Key Drivers And Strategies

Our short article discussed our initial thoughts about KLX Energy Services’ (KLXE) Q2 2024 performance a few days ago. KLXE’s revenue per rig in Q2 2024 was up by 10% sequentially, reflecting the company’s market share gains. Readers may note that the company’s revenues strongly correlate with the US rig count. Despite a relatively flat rig count in Q2, its performance was steady in Q2 due to enhanced laterals, completion technologies, and production and intervention services. On top of that, the company strategy of customer alignment and driving multiple PSLs (product specifications) through the sales channels kept its performance strong in Q2.

KLXE’s production and intervention revenue increased in Q2 following strategic capital spending and repositioning of its rental portfolio. Its downhole technology portfolio had traction due to a recovery in fishing activity. The company has sustainable earnings and cash flow as a result of geographic and product service line diversification. Its completion-focused activity accounted for 51% of Q2 revenue, while the Drilling & Production and Intervention segments accounted for 21% and 28% of its sales, respectively.

Outlook Explained

In Q3, KLXE’s management expects completions and production-oriented activity to continue, particularly in the Rockies and Southwest, with an uptick in the Northeast Mid-Con. So, in Q3, it expects revenue to be “flat to slightly up” compared to Q2. It also expects the adjusted EBITDA margin to remain unchanged. In 2025, it anticipates an increase in activity after the energy operators complete the recent M&A spree. Also, natural gas-directed activity, led by higher demand from LNG export volumes and data centers, would contribute to higher sales.

From Q1 through Q2, KLXE’s cost reduction measures saved $16 million (annualized). Its cost of sales and G&A were down sequentially 5% and 8%, respectively. In Q2, it reduced insurance IT and third-party professional fees, which benefited its Q2 margin significantly. The measures will likely have a substantial effect in Q3 and may continue to help it for the remainder of 2024 and beyond.

A Discussion On Q2 Performance

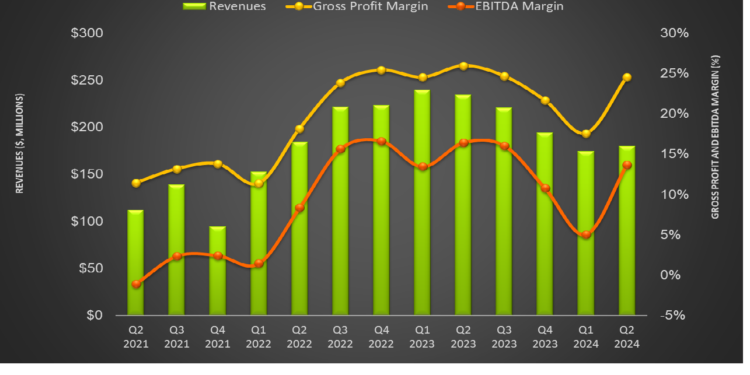

Quarter-over-quarter, KLXE’s revenues in the Rocky Mountains increased the most, by 35% in Q2. At the same time, its operating income turned significantly positive (profit of $10.5 million) compared to a loss a quarter earlier. Reduced natural gas-focused activity, lower drilling, completion, and production offerings, and lower pricing hurt the segment result in Q2. KLXE’s adjusted EBITDA margin (company-wide) expanded significantly (by 810 basis points) from Q1 to Q2.

Cash flow from operations and free cash flow turned positive in Q2 2024. It expects FY2024 capEx to be in the range of $50 million to $55 million. Due to a low shareholders’ equity base and a rise in net loss, its debt-to-equity increased to 29x as of June 30, 2024, from 7.3x by the end of 2023. The company’s liquidity was $121 million in Q2.

Relative Valuation

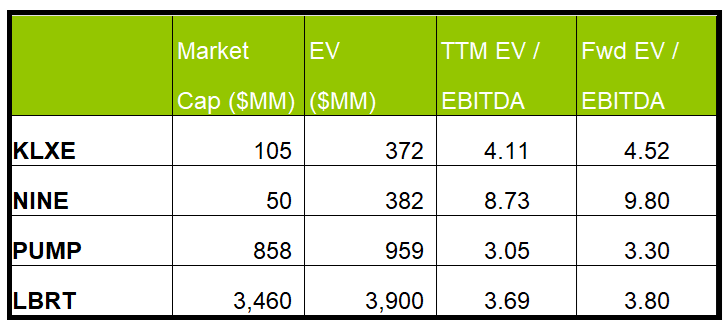

KLXE is currently trading at an EV/EBITDA multiple of 4.1x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is higher (4.5x).

KLXE’s forward EV/EBITDA multiple expansion versus the current EV/EBITDA is steeper than its peers’ because its EBITDA is expected to decrease sharply over the next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (NINE, PUMP, and LBRT) average. So, the stock is reasonably valued compared to its peers.

Final Commentary

In Q2, KLXE was estimated to have gained market share, reflected in higher revenue per rig. Enhanced laterals, completion technologies, and production and intervention services contributed to its stable performance in Q2. Also, its downhole technology portfolio had traction due to a recovery in fishing activity. The company expects completions, production-oriented activity, and higher natural gas demand for LNG export and data centers to benefit its near-to-medium-term outlook. Various cost reduction measures should also improve its EBITDA margin in Q3.

However, lower drilling, completion, production offerings, and pricing are key challenges. Due to a low shareholders’ equity base and a rise in net loss, its debt-to-equity skyrocketed in Q2, making its balance sheet risky. The stock is reasonably valued versus its peers.