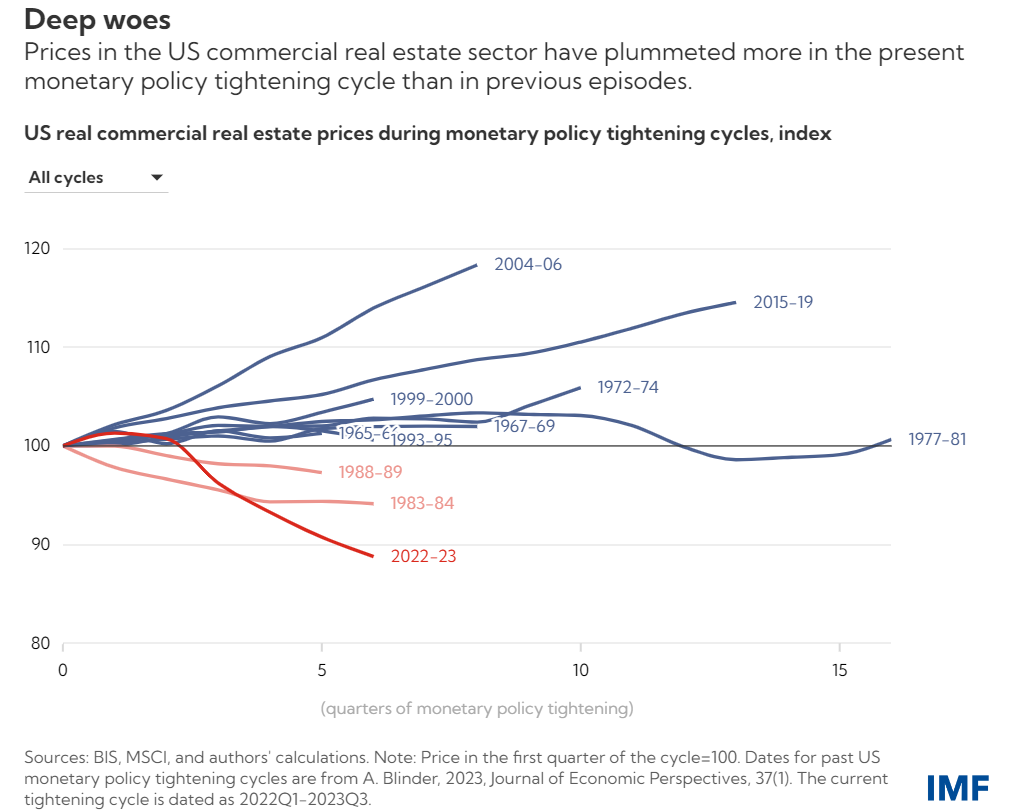

The global economy seems to be giving mixed signals. Structural weaknesses remain but things also seem to be improving in some regards – as indicated by Credit Cycle Indicators (about which we talked about in our article here). Look at the commercial sector in the U.S. that has been adversely impacted by the tightening monetary policy – and the very pace of it! As per Banker’s Mortgage Association around $1.2 trillion of commercial real estate debt is maturing in the next two years in the U.S. Out of this about 25 percent was given to the office and retail segments, “most of which is held by banks and commercial mortgage-backed securities.”

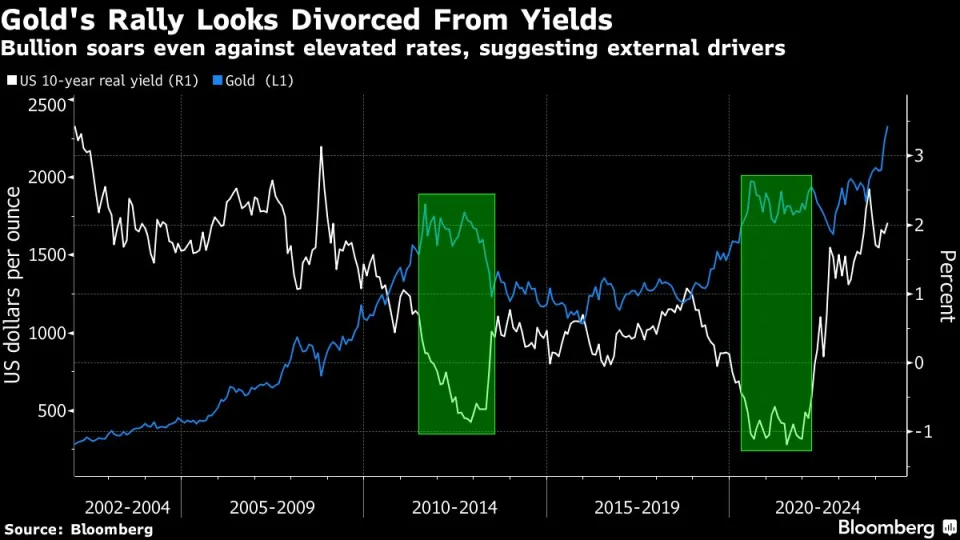

The overall sentiment in the gold and oil markets is extremely bullish but this optimism is based on critical assumptions such as a rebound in global economic demand, no further escalation in the ongoing conflicts and that interest rates will fall this year – starting from June by Fed. However, if the recent few years have shown us anything it is to not rely on assumptions as things can take a turn for the worse at any given time.