In this weekly update, Primary Vision Network takes a closer look at the oil markets which seem to be between a supply-crunch and demand-resurgence (both of course assumptions). Data from the physical markets show the there is more oil slooshing around the sea and in transit than the demand can absorb. The global economy is playing its own role in keeping the demand muted. Where are we headed to? Will oil prices fall further? This update provides direct insights to these questions.

1. Monday Macro View: Efficiency in the Shale Industry – PREMIUM

The U.S. shale oil industry is once again in the spotlight, not for the explosive growth of the past but for a more measured, strategic approach to production. The shale industry continues to adapt to new market realities while still pushing the boundaries of efficiency. U.S. shale drillers have been quietly upping their production targets, and this is not without consequence, especially for the global oil market and OPEC+ nations.

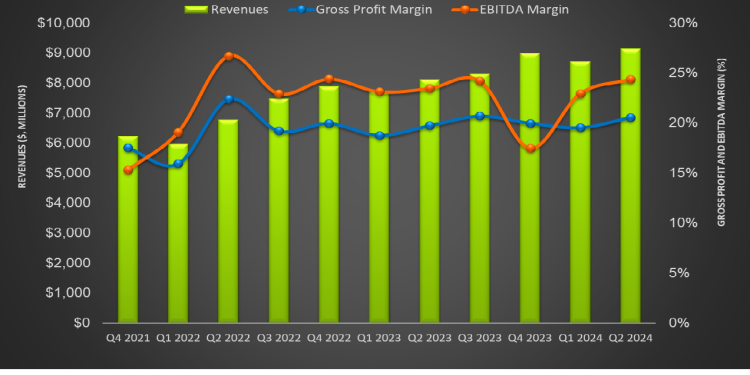

2. SLB Perspectives in Q2: Key Takeaways – PREMIUM

The company’s management plans to direct investments in key international markets like the Middle East and Asia while focusing on the global offshore market. The upcycle in natural gas and deepwater projects and production and recovery activity should benefit it. In the Middle East, using the company’s fit-for-basin technology and differentiated integration capability accelerated the scale of investments in gas development. What will this mean for SLB moving forward? Read Avik’s wonderfully interesting article to find out.

3. PRIMARY VISION INSIGHTS – ENTERPRISE

The energy markets have been in a free fall as economic uncertainty gained the upper hand against the geopolitical theater heating up. The market is finally starting to weigh in on a weak economic backdrop and slowing demand. Our base case was for OPEC+ to keep the production cuts through at least 2024 with a likely extension into Q1’25. China has reduced Angola purchases, which pushes a lot of that crude into the European markets. Tanker rates have remained depressed in the ME and Med amid lower chartering activity. Read this INSIGHT from our senior analyst Mark Rossano speaking about the latest happenings in the world of energy and economy.

4. Market Sentiment Tracker:No signs of a Soft Landing – PREMIUM

In the U.S., the Producer Price Index (PPI) is set to rise by 0.2% month-over-month, with year-over-year rates expected to ease to 2.3% and 2.7%. Retail sales are projected to increase by 0.6%, indicating steady consumer spending.hina’s economic outlook continues to face significant challenges. While industrial production is expected to remain steady at 5.2% year-on-year, concerns persist over weak domestic demand and ongoing struggles in the property sector. The Eurozone’s economic outlook remains mixed. The second quarter GDP is expected to stay unchanged at 0.3% quarter-on-quarter and 0.6% year-on-year, with Germany’s industrial production anticipated to rebound by 0.5% month-on-month.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co