This week’s economic indicators reveal a complex portrait of global economic trends, as data highlights both advancements and emerging challenges. Here, we analyze these multifaceted signals to gauge the broader economic trajectory.

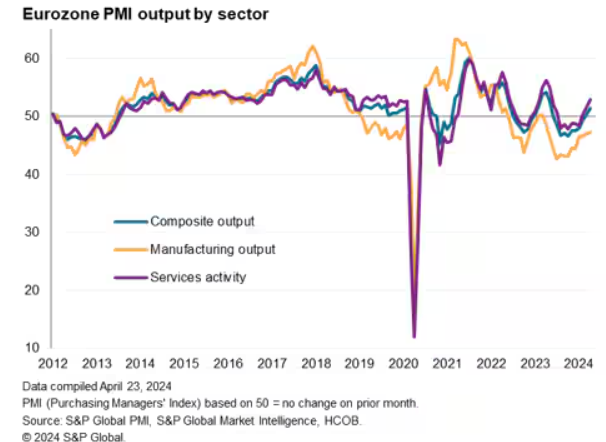

April’s flash Purchasing Managers’ Index (PMI) data signals a more uniform economic expansion across the major developed economies, notably with improved growth rates in Europe and Japan. This is contrasted sharply by a slowdown in the United States, where the PMI output index slightly dipped from 51.7 in March to 51.6. The resilience in Japan is underscored by escalating service sector inflation, partly due to a weakening yen.

Europe showcases robust recovery dynamics, hitting 11-month growth highs, buoyed particularly by strong service sector performance, despite ongoing manufacturing struggles. This reflects a patchwork recovery, where different sectors and regions show variable progress.

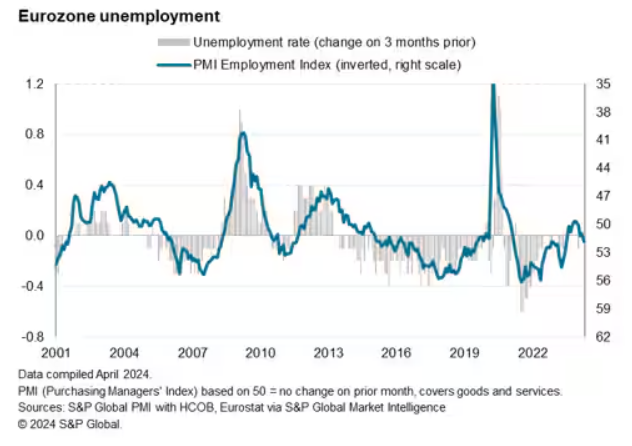

A troubling aspect revealed was the stagnation in employment across the ‘G4’ economies in April, the first instance of no net job creation since August 2020, occurring alongside a drop in the new orders index to 49.9. This suggests potential economic deceleration ahead.

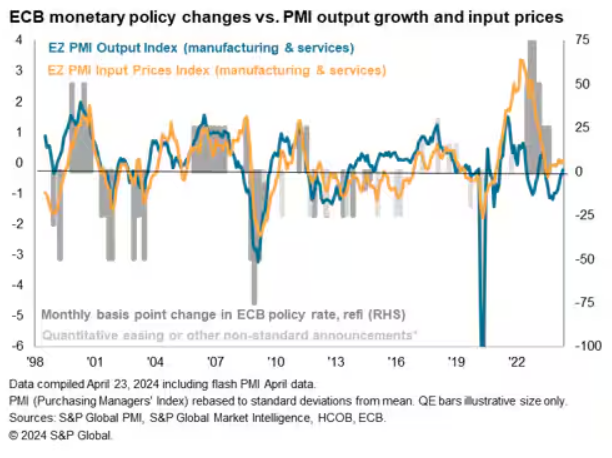

Inflation remains stubborn across the board. While there are pockets of relief, such as the US, where selling price inflation has cooled significantly, the general trend features persistently high service sector inflation rates. The manufacturing sector also continues to see rising input costs, particularly influenced by higher oil prices and other raw material costs, presenting ongoing inflationary pressures.

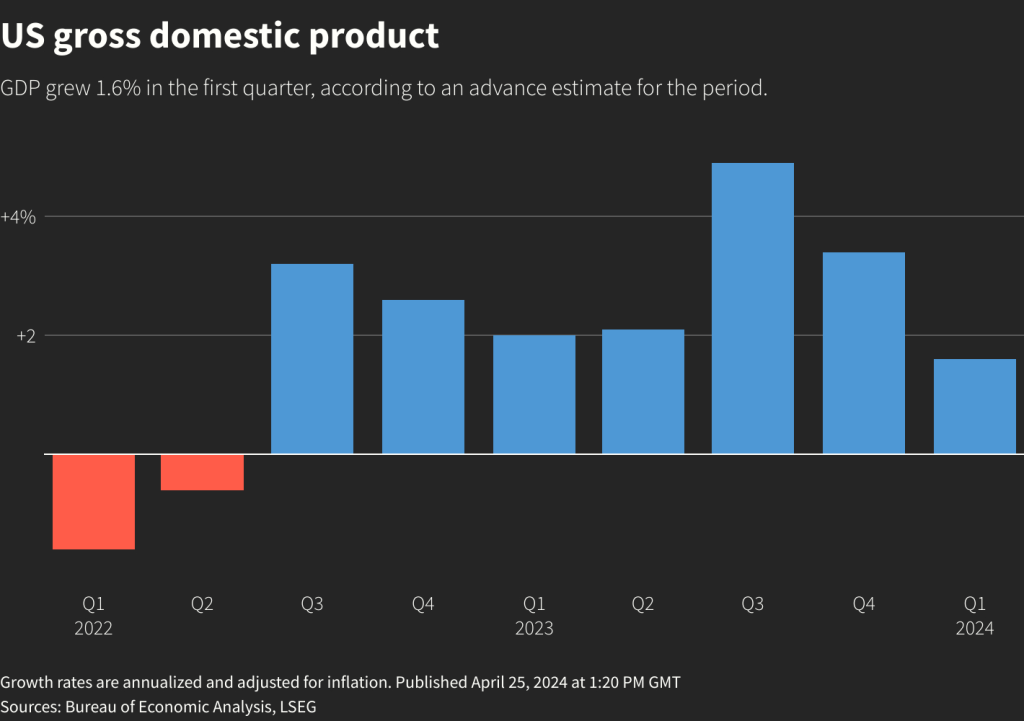

Recent data from the Bureau of Economic Analysis highlighted a significant deceleration in the US economy, with GDP growth slowing to an annualized rate of 1.6% from last quarter’s 3.4%. This was accompanied by a spike in the core PCE price index to 3.7%, signaling an inflationary trend that exceeds expectations and complicates policy responses.

These factors collectively suggest the fading likelihood of a “soft landing” where the economy slows enough to curb inflation without triggering a recession. Instead, the risk of stagflation looms, reminiscent of the challenges seen in the 1970s, where slow growth coincided with high inflation and unemployment.

The data paints a picture of an economic landscape at a crossroads. While some regions like Europe and Japan show signs of enduring resilience and recovery, the overarching risks of inflation and uncertain employment prospects cast shadows on the global outlook. The US, in particular, confronts significant headwinds, suggesting a tougher economic climate may lie ahead than previously anticipated. The possibility of a hard landing remains plausible, with sector-specific downturns, such as potential overinvestments in technology like AI, poised to impact economic trajectories further. Coordinated policy measures and economic adjustments are crucial to navigate these turbulent times effectively. In conclusion, while certain areas of the global economy exhibit improvement and resilience, the broader landscape is fraught with complex challenges that could tilt toward a harder landing if not adeptly managed.