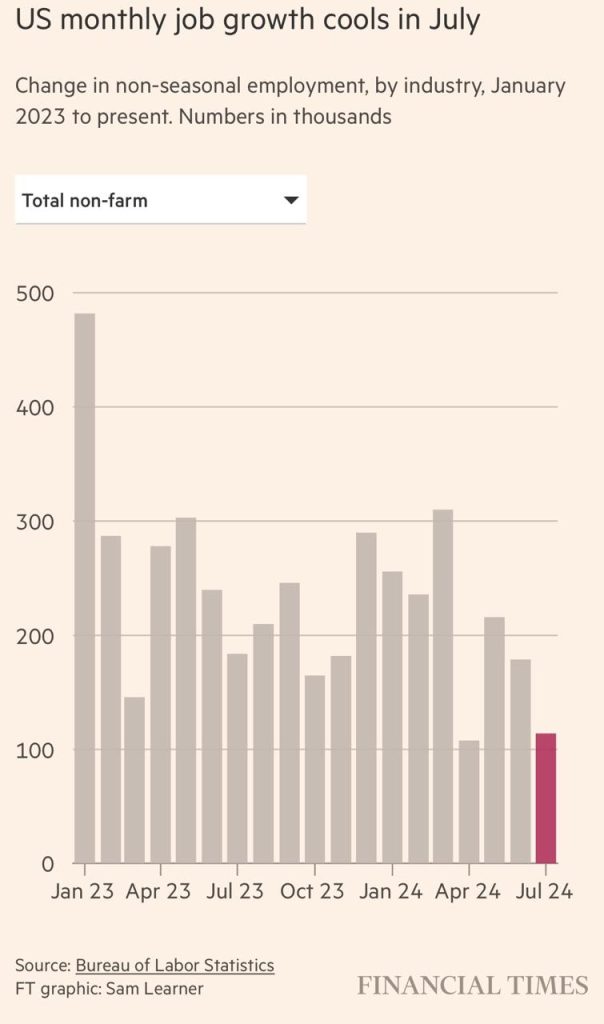

The Federal Reserve’s recent decision to maintain interest rates at their 23-year high has sparked considerable debate among economists and policymakers. The US economy’s cooling job market, slowing manufacturing, and fears of an impending recession have added fuel to the fire. With July’s employment report showing a significant drop in job growth, concerns are mounting that the Fed’s hesitation to lower borrowing costs could lead to the very recession it aims to avoid.

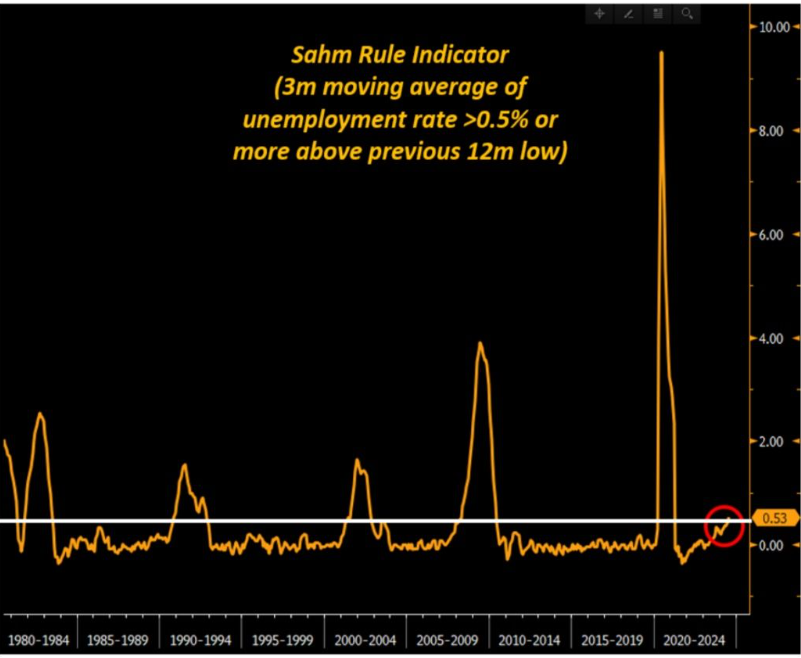

In July, the US economy added only 114,000 jobs, well below the 12-month average of 215,000. This sharp decline in job growth, coupled with a rise in the unemployment rate to 4.3%, has triggered the Sahm Rule, which links the start of a recession to a notable increase in the jobless rate. The Fed’s decision to hold the benchmark interest rate steady, despite these worrying signs, has drawn criticism from various quarters. Chair Jay Powell emphasized the need for more evidence that inflation is on track to hit the 2% target before making any monetary policy changes. However, he did hint at the possibility of a rate cut in September.

Economists argue that the Fed should have acted sooner. Mark Zandi, chief economist at Moody’s, suggested that a quarter-point cut in September might not suffice, advocating for a more aggressive half-point reduction. Gregory Daco, chief economist at EY Parthenon, described the Fed’s July meeting as a missed opportunity, emphasizing that the data already pointed towards a slowing economy and labor market.

Political voices have also joined the chorus of criticism. Progressive Democratic Senator Elizabeth Warren has been vocal about the need for immediate rate cuts, warning that the Fed’s delay could drive the economy into a recession. Traders in federal funds futures markets have adjusted their bets, now anticipating more than a full percentage point cut by the end of the year, implying two half-point cuts are likely given the remaining three meetings in 2024.

The broader market has reacted sharply to these developments. Wall Street experienced a major sell-off, with the Dow Jones falling nearly 500 points (1.2%) and the S&P 500 dropping 1.3%. Tech stocks were hit particularly hard, with the Nasdaq down 2.3%. Disappointing results from major tech companies like Intel and Amazon exacerbated the sell-off. Two critical economic data points released on Thursday further spooked investors: manufacturing activity hit an eight-month low, and new unemployment benefit applications reached an 11-month high.

Despite the day’s downturn, the stock market has had a relatively strong year, with the S&P 500 and Nasdaq up 14.3% and 16%, respectively. However, Thursday’s data and the Fed’s recent announcements have cast a shadow over the optimism. Investors are now closely watching for the Fed’s next move in September, with many expecting the first rate cut to occur if inflation remains stable over the summer. June’s inflation rate was 3%, one of the lowest since 2021, giving some hope that the Fed might be inclined to ease borrowing costs.

The IMF’s recent report adds another layer to the complex economic picture. It highlights signs of cooling in the US economy, with projections for slower growth and persistent inflation posing significant risks. The IMF now expects US economic growth to rise to 2.6% in 2024 from 2.5% in 2023, a slight downgrade from earlier projections. This cooling is evident in the labor market and consumer spending, which could impact overall economic stability.

Globally, inflation remains a concern. The IMF notes that rising prices for services could lead central banks to maintain high borrowing costs, further straining economic growth. The report also underscores geopolitical risks, including protectionism and mounting debt burdens, which could disrupt global trade and economic recovery.

The Sahm Rule has been triggered, indicating a potential recession as the three-month moving average of the US unemployment rate has risen by 0.5 percentage points or more relative to its low during the previous 12 months. This, combined with an inverted yield curve for 25 months and a slowing economy, raises questions about the resilience of the current economic expansion.

The Federal Reserve faces a delicate balancing act. While Powell has emphasized that the chances of a “hard landing” remain low, the latest data suggests the economy is cooling more rapidly than anticipated. The recent GDP growth of nearly 3% in the last quarter and continued consumer spending and hiring indicate some underlying strength. However, the rising unemployment rate and slowing job creation signal that the labor market is under pressure.

Fed officials like Austan Goolsbee have cautioned against overreacting to a single month’s data, urging a more measured approach. Yet, the pressure is mounting for the Fed to act decisively. If they don’t cut rates soon, they risk creating the very recession they are trying to prevent. The coming months will be critical in determining the Fed’s response and the direction of the US economy.

As the debate continues, the central bank’s decisions will be closely scrutinized. The balance between curbing inflation and fostering economic growth remains a challenging task. The Fed’s ability to navigate these complexities will be pivotal in shaping the economic landscape in the coming years. The question remains: will the Fed’s actions be enough to steer the economy away from recession, or have they already waited too long?