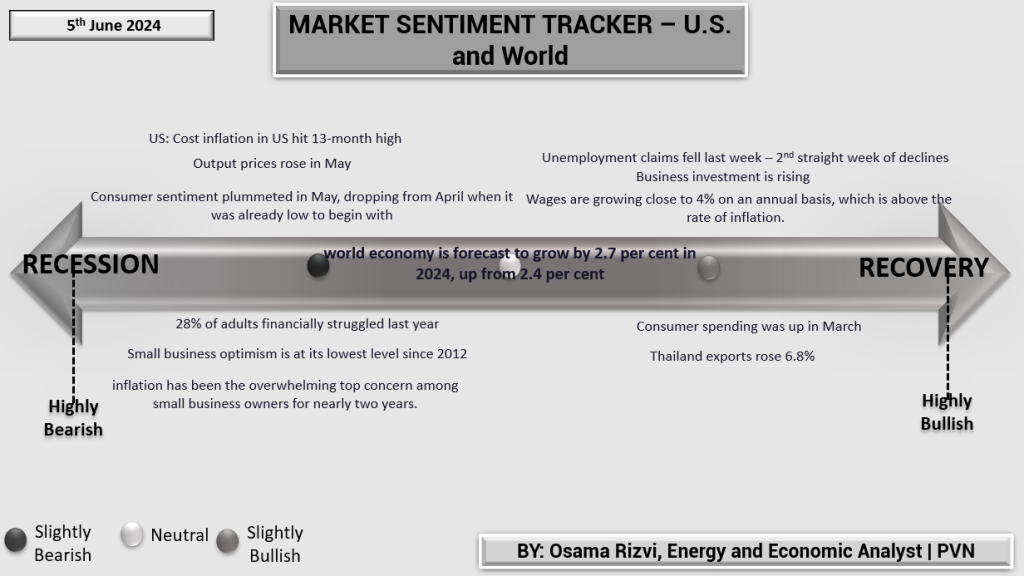

In the U.S., cost inflation hit a 13-month high, with output prices rising in May. Consumer sentiment plummeted in May, dropping from April’s already low levels, indicating significant consumer concerns. Despite this, unemployment claims fell for the second straight week, and business investment is rising. Wages are growing close to 4% on an annual basis, which is above the rate of inflation, offering some relief. The world economy is forecast to grow by 2.7% in 2024, up from 2.4%, suggesting a broader global economic recovery. However, small business optimism is at its lowest level since 2012, with inflation remaining a top concern for nearly two years.

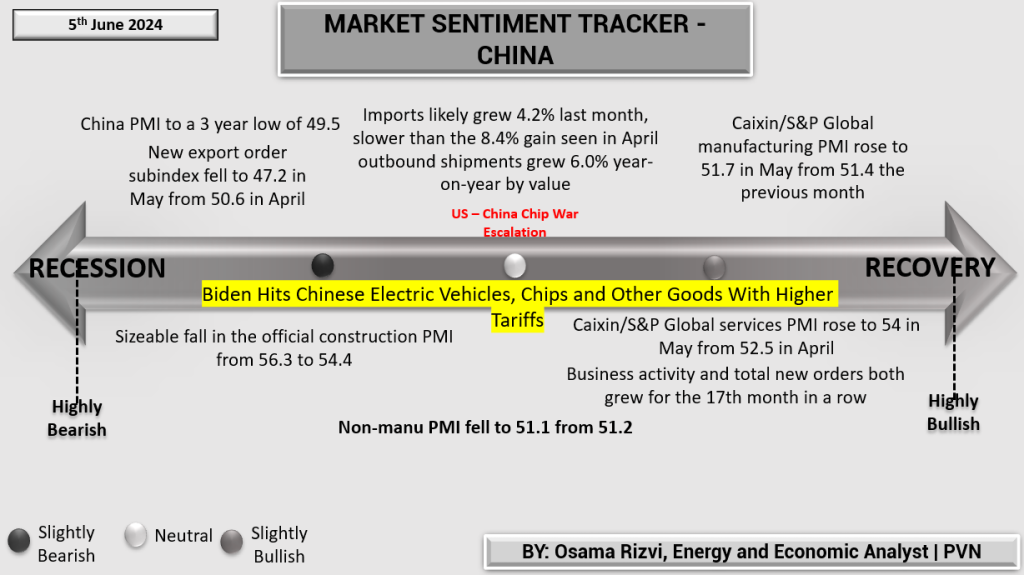

In China, the PMI fell to a three-year low of 49.5, indicating contraction. New export order subindex fell to 47.2 in May from 50.6 in April, highlighting weak external demand. Imports likely grew by 4.2% last month, slower than the 8.4% gain seen in April, while outbound shipments grew 6.0% year-on-year by value. Business activity and new orders both grew for the 17th month in a row, with the Caixin/S&P Global services PMI rising to 54 in May from 52.5 in April. The manufacturing PMI also showed a slight improvement, rising to 51.7 from 51.4. The ongoing U.S.-China chip war escalation and Biden’s higher tariffs on Chinese electric vehicles and chips add to the geopolitical tensions affecting China’s economy.

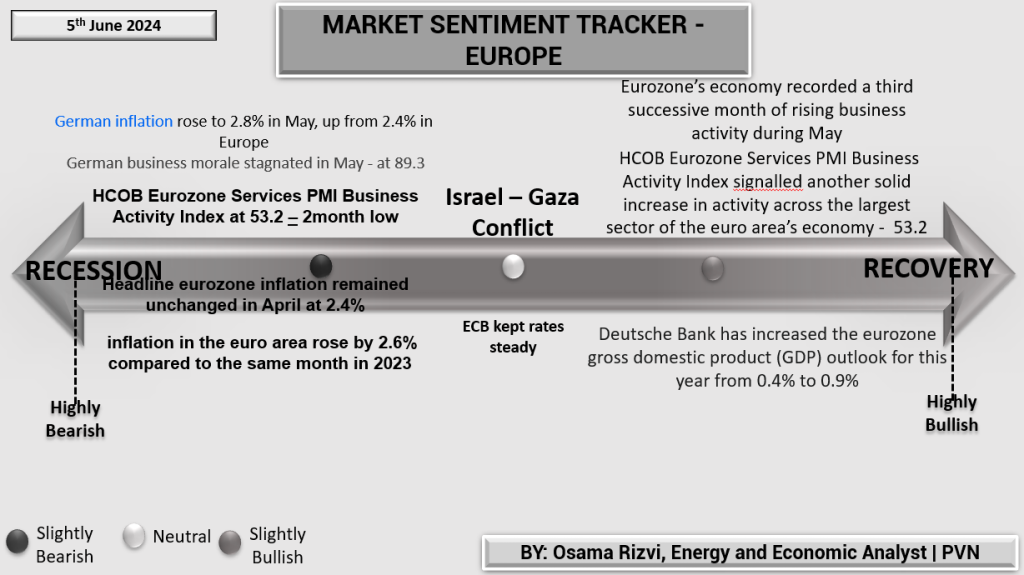

In Europe, German inflation rose to 2.8% in May, up from 2.4%, while German business morale stagnated at 89.3. The HCOB Eurozone Services PMI Business Activity Index recorded a two-month low at 53.2 but still indicates expansion. The eurozone economy recorded its third successive month of rising business activity during May. Deutsche Bank increased its GDP growth forecast for the eurozone from 0.4% to 0.9% for this year. Headline eurozone inflation remained unchanged at 2.4% in April, but year-on-year inflation rose by 2.6%. The ECB kept interest rates steady, reflecting a cautious approach to balancing growth and inflation control.

Overall, the global economic landscape is marked by inflationary pressures, geopolitical tensions, and varied growth trajectories across regions. The U.S. shows mixed signals with rising inflation and improving labor market conditions. China faces contraction in certain sectors but sees growth in services and manufacturing, despite geopolitical headwinds. Europe displays steady business activity growth and stable inflation, although inflationary concerns persist.