This week’s Monday Macro View will focus on the recent economic developments in China and the United States. Let’s dive into the key insights and trends shaping the current economic landscape.

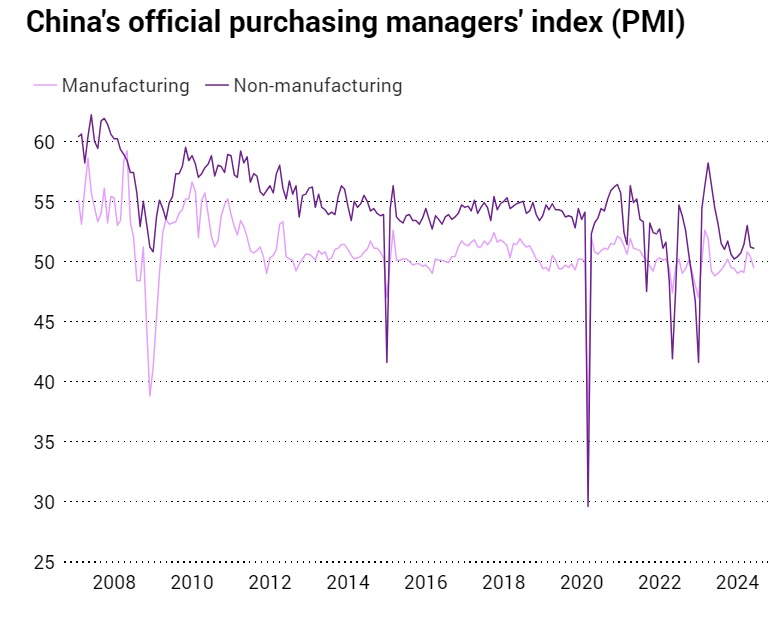

China’s economic growth is facing significant headwinds, as highlighted by the latest purchasing managers’ indices (PMI) data. The official manufacturing PMI for May fell to a three-month low of 49.5, down from 50.4 in April, signaling contraction. This decline was driven by a drop in the output component and a softening in new and export orders, likely influenced by the new U.S. tariffs on Chinese goods, including semiconductors, electric vehicles, steel, and batteries. The new export order subindex dropped to 47.2 from 50.6, further indicating potential declines in exports.

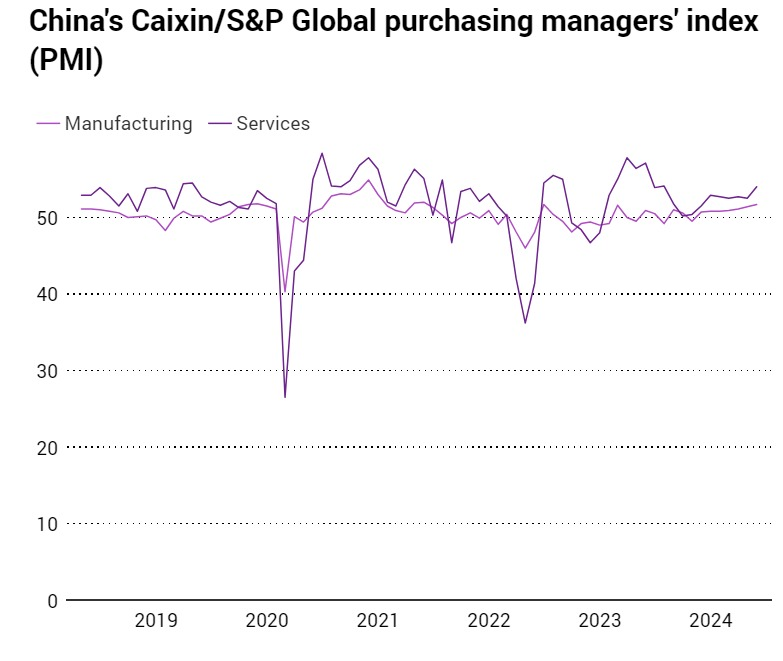

Interestingly, the Caixin/S&P Global manufacturing PMI, which tends to focus more on smaller, export-oriented firms, rose slightly to 51.7 in May from 51.4 in April. This survey reported the fastest pace of output growth since June 2022, with notable performance in the consumer segment.

In the services sector, China’s official non-manufacturing PMI held steady at 51.1, indicating expansion for the fifth consecutive month. However, the construction PMI fell from 56.3 to 54.4, reflecting the diminishing impact of fiscal stimulus on infrastructure spending. The Caixin/S&P Global services PMI painted a more optimistic picture, rising to 54 from 52.5, driven by robust business activity and new orders.

The composite PMI data presents a mixed outlook. The official composite PMI fell to a three-month low of 51, while the Caixin/S&P Global composite PMI rose to 54.1, its highest in a year. This suggests that while the overall economic recovery in China may regain some momentum due to fiscal support, challenges remain, particularly in industrial activity and retail sales.

Turning to the United States, the economy appears healthy but is overshadowed by persistent inflation. Key indicators show wages growing at an annual rate close to 4%, surpassing inflation. The unemployment rate remains low at 3.9%, and consumer spending and business investment are on the rise. The economy grew nearly 3% in 2023, with the Atlanta Federal Reserve estimating a robust 4.2% growth for the second quarter of 2024.

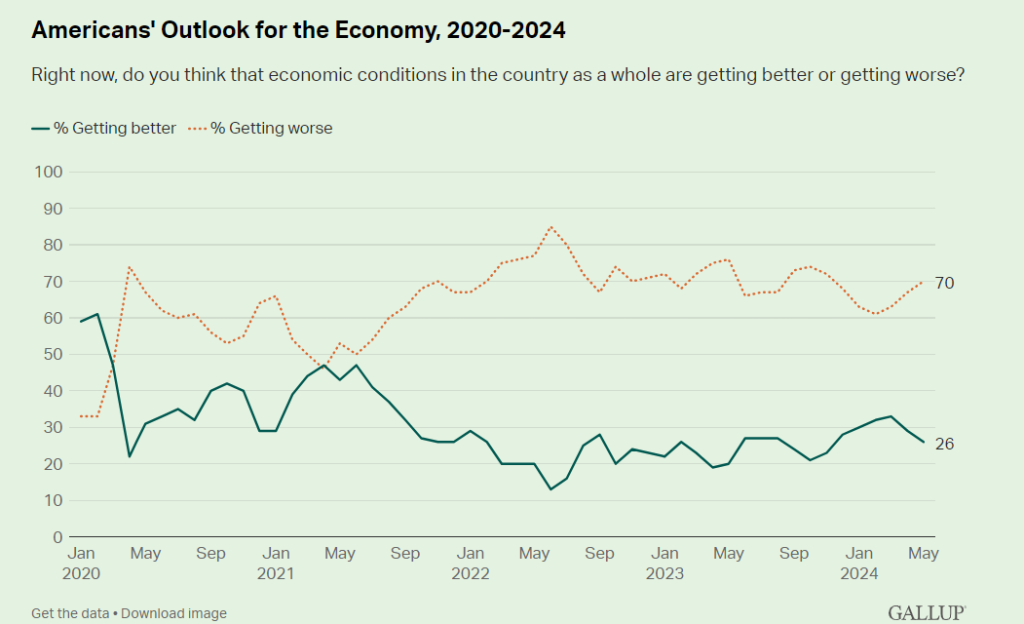

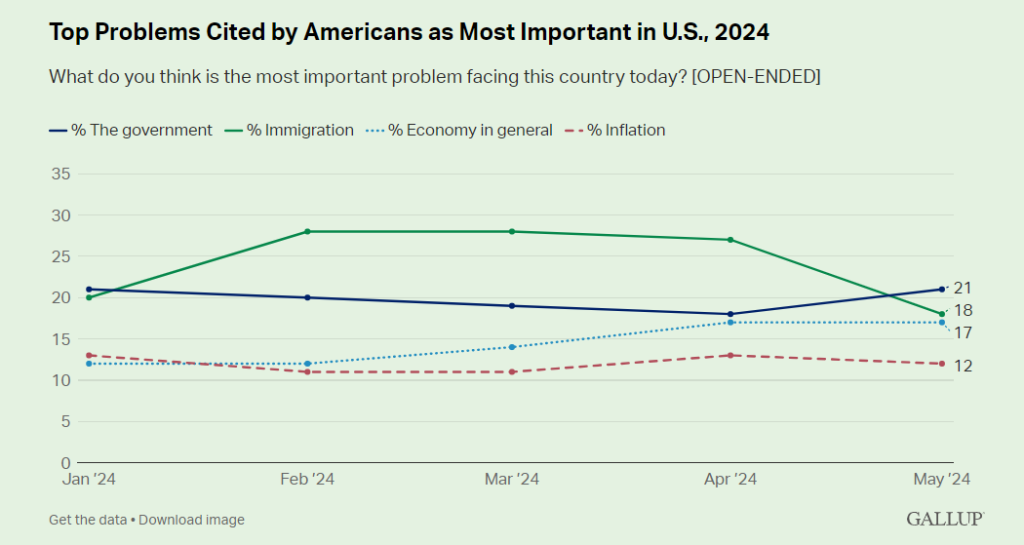

Despite these positive signs, consumer sentiment has plummeted, with Gallup’s Economic Confidence Index dropping to -34 in May, reflecting increased pessimism about the economy’s current state and future trajectory. This decline in confidence is fueled by ongoing concerns about inflation, which continues to make it difficult for families to save for the future and for businesses to maintain profit margins amid rising costs.

The U.S. Chamber of Commerce has highlighted that inflation remains a top concern for small business owners, impacting their optimism and financial health. Additionally, the economic confidence index shows that 70% of Americans believe the economy is getting worse, a sentiment that has been consistent since May 2021.

In summary, while China’s PMI data indicates a mixed economic outlook with sectors experiencing varying degrees of growth and contraction, the U.S. economy shows resilience in growth metrics but is weighed down by inflation and declining consumer confidence. These developments underscore the complex and interconnected nature of the global economy, influenced by policy decisions, geopolitical tensions, and domestic economic conditions.