The crude markets made another surge higher following a step-up in geopolitical risk. “Israel called up Israel Defense Forces Aerial Defense Array reservists April 3 and the IDF canceled leave for all combat units as the country braced for potential Iranian retaliatory attacks following Israeli strikes April 1 on the Iranian Consulate in Damascus, Syria. That attack killed dozens of Islamic Revolutionary Guard Corps officials, including senior Gen. Mohammed Reza Zahedi, a top leader in the IRGC Quds Force, which is responsible for overseas operations. Israeli civilians also reported possible signs of GPS jamming in central Israel designed to confuse enemy guidance systems.” Iran will likely send some sort of message following the attack on their embassy. After the U.S. killed Soleimani, Iran responded by firing missiles at a U.S. base causing minimal damage and bodily harm. After the U.S. strike, crude prices spiked almost $10, but once Iran responded- prices proceeded to fall almost $12.

The most recent intelligence supports what we view to be a likely scenario- a “swarm” setup to overwhelm the anti-missile equipment: “Senior U.S. Intelligence Officials have now obtained Information regarding an Iranian Retaliatory Attack for Monday’s Airstrike by the Israeli Air Force against the Iranian Embassy in Damascus, which will likely come sometime between Now and the End of Ramadan on April 9th, with the Attack expected to involve a Swarm of “Shahed” One-Way Attack Drones and/or Land-Attack Cruise Missiles utilized to Target an Israeli Diplomatic Facility.”

Until this happens- we will see brent hold its premium over $90. It will likely fluctuate between $89-$91 while intelligence agencies assess the likelihood of attack. The newest information shows that Iran has slowed preparation of an attack, but we are heading into Eid- a high holy celebration to end Ramadan. If something happens, it will likely come after the holiday.

There is already so much geopolitical risk baked into the crude price, the spike up and down will be much smaller in the near term. The below gives you an idea of where things sit currently:

- Iran sees Israel’s airstrike on the Iranian consulate in Damascus as a direct attack on Iran itself. Israel had avoided hitting the consulate, which is part of Iran’s overall embassy complex, throughout its roughly decadelong covert operations against Iran and Iranian proxies in Syria to degrade the Iranian military buildup there.

- Zahedi was one of the most high-profile Iranian officials assassinated since the January 2020 U.S. killing of Gen. Qassem Soleimani. His killing provoked a U.S.-Iranian crisis that ended after Iran fired ballistic missiles at U.S. forces based in Iraq in an attack that wounded, but did not kill, any U.S. personnel. As a result, the United States did not directly retaliate for the barrage.

- Quds Force and IRGC leaders also use Iranian embassies and consulates in other third-party countries, like Lebanon and Iraq, to coordinate activities with proxy militias like Hezbollah given they are nominally protected from military action under international law.

The “least” escalator option would be for Iran to strike Israeli assets outside of Israel, but Israel has been striking Iranian assets at will in Syria and Lebanon. This may push Iran to strike “harder” by sending a missile attack into the country, which would be a big escalation.

One of the delays of Israel moving into Gaza was to ensure the U.S. and her allies at anti-ballistic missile assets in the area to create a protective “dome” over the region. The “Iron Dome” is meant to shoot down mortars and rockets, but it can’t stop a ballistic missile. This is where the bigger assets will be needed, but if Iran makes this step forward- the sinking of the Iran spy ship could follow quickly. Iran could use a “swarm” strategy to overwhelm the missile batteries in order to strike areas in the Golan Heights or Israel infrastructure. Any of these hits would be an escalation, and it wouldn’t deter the Israeli’s from targeting high level Iranian officials.

Even if the attack falls flat or is “for show,” there will likely be a step-up of attacks against U.S. assets in the region by Iranian proxies. The U.S. has shown restraint in sinking the MV Behshad, but an increase in attacks would prove a point needed to sink the ship. The U.S. has been working with the Houthis through back channels and negotiations to end the attacks on the shipping lanes. The rumors have been the Houthi’s stop attacks, and the U.S. takes them off the terrorism list, but I think this is more speculation versus actual.

I’ve discussed for several years now how the Israeli’s have been able to strike Iranian assets at will in all of their areas of operations and proxies. The Iranian government and IRGC is leaking intelligence, and it’s unlikely to stop any time soon. The Iranian regime is flailing, and the current actions are not coming from a point of strength. Instead, it’s them trying to stay relevant to their populace that has already turned their backs. There have been several deaths recently of women by the Morality Police, which have caused riots and protests around the country. They are trying to hold onto power and be relevant as their funds and assets are dwindling rapidly. The allies have been cutting off the heads of snakes for some time, and it will inevitably lead to a change in government. Any major change has to happen from the inside out, and the people have already spoken.

To add to Iran’s troubles, there was an attack in the province of Sistan-Balunchestan, which borders Afghanistan and Pakistan. At least 11 IRGC forces were killed at a headquarters in the southeast region of the province.[1] This area has always been a flash point, and this is just another example of pressure in the region.

The Russian situation remains fluid after the attacks from Ukraine against their refining assets. There have been other suicide drone attacks since, but the below chart gives you an idea of what has been damaged to date.

There are additional assets within striking distance, and you can see the additional attacks that took place below. Russia’s refineries processed more crude in the first days of April as some of the nation’s major plants restored operations halted by Ukrainian drone attacks. The repairs and turnarounds have gained some pace, which will help keep some refined products heading to the coast. We don’t expect to see it back to previous levels, but it will support some additional flows that were thought to be offline longer.

Russia Oil Refining Recovers in Early April as Repairs Gain Pace

- Refineries handled 5.25 million barrels a day from April 1-3

- Russia expects damaged refineries to finish repairs by June

This refining update also confirms my view that many of the attacks hit storage depots and not CDUs. If there’s another wave, it will likely hit the CDUs. I expect to see more Russian flow into India and China over the next few months, especially after China saw a bit a spike in March. Crude quality is important for the slates moving into refiners, and while Chinese refiners took advantage of the discounts- heavier blends will be desired over the next few months.

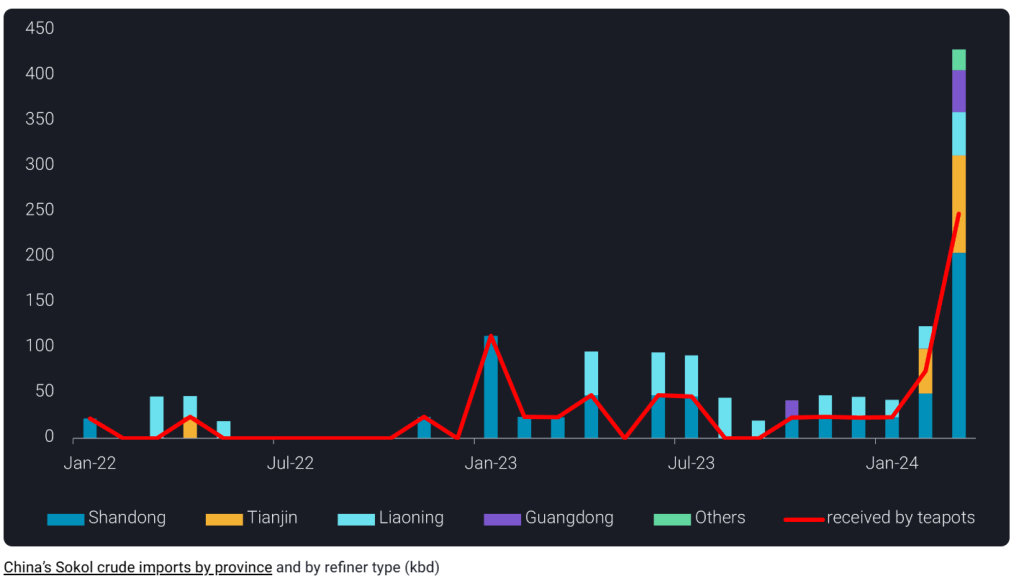

This view was also expressed by Vortexa: “China received a record 430kbd of Russian Far East Sokol crude in March, as Chinese refiners expedited the discharge of stranded Sokol cargos carried on sanctioned vessels within the waiver period granted by Washington. Meanwhile, Indian refiners retreated from purchases amidst tighter US sanctions, diverting more March-loaders to China. The heavy discounts on Sokol barrels attracted new buyers, including some state-run refiners, keen on the light-distillate-rich grade to augment gasoline production in April, anticipating driving spikes during the Chinese Memorial Day holiday and upcoming Labor Day Golden Week holidays. However, the enthusiasm for such sweet-light grade may wane in April as discounts narrow, and teapot refiners, accustomed to heavy-sour feedstocks, may opt to avoid excess Sokol barrels amid impending maintenance work and poor margins.”[2]

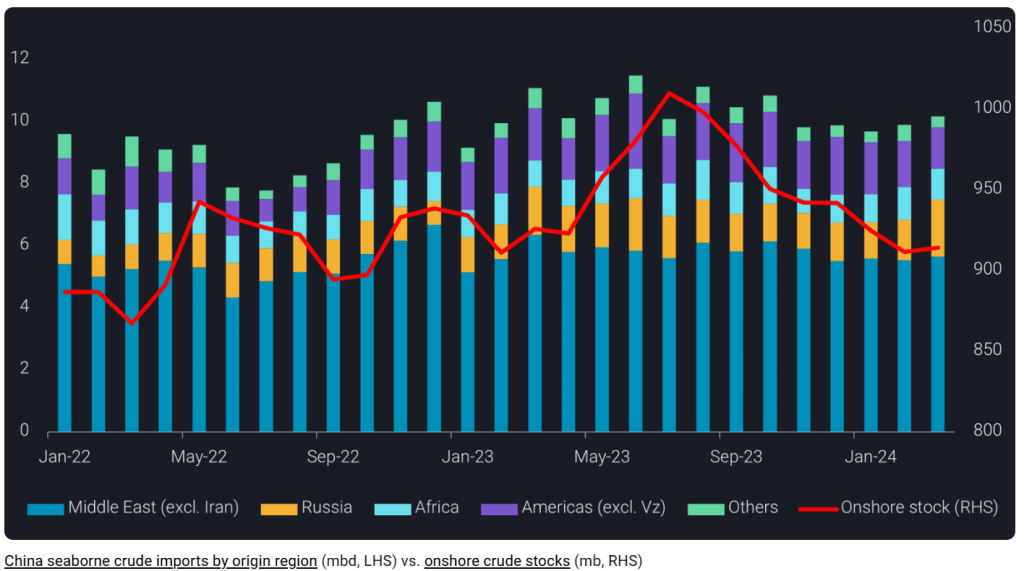

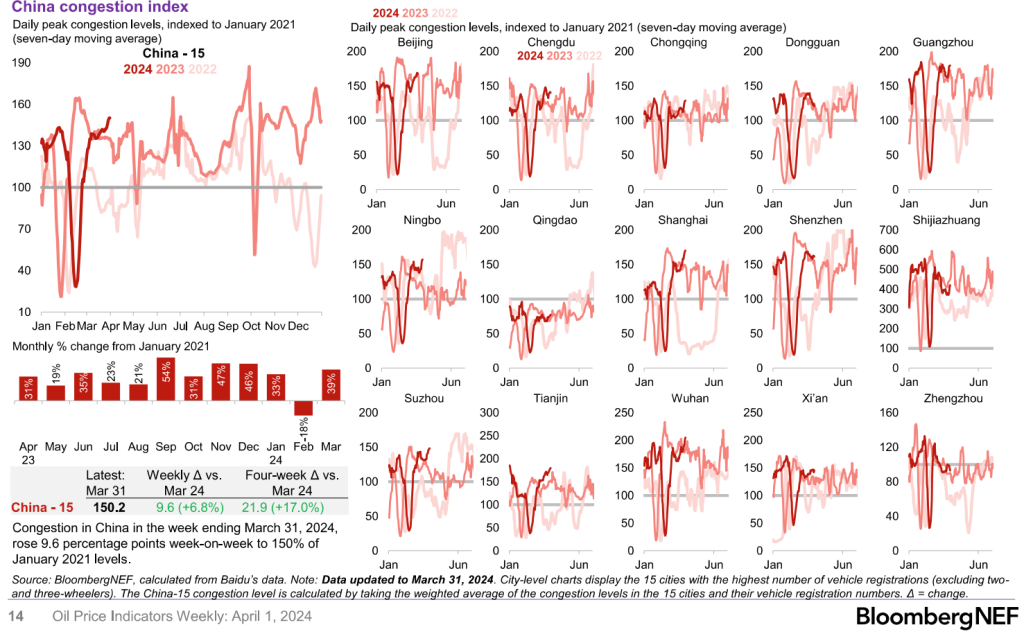

ESPO also saw an increase in buying, but it should also slow a bit- especially with some of the Chinese facilities moving into turnarounds. “As more refining capacities commence seasonal maintenance (as sluggish diesel demand from mining and infrastructure constrains refining runs) and crude benchmark prices are nearing the $90/b mark, Chinese refiners are expected to curb crude purchases.” The congestion data in China is supportive of a strong holiday this week, but it’s likely to fall back to the range we saw in 2023. We are also seeing a bit of a pivot with how Russia is processing their diesel/gasoil. They are running it through Turkey: Turkish loadings of diesel and gasoil for export hit a record high of 1.02mn t in March. Russian diesel and gasoil exports to Turkey hit a record 1.69mn t in March.

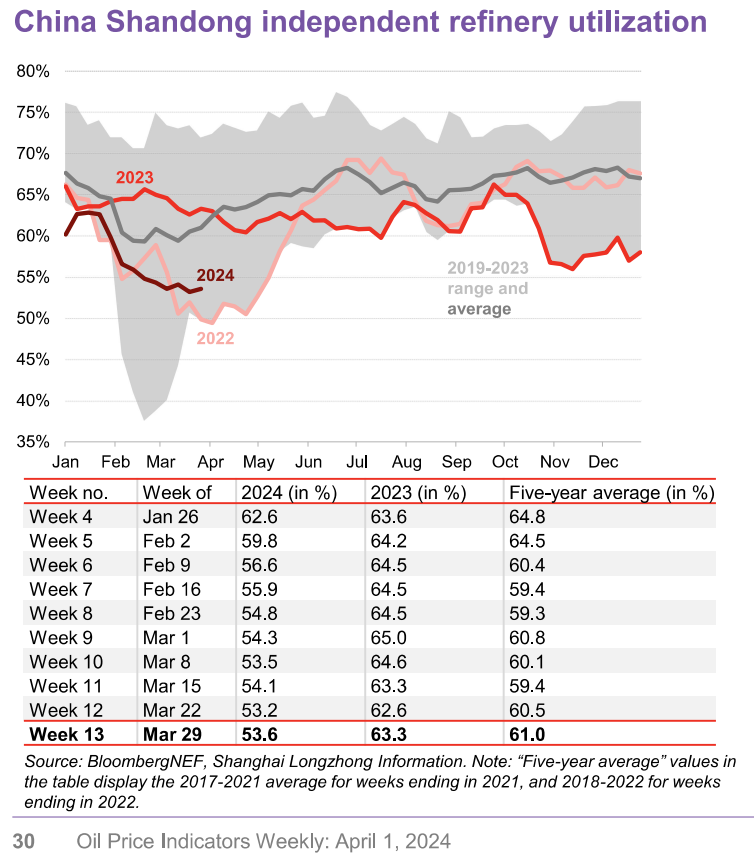

The slowdown in local demand is being reflected by how quickly refiners in China have slowed down for turnarounds. There was a nice increase in exports of refined products that have kept a cap on crack spreads in Asia as more product hit the market. Turnarounds in China are well below the 5 year average, and we don’t see a big increase in the near term. Storage at holdings tanks for teapots continues to point to challenges. Even though they’ve been running well below seasonal norms, there is still a significant amount of crude sitting in storage. “Crude holdings have surged at a Chinese refining hub, including volumes of Iranian crude, suggesting that the appetite for feedstocks from the nation’s hard-pressed independent refiners may be slowing. Inventories at two commercial storage sites —— Hankun and Hongrun — rose by 200,000 barrels a day in March, the first inventory build since September, data from Vortexa Ltd. showed. The facilities are in Shandong, the hub for the nation’s small refiners known as teapots, and they now hold about 53 million barrels.”

“Extra imports from Iran have mostly been put into storage, “instead of being processed, indicating weak demand from Shandong teapots,” said Emma Li, an analyst at Vortexa. Imports of Iranian oil into Shandong rose to 970,000 barrels a day, above February’s 910,000 barrels, she added. Total inventories in Shandong increased in nine of the past 12 weeks, hitting 263 million barrels as of March 28, according to satellite firm Ursa Space Systems. That’s a contrast to the nationwide trend, which has seen stockpiles fall since last summer, said Geoffrey Craig, a senior product strategist.”

Even state-owned refiners are reducing volumes, which is a mixture of turnarounds and weaker economics internally. State-owned refiners in China will reduce processing volumes to 41.38m tons this month, according to Mysteel OilChem, which cited a survey. That’s -5.6% m/m, with crude units’ run rates falling to 78.15%.

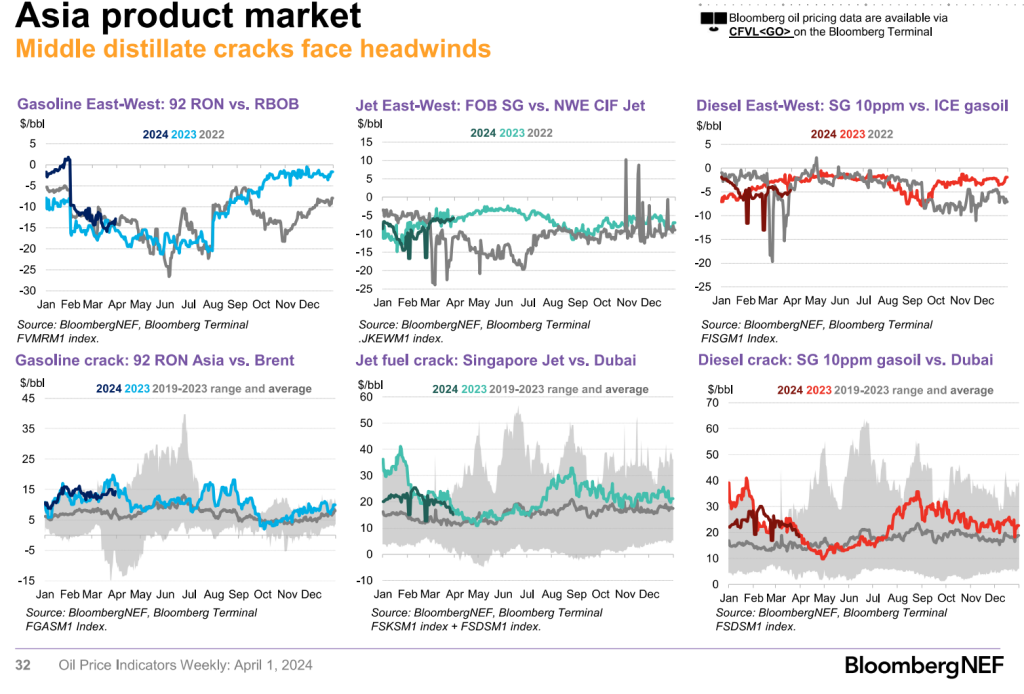

The below charts show the pressure we see in the Asian cracks in the near term as economic pressure/headwinds mount pushing down demand. Even as Russia exports less product, we aren’t seeing a big increase in cracks as demand stays fairly sluggish.

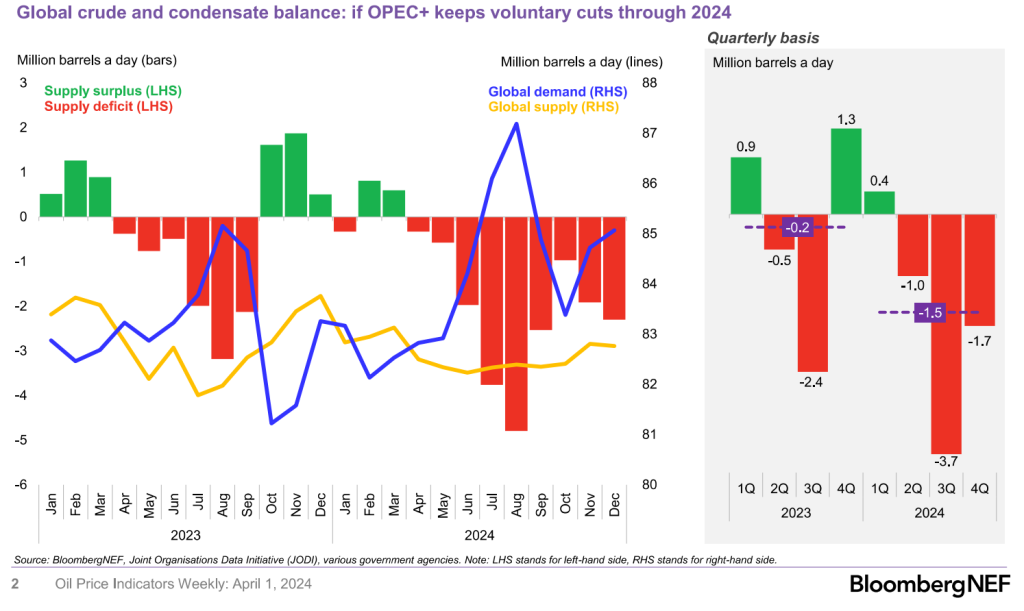

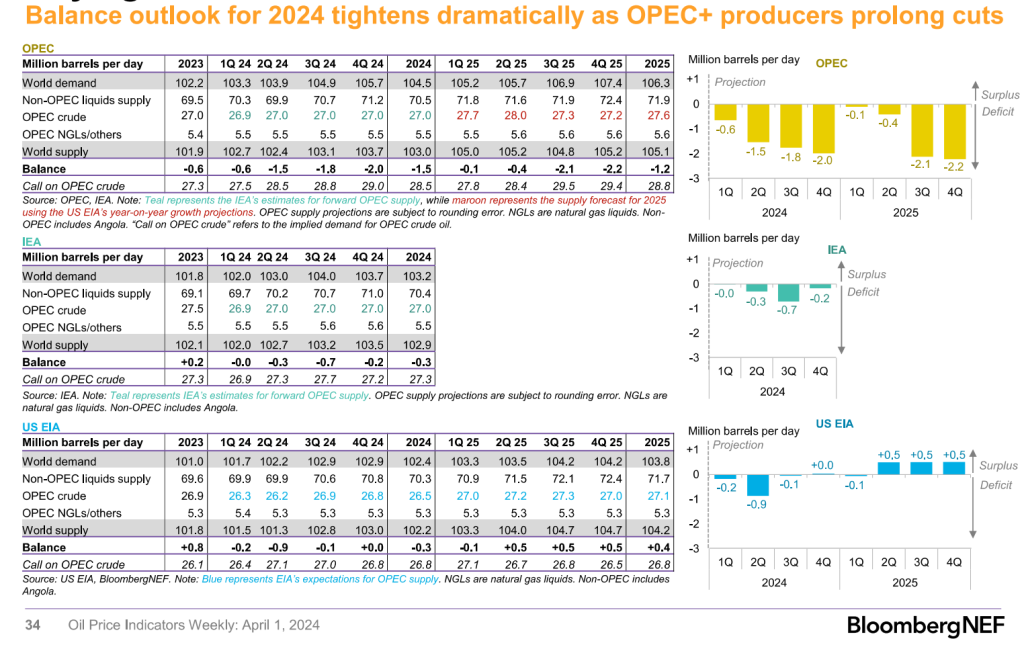

The market is expecting a deficit in the crude markets as supply stays off the market, but I think demand is overstated if crude prices stay in this price range. The global consumer is in a much worse position year/year as inflation accelerates in key regions- especially the U.S. Central banks are going to be kept on the sidelines, and the Fed won’t be cutting rates any time soon. I believed that the Fed could cut rates MAYBE twice this year (per the YT channel and insights.) My view was that inflation would re-accelerate as the PMI data between manufacturing and services converged around 50. This would usher in a stagflation backdrop, which is where I see the world sitting for the near and medium term.

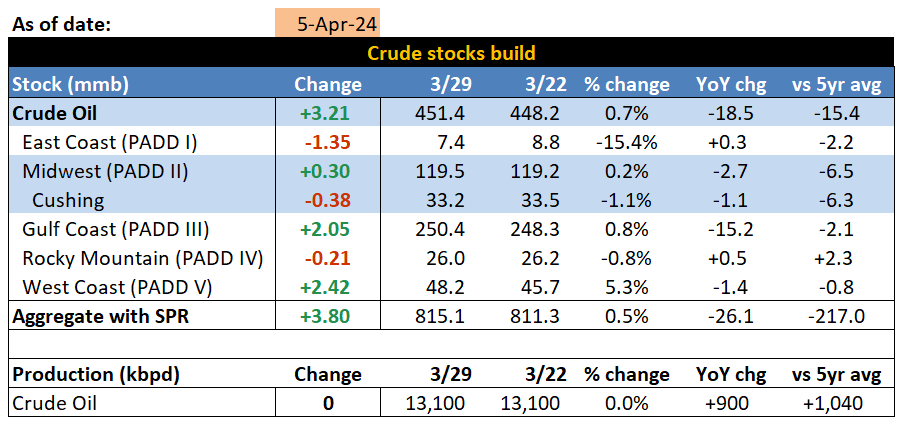

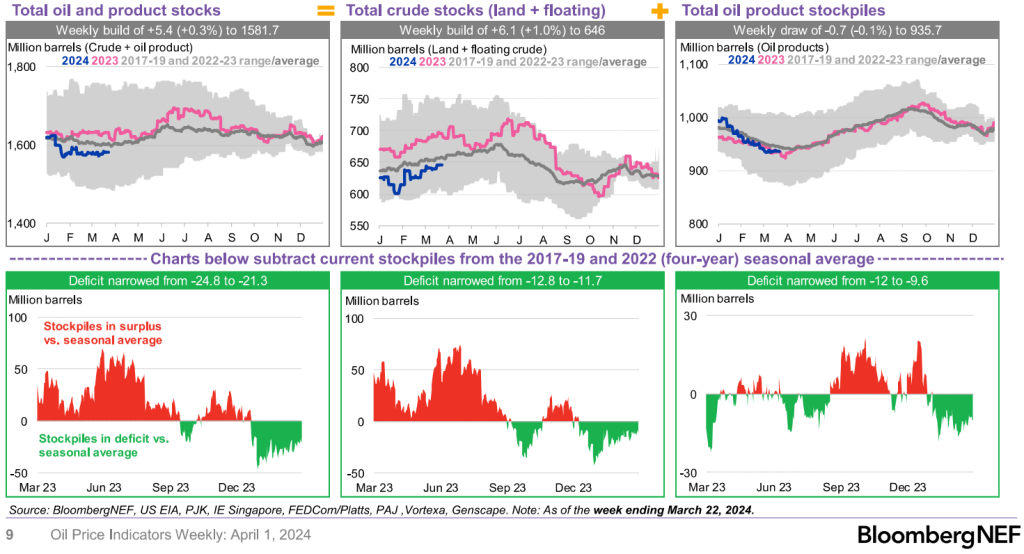

These characteristics won’t be supportive of demand, which is why I think the expectations for that sizeable “blue spike” will fall away. Builds in the U.S. increased, and I expect that to continue in PADD 3 as exports slow down further. The spreads for U.S. crude into Asia has closed, and Europe is sitting on a sizeable amount slowing near term purchases. This will cap flows and push storage up higher over the next few weeks.

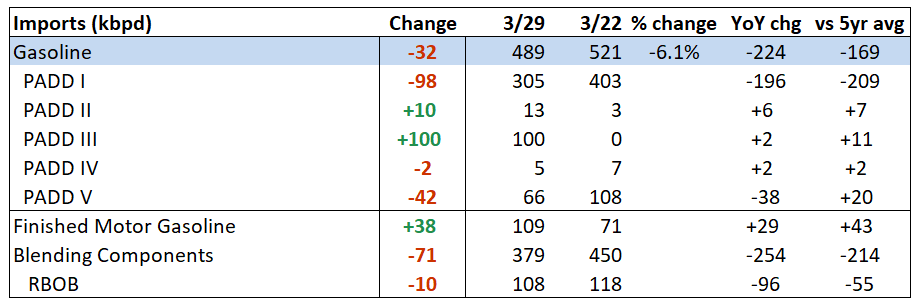

The key thing to watch in the U.S. is imports of gasoline into the East Coast. The arbitrage between Europe and the U.S. is wide open, and it will pull in more volume as Europe is already in a recession and sitting on a huge amount of gasoline.

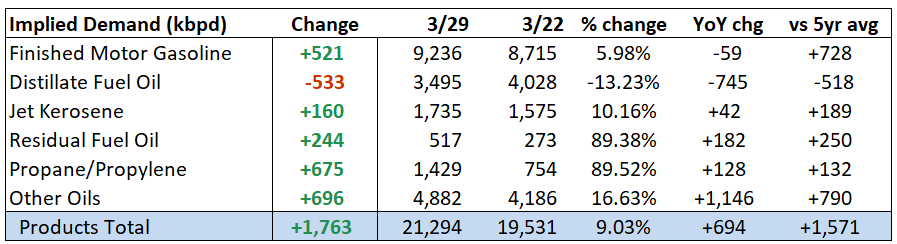

Implied demand in the U.S. had a nice bump driven by a surge of retail gas stations preparing for summer grade pivots. The gasoline data was very much timing driven, and there will be a correction back down to the below average levels we’ve seen to date. The same can be said for distillate but on the opposite side of the equation. The drop was sizeable, and it will likely reverse next week while staying well below the 5-year average.

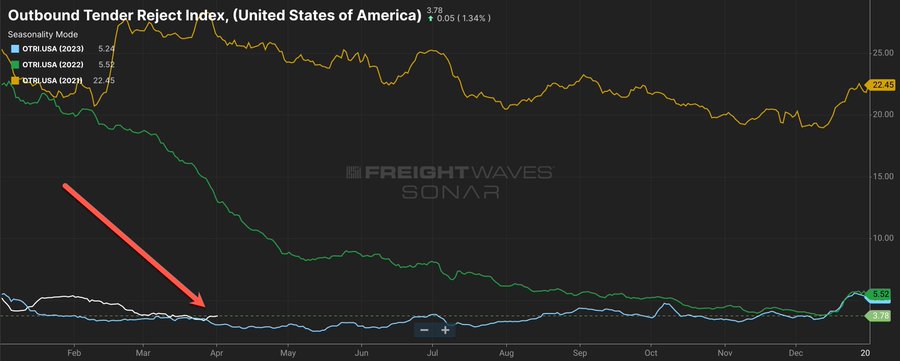

The winter weather was very mild while trucking data stayed in the doldrums. Tender rejections are roughly in line with 2023 numbers (which represented all-time lows). Since the Great Freight Recession started in 2022, whenever there is momentum in the market, it’s short-lived.

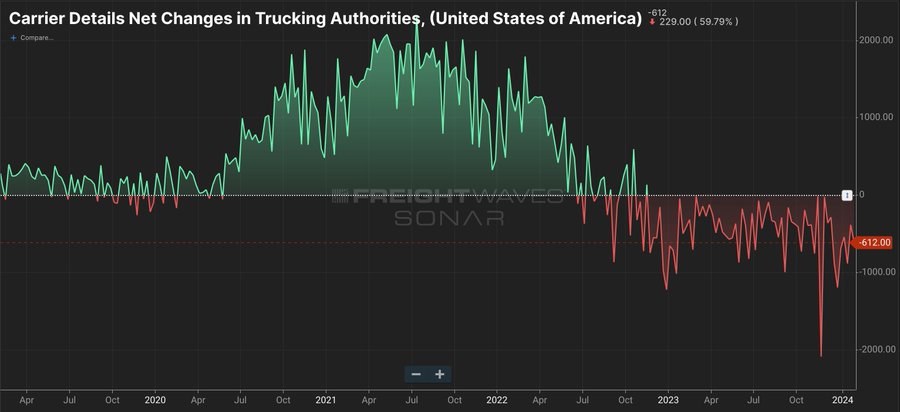

As we described last year, we expected to see a spike in January that would fall away rapidly in February and stay slow across the next few months. The pressure is also caused by a ton of extra capacity sitting in the market. Until more is removed, we don’t see a shift with a large part driven by a reduced demand side.

Even with the reduced flows, there is still a balanced amount of crude and products in the market. This comes with reduced flows from Russia, and is pointing to more of a slowdown in demand.

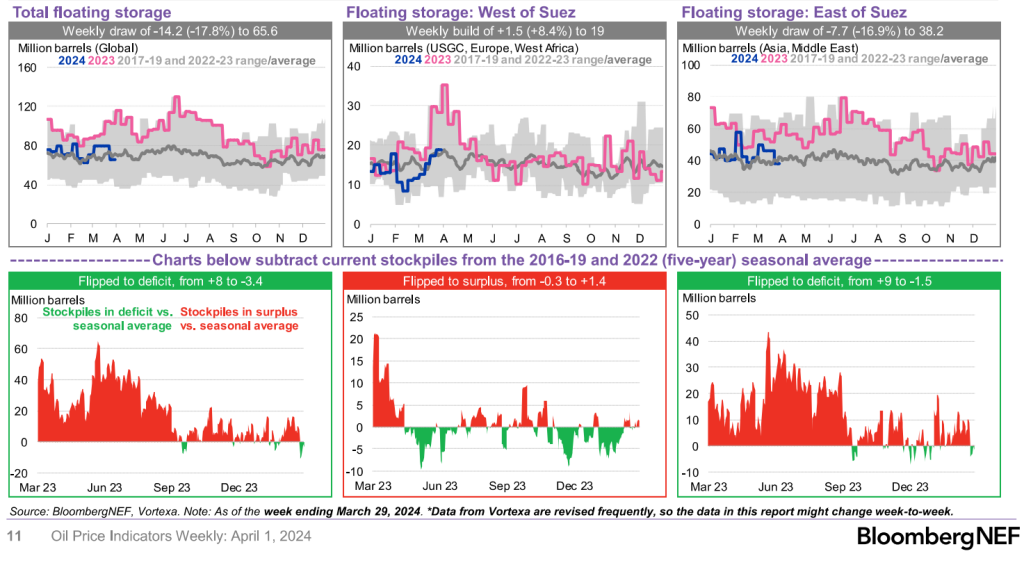

There has been a reduction in floating storage as more crude as moved into the “Crude oil in transit” category, but it isn’t balanced as we see more crude in storage across Europe and WAF.

The builds in WAF have pushed some additional cuts in pricing:

Cepsa cut its Okwuibome offer price again on Platts, while Chevron also offered Agbami at lower levels than a day earlier. India refiner IOC is seeking to purchase West African crude for late-May loading via tender.

PLATTS:

- Cepsa Trading offered 950k bbl of Nigeria’s Okwuibome for May 10-15 arrival on CFR Augusta basis at Dated +$5.65/bbl: trader monitoring window

- Decreased from +$6.20 on April 4, +$6.50 on April 3, +$6.70 on April 2

- Cargo to be unloaded from Delta Tolmi

- Chevron offered 1m bbl of Nigeria’s Agbami for April 26-27 loading at Dated -70c/bbl or for May 3-7 arrival on CFR Rotterdam basis at Dated +$1.55

- Cargo to be discharged from Almi Galaxy

- Prices steady with offers on April 4

This cut in pricing comes after Nigeria increased some of their OSPs, but it’s unlikely to see some of that pricing stick.

NIGERIA OSPs:

- Qua Iboe OSP raised to Dated +$3.97/bbl for April from +$2.71 for March

- That’s the highest since October when it was at the same level

- Bonny Light OSP raised to +$3.28 in April from +$2.42 previously

- Highest since September 2022

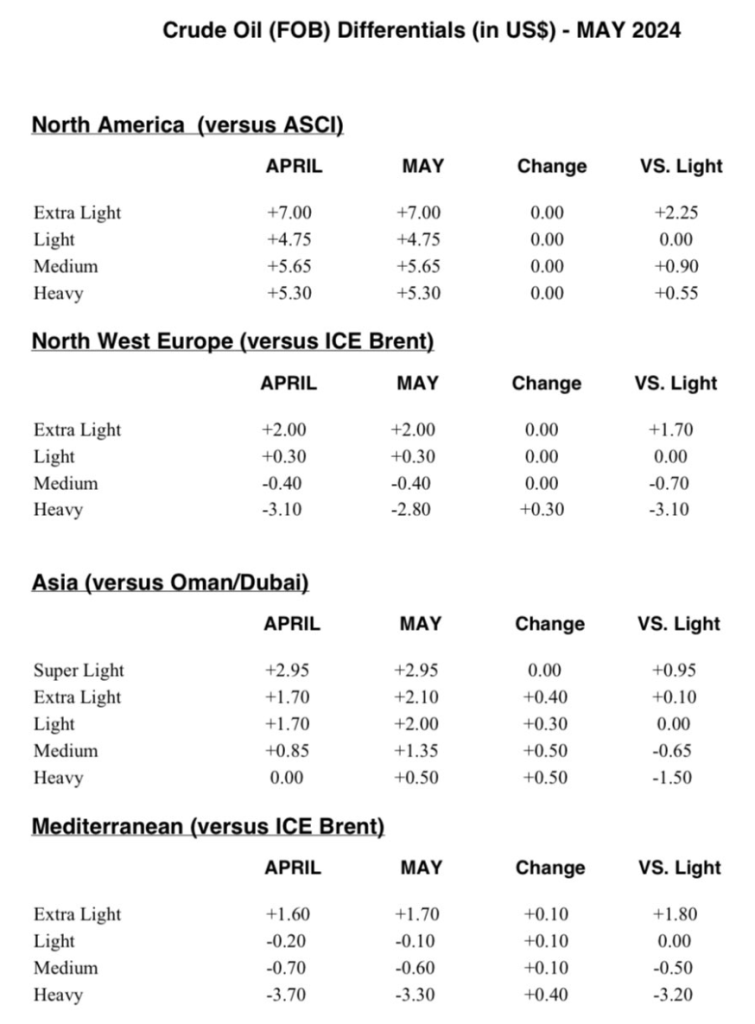

OSPs from KSA were mixed with some strength moving back into the heavy market while the lighter grades stayed similar. The heavy side of the barrel remains tight, which is where we see the most premiums over the near term. The premiums will stay elevated on the heavy/medium side with more pressure on spreads on the light side.

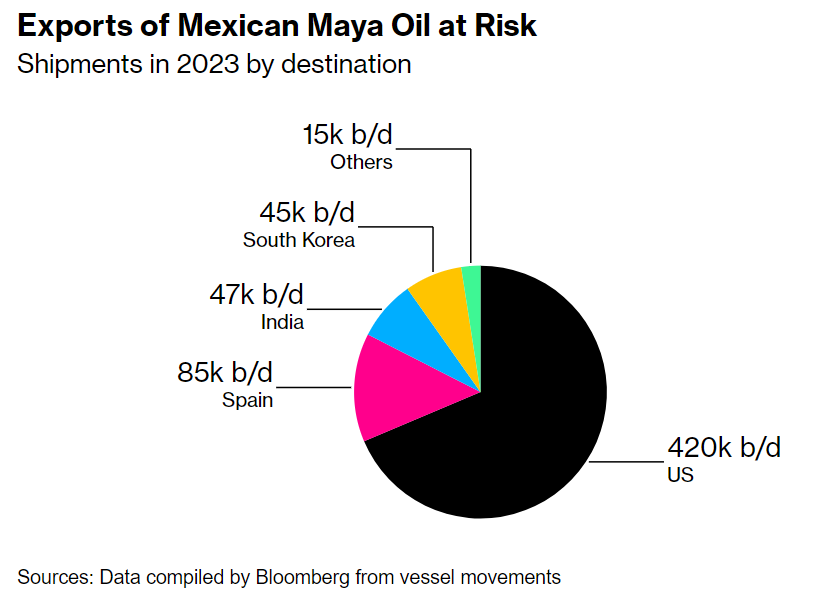

The heavy side also tightened further as Mexico said they were going to limit exports of Mayan crude.

“Physical supplies — especially heavier, sour grades such as Maya — are tightening even further with Venezuelan exports set to fall after the reinstatement of US sanctions on its oil industry. Petroleos Mexicanos, also called Pemex, canceled contracts to supply its flagship Maya crude oil to refiners in the US, Europe and Asia, according to people with knowledge of the situation, who asked not to be named because the information is private.”[3]

The push by PEMEX to cut exports is to produce more refined product internal, so the exports would be consumed internally at local refiners. Mexico has been looking to increase local refinery runs to make more product local, which would reduce demand for U.S. product exports. This was more of a political move, and we should see some of the refinery runs in Mexico slowdown; but there will be near term tightness on heavy: Mars traded at a premium of $1.60 a barrel above futures Monday, according to preliminary data from pricing agency General Index. That would be the strongest since November. This directly impacts U.S. imports and runs: Valero Energy Corp, Chevron Corp and Marathon Petroleum Corp import 420,000 barrels of the heavy sour variety per day. In 2023, Maya exports reached 612,000 barrels a day.

Mexico will likely find a balance with the reduction of exports used for line fill of the new facility. Once this is complete, I expect to see more exports come back to the market: In February the country’s six refineries operated near the highest rates seen in more than six years. Oil use should keep rising as Pemex works to start commercial operations of the new Olmeca refinery, also known as Dos Bocas, with capacity to process 340,000 barrels of crude oil a day.

BP raised bid for CPC Blend for May but failed to find a buyer. Saudi Aramco raised slightly its crude OSPs for May to Mediterranean while keeping most prices to Northwest Europe stable.

PLATTS:

- BP bid 132k tons of CPC Blend for May 11-15 at Dated -$2.25/bbl, CIF Augusta: traders monitoring Platts window

- Compares with -$2.50 for its previous bid on Thursday

It’s typical to see companies try to push up pricing at the start of a month, but the fact no bidders emerged will be important to watch as demand at these prices stay sluggish. The clearing price will be important, and I think it’s likely it slips back to $-2.50.

- Saudi Light Oil’s Premium to Heavy Grade at Smallest Since 2022

This premium will remain tight as heavy/medium demand stays elevated with the U.S. putting more light crude on the water. India has begun rejecting more Russian crude on sanction fears, which will push down the premiums further and likely send more to China.

Supply deficits are expected to persist, but we have seen some of the refinery margins get a bit more bearish. The below shows some of the expectations, but I think the assumption of stronger demand is overstated. The price of crude and refined products will keep people on the sidelines.

The misunderstanding remains around the health of the consumer and the underlying economy. Credit card rates hit a new record with more pressure behind it when you look at APRs. The consumer is turning to credit more and more, and the compounding damage from it is accelerating across the board.

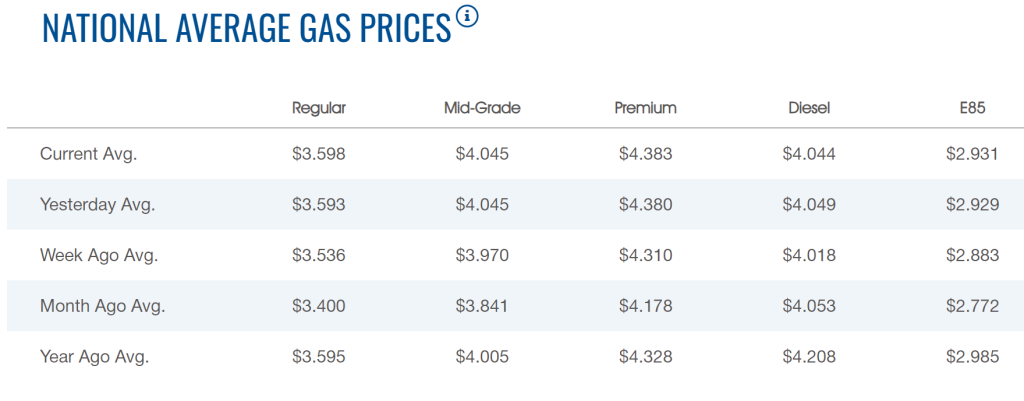

Gasoline prices are fairly close to last year, but the consumers’ balance sheet has gotten much worse. The additional pressure at the consumer level and no relief in pricing will keep people from doing as much as the market is expecting. There is always a bump in spring/summer, but I think the market is expecting too much as we head into key driving season.

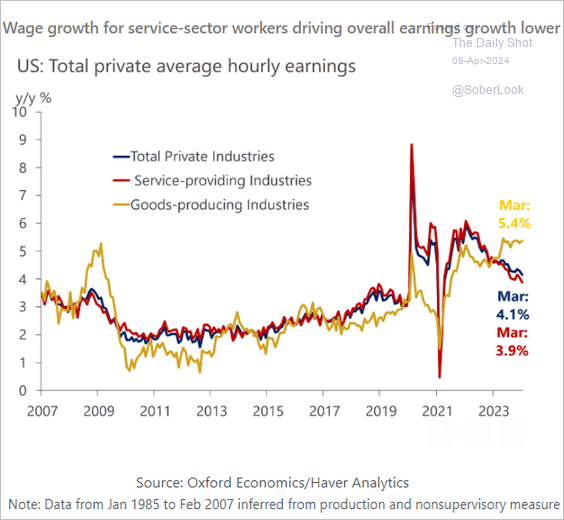

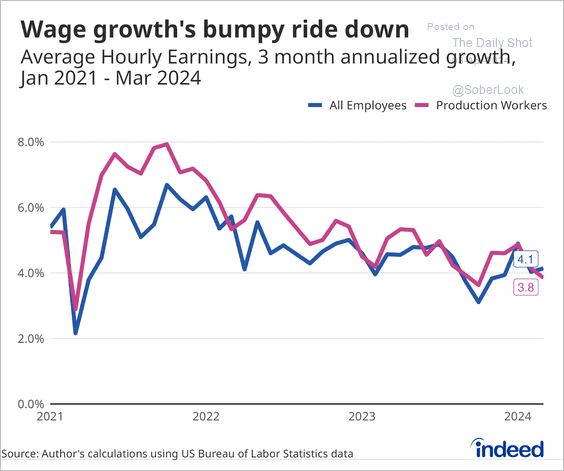

Wage growth has been slowing as inflation re-accelerates. You can see that with the amount of consumers turning to credit cards, slowing savings rate, and reduction in retail sales.

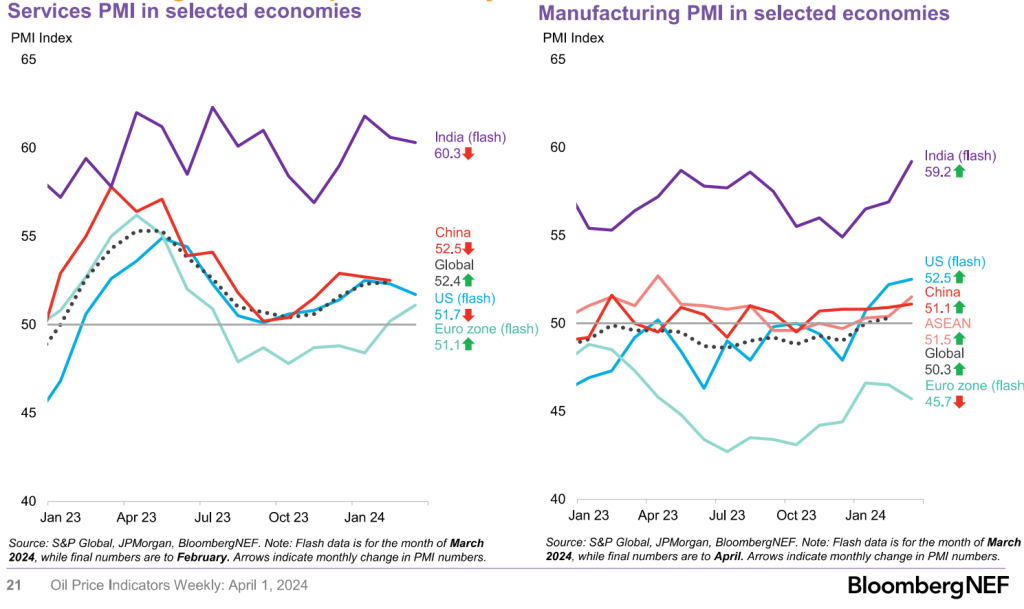

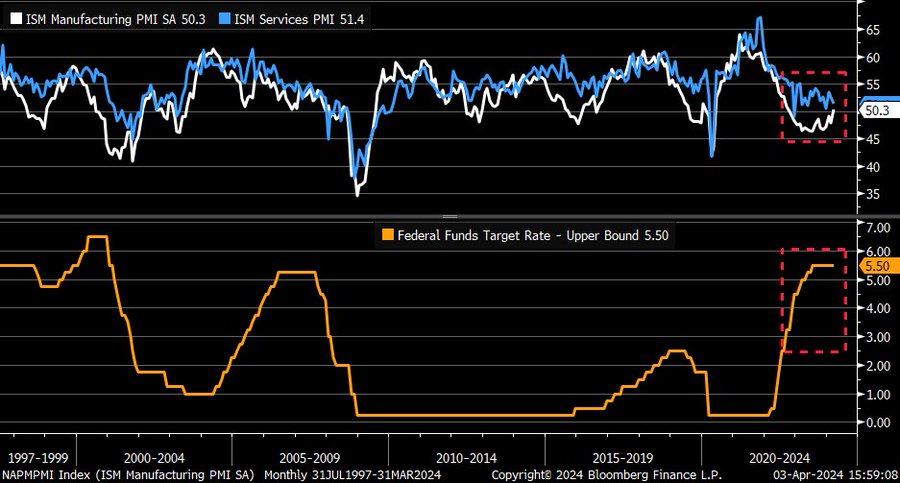

The current backdrop of employment and inflation is going to keep the Fed on the sidelines, and the expectations of a cut in June has dipped below 50%. I still believe nothing is coming until we get to November at the earliest. My view has been from the beginning that industrial and service activity would “converge” around 50 as stagflation sets in and we are here:

Service data has weakened in key areas even as some manufacturing data picks up. Here is another look: “Interesting that ISM Manufacturing PMI (white) is improving as Fed hasn’t yet cut, but now ISM Services (blue) looks to be wobbling a bit (but still in expansion) … unique setup relative to prior Fed cycles.”

I will cover more of the economic data this Friday… more to come!

- https://www.aljazeera.com/news/2024/4/4/at-least-11-killed-in-attack-on-irans-irgc-in-border-province-state-media

- https://www.vortexa.com/insights/crude/chinas-crude-imports-rebound-on-record-russian-barrels/

- https://www.bloomberg.com/news/articles/2024-04-01/mexico-to-halt-some-oil-exports-further-squeezing-global-market?sref=9yOLp5hz