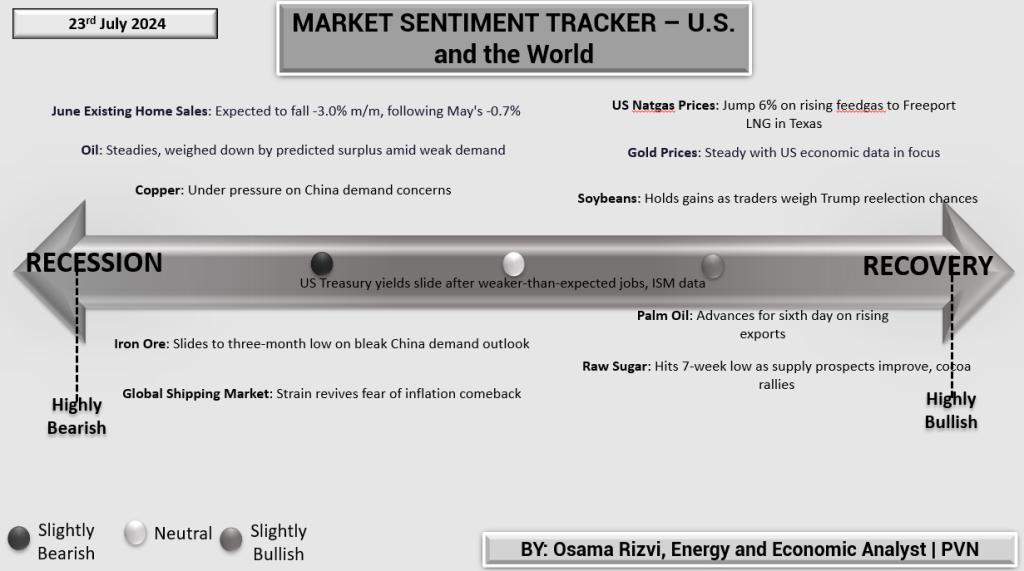

U.S. and the World

The economic signals from the U.S. continue to be a mixed bag. June’s Existing Home Sales are forecasted to drop by 3.0% m/m, following May’s 0.7% decline, indicating ongoing challenges in the housing market. Oil prices remain steady, though weighed down by a predicted surplus and weak demand. Similarly, copper and iron ore prices are under pressure due to concerns about demand from China, highlighting a bleak outlook for global commodities. On the flip side, U.S. natural gas prices spiked by 6% on rising feedgas to Freeport LNG in Texas, and gold prices remain stable with U.S. economic data in focus. Soybeans are holding gains as traders consider Trump’s reelection prospects, and palm oil continues to advance, supported by rising exports. Additionally, raw sugar has hit a seven-week low, suggesting improved supply prospects and a rally in cocoa prices. These elements reflect a cautious optimism amidst broader economic uncertainties.

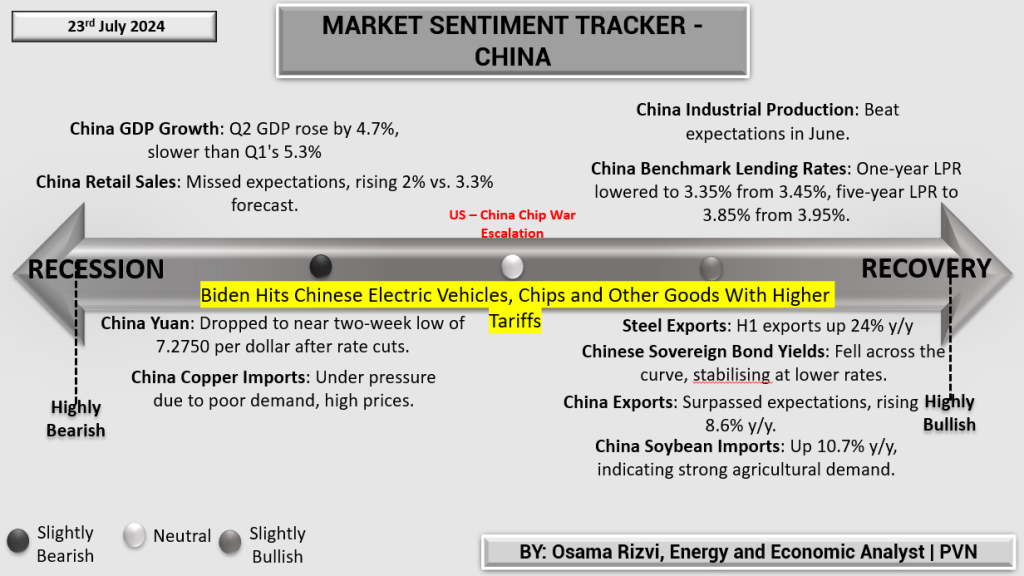

China

China’s economic performance presents a nuanced picture. The Q2 GDP growth slowed to 4.7%, down from Q1’s 5.3%, and retail sales missed expectations, rising only 2% versus the forecasted 3.3%. The yuan has dropped to a near two-week low of 7.2750 per dollar following recent rate cuts, and copper imports are under pressure due to poor demand and high prices. However, industrial production beat expectations in June, and the benchmark lending rates were reduced, with the one-year LPR cut to 3.35%. Steel exports saw a significant rise of 24% y/y in H1, and Chinese sovereign bond yields fell across the curve, stabilizing at lower rates. Export performance was strong, rising 8.6% y/y, and soybean imports surged by 10.7% y/y, reflecting robust agricultural demand. These indicators suggest strategic adjustments and resilience within China’s economic framework.

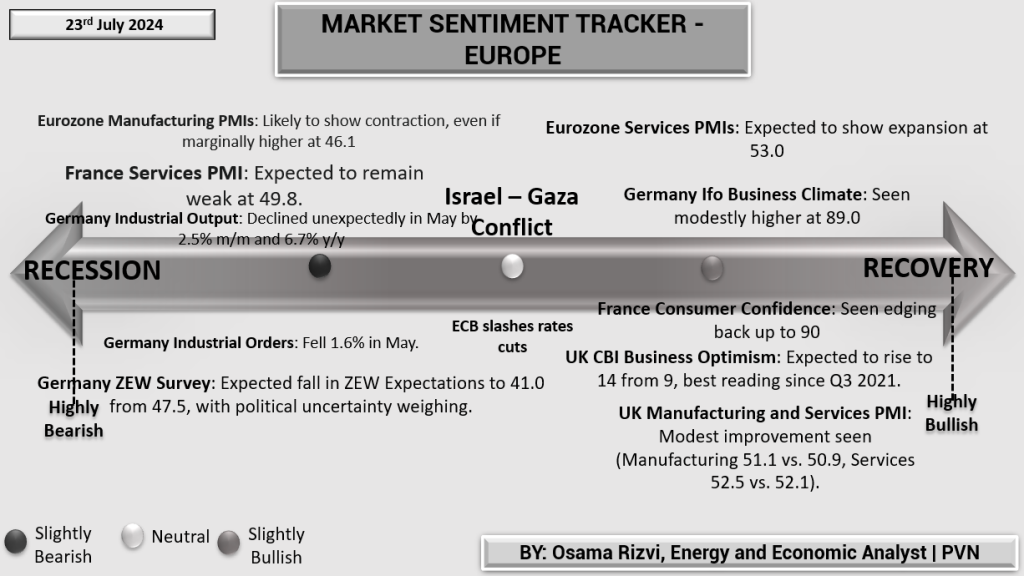

Eurozone

The Eurozone’s economic landscape is a blend of challenges and opportunities. On the bearish side, Germany’s industrial output declined by 2.5% m/m and 6.7% y/y, with industrial orders falling 1.6% in May. The ZEW Survey expects a drop in expectations to 41.0 from 47.5, driven by political uncertainty. Manufacturing PMIs are likely to continue showing contraction at 46.1, and France’s Services PMI is expected to remain weak at 49.8. Despite these challenges, there are positive signs: Eurozone Services PMIs are projected to expand at 53.0. Germany’s Ifo Business Climate is anticipated to improve modestly to 89.0, and France’s consumer confidence is set to edge up to 90. In the UK, the CBI Business Optimism index is expected to rise to 14 from 9, marking its best level since Q3 2021. Additionally, UK Manufacturing and Services PMIs indicate slight improvements, with Manufacturing at 51.1 and Services at 52.5.

In essence, while the global economic environment remains fraught with recessionary pressures, pockets of resilience and growth are evident, particularly in the U.S. energy sector, China’s industrial output, and Europe’s business sentiment. These factors underscore a complex, yet dynamic global economic landscape.