Market Outlook

We have already discussed Liberty Energy’s (LBRT) Q1 2024 financial performance in our recent article. Here is an outline of its strategies and outlook. LBRT views the fracking industry as “constructive” based on disciplined pricing and service quality improvement. Although natural gas prices softened due to strong production and mild winter weather, its adverse impact on the North American frac services has been relatively modest. On the other hand, the rising geopolitical conflict and increased global demand kept crude oil prices high. LBRT’s management expects the natural gas prices to strengthen in the future, backed by increasing LNG exports. The power sector estimates up to 10 Bcf per day of incremental natural gas demand.

Strategies And Key Focus Areas

After Q1, LBRT sees the fracking market stabilizing after a dip in 2H 2023. In 2H 2023, when the fleet count went south, the pricing pressure dissipated. Now, the industry sees a gradual pullback as the pricing recovers. In addition to pricing, the quality of fracs and technology has also improved. As discussed in our previous articles, the company has been leaning toward natural gas-burning activity. Its investments in natural gas transition of its frac equipment are likely to be at the peak at this point. While it will continue to invest in new technologies, the management sees investment in the frac fleet decreasing in the coming years. The deceleration will include the LPI business, which, at present, is at the center of Liberty’s activity buzz.

LBRT has been strategically shifting towards low emissions, capital-efficient natural gas-fueled technologies. It offers critical solutions like power generation to the CNG fuel supply that supports digiFleet deployments. There has been a surge in demand for power from AI-driven data centers. Liberty Power Innovations will likely benefit from demand outside the traditional energy sector. It will also benefit from investment in next-generation pump technology, the company’s ownership of power generation, and fuel infrastructure. It lowers operators’ fuel consumption by integrating digiTechnologies with cloud-based software for its pumping control systems.

In Q1, it deployed its first few digiFleets. It is currently enhancing its automated pump control technology with customization. The solution provides a customized fracture treatment across basins and horizons, minimizing downtime and maintenance costs. The company reckons its DigiPrime natural gas fuel pumps use less natural gas and diesel than Tier 4 DGB pumps. In 2023, it expanded its internal manufacturing capabilities with the launch of the Liberty Advanced Equipment Technologies division. In Q1, it launched operations in the DJ Basin with onsite fuel management services. As we discussed in our previous article, digiFleets, and dual-fuel fleets will account for 90% of its total frac spread composition by the end of 2024.

LBRT’s Outlook

In Q2, the company expects increased utilization and favorable weather to mitigate the effects of spring break-up in Canada. So, it expects “low double-digit” revenue and adjusted EBITDA growth in Q2 over Q1. It also expects to roll digiFleet deployments throughout the year. In Q2, it plans to deploy the seventh digiFleet. An increased share of digiFleets will result in incremental frac spread profitability. Also, it will focus on LPI, which provides a low-emission source for the power generation of fuel.

Although the company brought in the seventh digiFleet, it did not add new fleet capacity into the marketplace. LBRT does not plan to add any more capacity in 2024. So, it will replace existing equipment with next-generation equipment that will lower operating costs and improve profitability.

Financial Performance And Balance Sheet

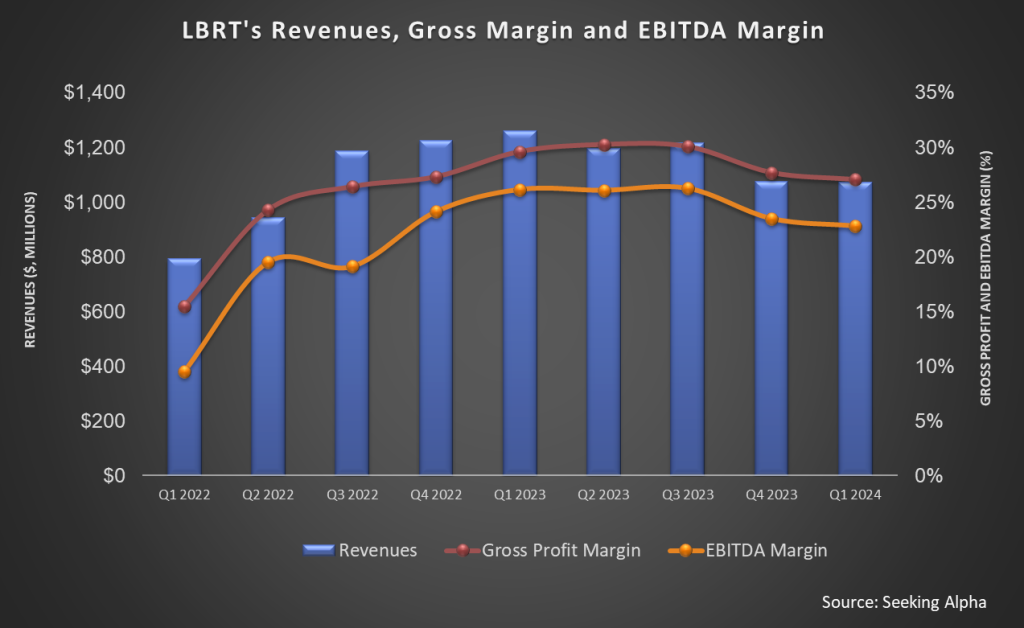

LBRT’s revenues remained nearly unchanged in Q1 quarter-over-quarter, while its adjusted EBITDA recorded a 3% fall. Its net income decreased by 11% in Q1 2024 from Q4 2023. Read more about LBRT’s performance in our short article.

In Q1, LBRT distributed $42 million to its shareholders. Since July 2022, it has retired 12.5% of shares outstanding plus cash dividends. In Q1 2024, led by lower revenues, Liberty’s cash flow from operations decreased by 22% compared to a year ago. Its free cash flow also declined by 80% in Q1 2024 during this period. Net debt increased by $39 million since the end of FY2023. Its liquidity, including cash and availability under the credit facility, was $315 million as of March 31.

Relative Valuation

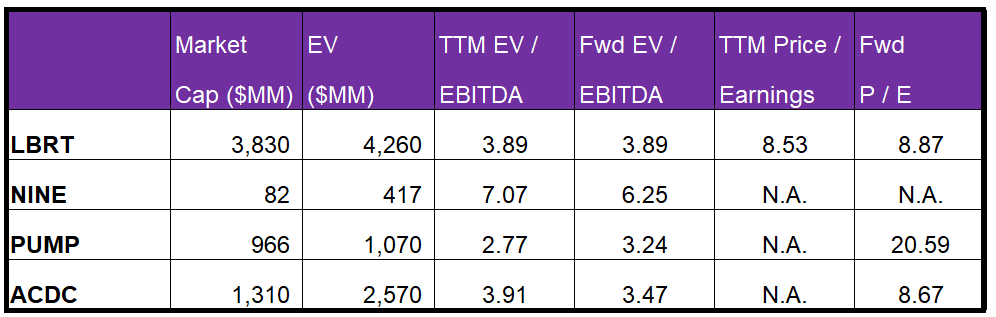

Liberty is currently trading at an EV/EBITDA multiple of 3.9x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is nearly the same. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of ~16x.

LBRT’s forward EV/EBITDA multiple versus the current EV/EBITDA is unchanged compared to a slight fall in multiple for its peers because the company’s EBITDA is expected to remain unchanged versus a marginal rise in EBITDA for its peers in the next four quarters. This typically results in a moderately smaller EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (NINE, PUMP, and ACDC) average of 4.6x. So, the stock is reasonably valued, with a positive bias, versus its peers.

Final Commentary

LBRT, after a pulldown in the fracking industry in 2H 2023, expects to see a moderate improvement in pricing. Over the years, it has invested heavily in the natural gas transition of its frac equipment. While natural gas prices will likely recover by the end of the year, the company may pull back some of its investments in the coming years. On the demand side, a surge in requirements from AI-driven data centers, next-generation pump technology, power generation, and fuel infrastructure can lead to growth. Combining digiTechnologies and LPI can diversify its revenue base. In Q2, it plans to deploy the seventh digiFleet, resulting in incremental frac spread profitability.

Despite the long-term growth drivers, LBRT’s topline growth stalled while its EBITDA declined in Q1. Cash flows, too, deteriorated in Q1. However, the management believes it can generate strong free cash flow in FY2024 and, therefore, can continue to generate strong shareholder returns. The stock is slightly reasonably valued versus its peers at this level.