Frac Fleets And Pressure Pumping Outlook

In our recent article, we have already discussed RPC’s (RES) Q1 2024 financial performance. Here is an outline of its outlook. At the end of Q1, RES’s management was optimistic about the energy price and drilling activities, although it reckoned pumping capacity would remain disciplined. In the E&P side of the market, the M&A activities in late 2023 led to non-core asset divestitures. In this scenario, RES will cater to both customer groups, e.g., the smaller spot and semi-dedicated customers, as well as large E&Ps.

RES will place the new Tier 4 DGB frac spread in service in a few months. However, it will pull a Tier 2 diesel frac out of service, although it will repurpose those assets in other parts of its business or keep them as spare parts and equipment. It will continue to invest with a strong focus on upgrading to Tier 4 dual fuel. The gas substitution efficiency of its DGB frac spreads has been over 65%. The company will control costs to keep assets utilized, which balances its interest in putting assets to work without burning them out on low-return projects. The company sees a considerable focus on the e-frac market. A lot of investment is going in at that “upper end of the market” as competition is intensifying. The ideal or appropriate configuration for the equipment and the ability to get power sources is evolving and changing.

Frac Pricing

RES’s current stance is this: It will not bid anything below a particular price level. However, if it fails to win anything at the current level, it will take more dramatic steps. It will keep pricing unchanged until demand shifts due to stiff competition, at which point, it can take “dramatic” steps.

The frac market sees a lot of competition from the smaller players who likely bid aggressively. Compared to a year ago, pricing has degraded as some players took advantage of the spot market and the semi-dedicated market. So, currently, pressure-pumping revenue is down more than some of the other service lines in the industry. The company’s management expects a shakedown followed by improvements in pricing. Also, with increased activity, the excess capacity will gradually be absorbed, giving fracturing companies more control over the pricing.

The Q1 Drivers

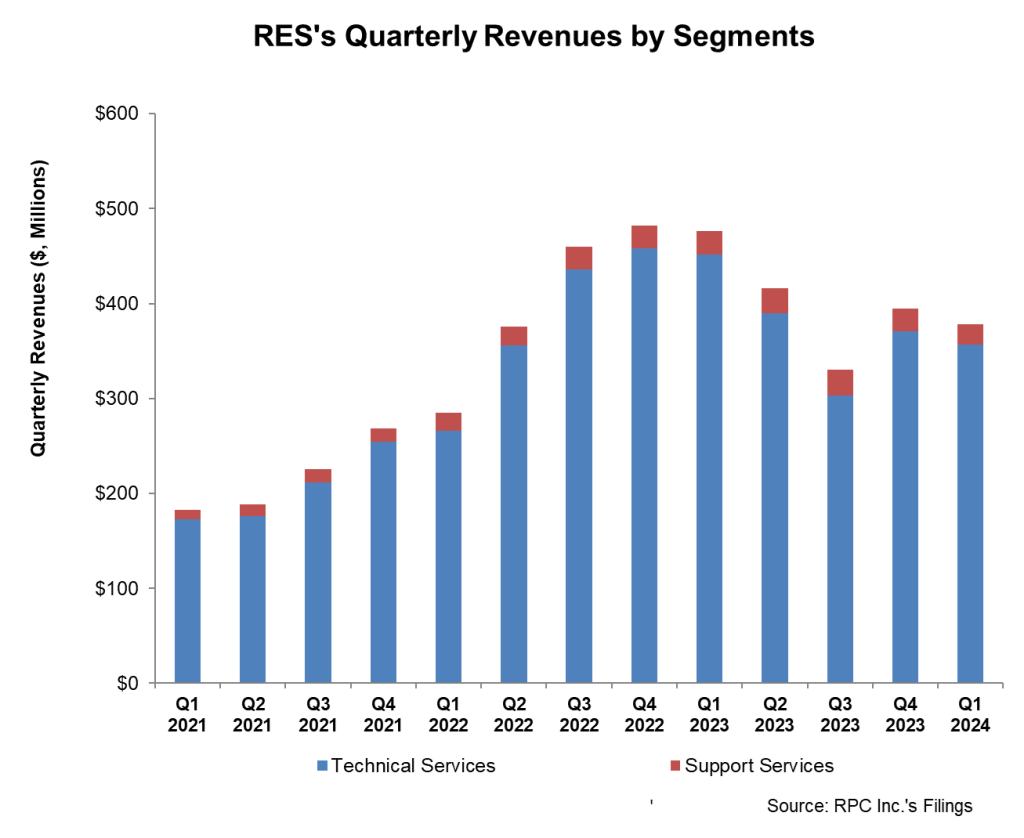

Quarter-over-quarter, RPC’s (RES) revenues decreased by 4.3% in Q1 due primarily to weaker oilfield services activity and continued pricing pressures. Its net income decreased by 32% in Q1 2024 compared to a quarter ago, while adjusted EBITDA margin contracted by 340 basis points. Despite the topline fall, pumping industry capacity and pricing indicated a steady completion activity environment.

Cash Flows And Shareholder Returns

As of March 31, 2024, RES had no debt and positive cash & cash equivalents balance ($212 million). To guard against any liquidity strain, the company can tap from its robust liquidity (revolving credit facility of $100 million). The company’s cash flow from operations decreased by 57% in Q1 2024 compared to a year ago. Its free cash flows declined severely in Q1. During Q1, it spent nearly $10 million on share repurchases. In aggregate, it returned more than $16 million of capital to shareholders.

Relative Valuation

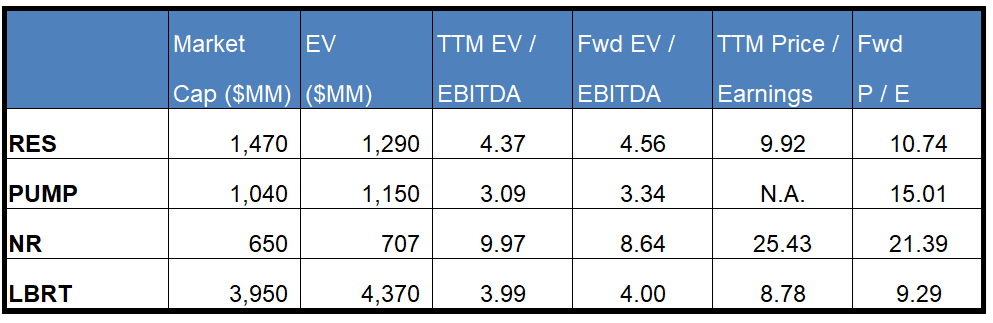

RES is currently trading at an EV/EBITDA multiple of 4.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 4.6x. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 29x.

RES’s forward EV/EBITDA multiple is expected to expand versus its current EV/EBITDA. In contrast the multiple is expected to remain unchanged for its peers. This implies the company’s EBITDA is expected to decrease as opposed to nearly no change in EBITDA for its peers in the next four quarters. This typically results in a lower EV/EBITDA multiple. The stock’s EV/EBITDA multiple is lower than its peers’ (PUMP, NR, and LBRT) average. The stock appears to be reasonably valued versus its peers.

Final Commentary

RES’s management plans to place a new Tier 4 DGB fleet in service in a few months, which will replace a Tier 2 diesel frac spread. It will continue to invest with a strong focus on upgrading to Tier 4 dual fuel. It also sees considerable focus on the e-frac market. However, the management also acknowledges the aggressive competition in the frac equipment market. Pricing has degraded over the previous year, leading to a lower topline in pressure pumping. It expects the excess capacity to gradually be absorbed, giving fracturing companies more control over the pricing.

In Q1, its cash flows declined significantly. Still, the presence of robust liquidity will ensure the risks are minimized. The stock appears to be reasonably valued compared to its peers.