The U.S. shale oil industry is once again in the spotlight, not for the explosive growth of the past but for a more measured, strategic approach to production. The shale industry continues to adapt to new market realities while still pushing the boundaries of efficiency. U.S. shale drillers have been quietly upping their production targets, and this is not without consequence, especially for the global oil market and OPEC+ nations.

In recent weeks, companies like Diamondback Energy Inc. and Matador Resources Co. have signaled increases in their 2024 production forecasts by about 5%. This follows last year’s unexpected surge of a million barrels per day in U.S. crude output, a move that caught many by surprise. The question now is, how much more can be squeezed out of these wells? Wall Street analysts seem to think there’s more to come, and that’s worth noting.

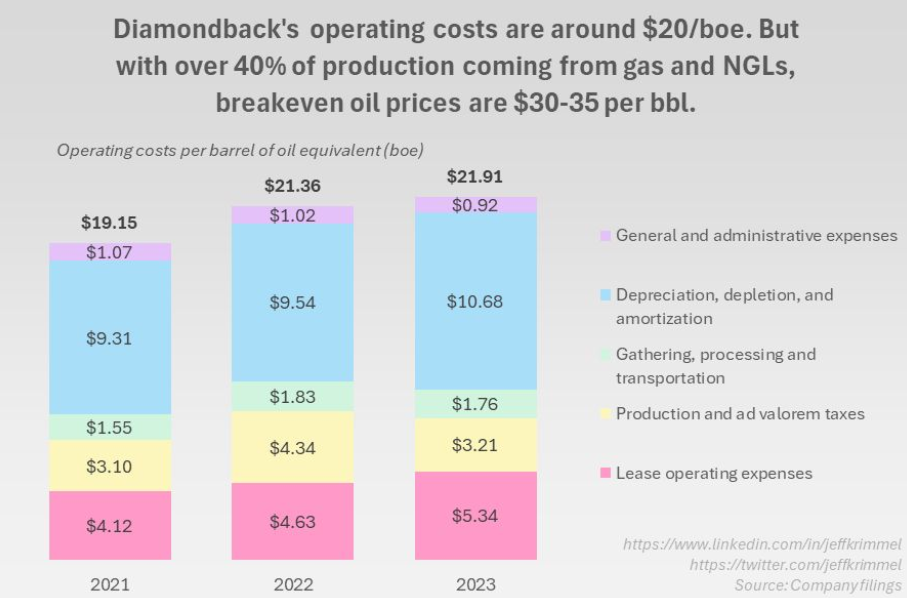

However, this isn’t the wild west of shale that we’ve seen in years past. The context has shifted. Global oil demand is lackluster, economic signals are mixed, and prices have been trending downward since early July. Despite these headwinds, the U.S. shale sector continues to operate with a level of efficiency that keeps it profitable even at lower price points. Diamondback, for instance, can break even at $40 per barrel, a testament to the industry’s relentless focus on cost control and operational improvements.

Efficiency has become the mantra. Take Diamondback’s operations in the Permian Basin, for example. Rigs that were drilling two wells a month at the start of the year have now increased that pace by over 8%. Fracking crews are completing wells 25% faster. These aren’t just marginal gains; they’re significant improvements that allow these companies to remain competitive in a challenging market. It’s telling that during Diamondback’s recent earnings call, there wasn’t a single mention of OPEC—a clear sign that these companies are focused on their own metrics, not what’s happening in Vienna.

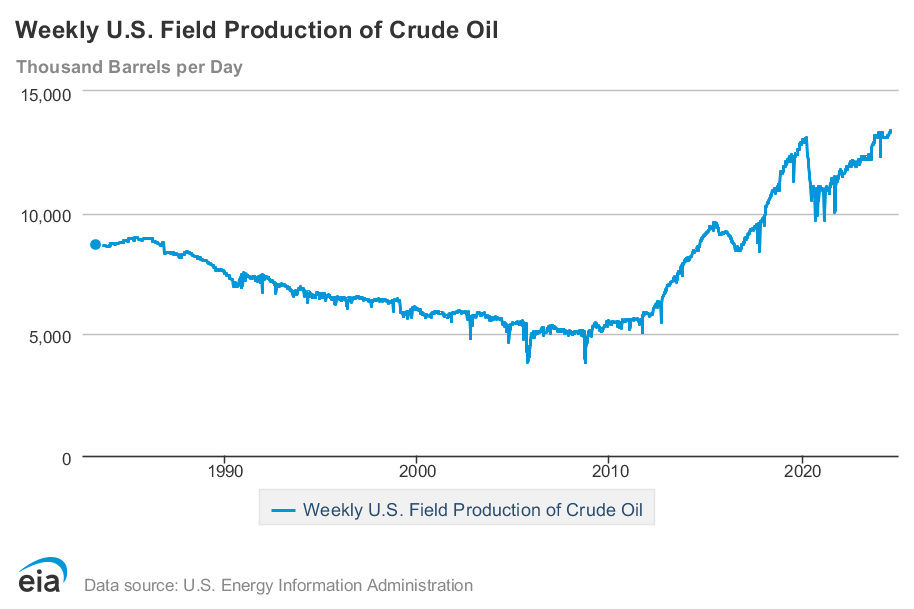

But let’s not overlook the bigger picture. The EIA recently revised its production estimates, forecasting an average of 13.2 million barrels per day for 2024, up from 12.9 million barrels per day in 2023. While this is growth, it’s more subdued than in years past. By 2025, the EIA expects production to reach 13.7 million barrels per day. This indicates that while the growth trajectory continues, it’s no longer the breakneck pace of the “drill, baby, drill” era.

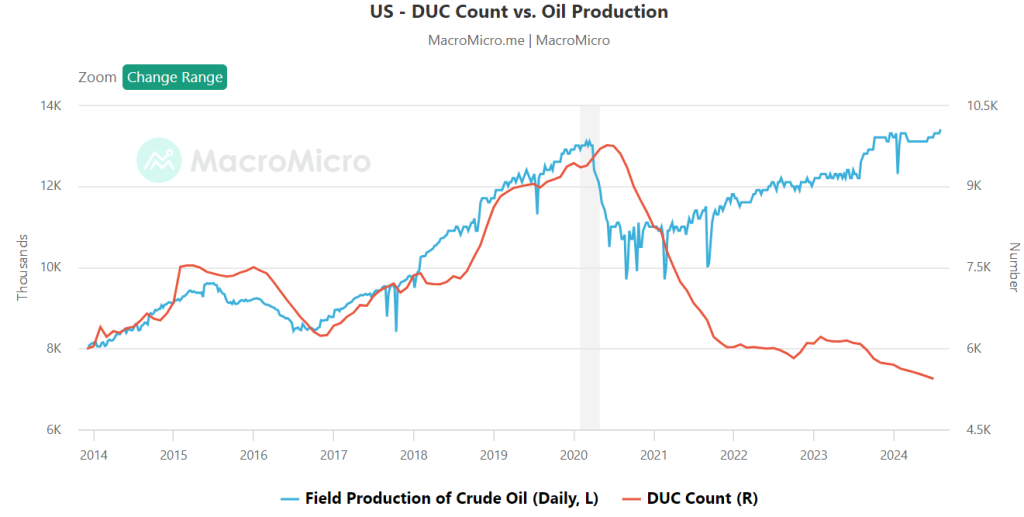

What’s driving this change? The shale industry has matured. Gone are the days of reckless expansion fueled by cheap debt. The pandemic was a turning point, forcing companies to prioritize financial health over sheer output. This has led to a focus on shareholder returns, with production decisions increasingly driven by profitability rather than volume. The increase in drilled but uncompleted wells (DUCs) earlier this year is a case in point. It suggests that shale producers are being more strategic, holding back production to avoid flooding the market and driving down prices.

This cautious approach is crucial, especially with OPEC+ poised to increase supply. The additional barrels from U.S. shale could complicate matters, particularly as global demand typically dips post-summer. It’s a delicate balance, and one misstep could lead to a significant price correction. Yet, despite these challenges, U.S. shale producers remain optimistic. Their ability to generate profits at lower prices, coupled with continuous efficiency gains, puts them in a strong position. But this isn’t about chasing growth at all costs. It’s about maintaining a sustainable, profitable business model in a market that’s becoming increasingly difficult to navigate.