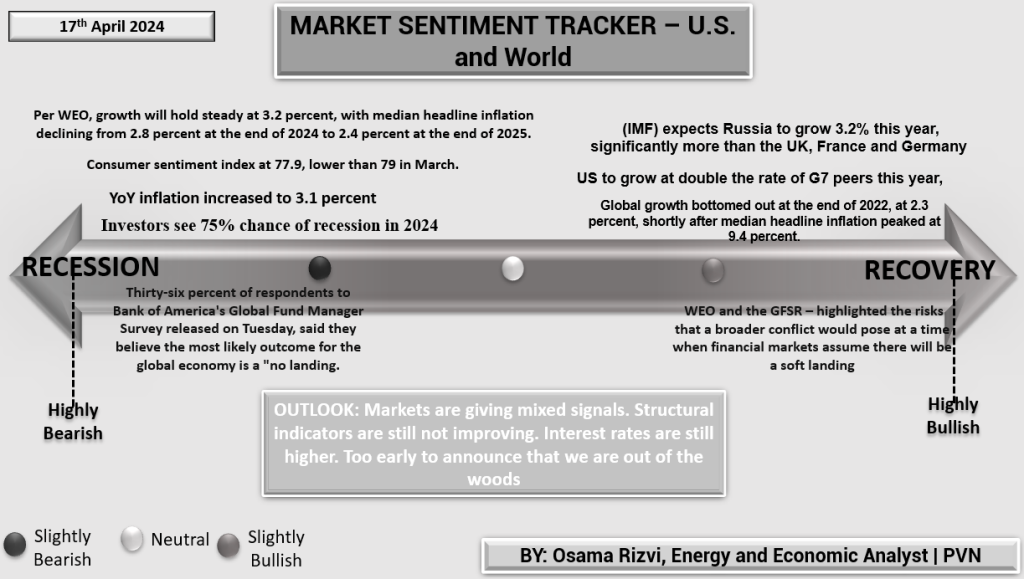

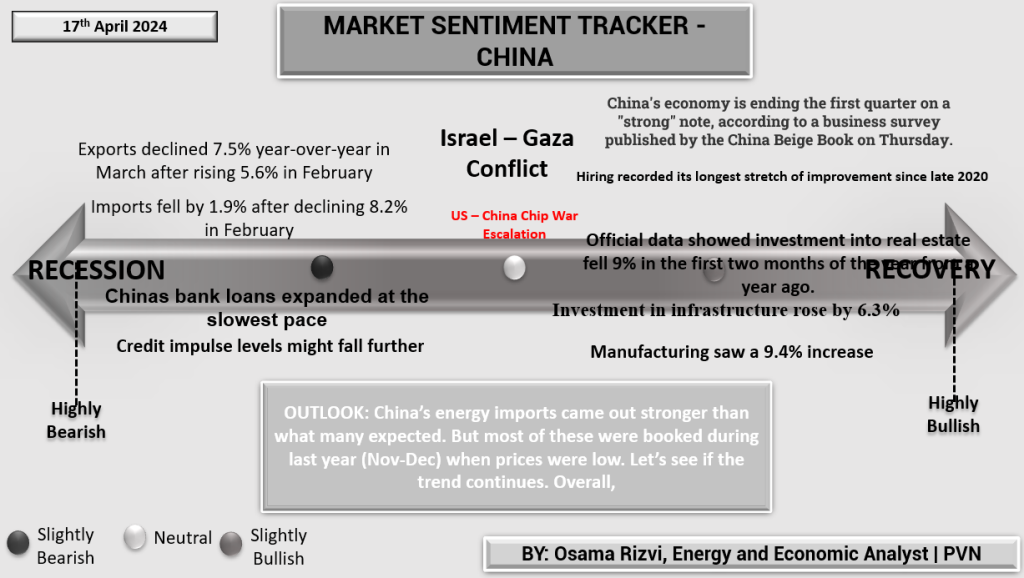

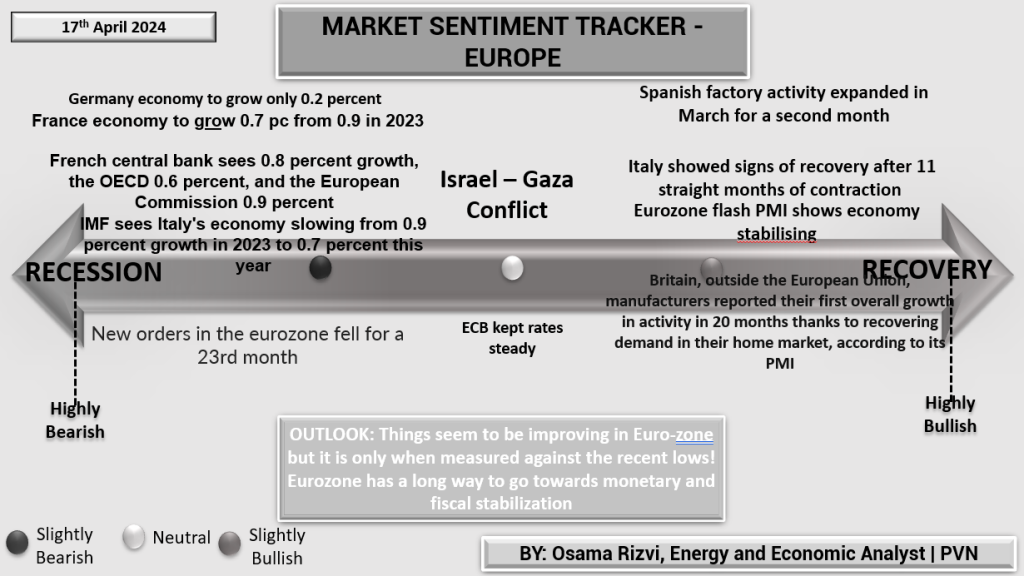

Analyzing the economic pulse across the United States, China, and Europe through recent Market Sentiment Trackers offers a glimpse into a global economy at a crossroads of recovery and uncertainty.

In the U.S., the sentiment is cautiously optimistic. Despite a hit to net savings and retail sales slightly underperforming against historical averages, factory activity is on the rise for the first time since late 2022, and payrolls are growing consistently, suggesting resilience. However, inflation persists, and there’s a 75% perceived risk of recession in 2024, indicating that the path forward is not without its potential pitfalls.

China’s landscape is a blend of concerns and strengths. While factory activity has contracted for five months and bank loan expansion has slowed, there are bright spots. Notably, China’s energy imports have strengthened, and manufacturing has seen a substantial 9.4% increase, highlighting robust facets of an economy that’s looking to rebound from a period of slow growth and market turbulence.

Europe’s narrative is mixed. The region is dealing with stalled manufacturing growth, yet some member states like Spain are witnessing expansion, and the broader eurozone flash PMI suggests stabilization. The European Central Bank’s steady rates reflect a careful balancing act amid these times of gradual recovery.

Despite the varying indicators, the overarching theme is one of cautious progress. Each region shows signs of emerging from the economic strain, with hiring upticks, industrial output increases, and service sector improvements. However, these positive trends are tempered by risks like potential recessions, lingering inflation, and geopolitical tensions, which could still sway the economic trajectories.