Key Developments And Outlook: On October 15, Nabors Industries (NBR) announced the acquisition of Parker Wellbore. Parker provides franchises of tubular rentals, well construction services, and drilling rigs. Nabors identified a synergies potential of $35 million (annualized run-rate). During Q3, NBR drilled three wells in the Delaware Basin utilizing PACE-X rig equipped with a Canrig Sigma topdrive.

NBR expects to see international growth, with 13 rigs scheduled to deploy through early 2026 in the Middle East and Latin America. In the US onshore, it does not anticipate increases in gas-directed drilling but expects the overall US onshore activity to improve in 2025.

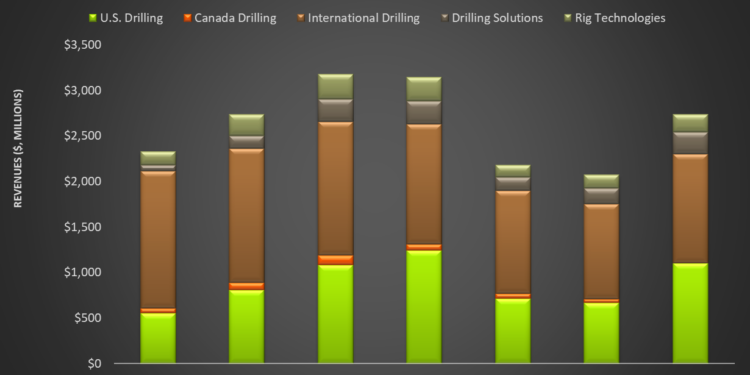

Key Drivers In Q3: Quarter-over-quarter, revenues in the company’s International Drilling operating segment witnessed a 3% rise in Q2. In contrast, the topline in the U.S. Drilling segment declined by 2%. Drilling Solutions and Rig Technologies also witnessed sequential revenue fall. Rig margins in U.S. Drilling declined by 4% while it improved by 6% in International Drilling during this period. The company’s net loss deteriorated to $56 million in Q3 compared to a $32 million loss in Q2.

Higher average daily margins and an improved mix kept its International Drilling segment performance steady in Q3. Rig additions in Algeria and Saudi Arabia resulted in performance stability in international operations. In U.S. Drilling, the company’s Q3 onshore rig count decreased by one compared to the previous quarter, although rig pricing remained stable. Also, its Drilling solution segment operating margin benefited from higher penetration of performance software.

Cash Flows Deteriorated As Leverage Remained High: NBR’s cash flow from operations weakened (21% down) in Q3 2024 compared to a quarter ago. As a result, its FCF decreased significantly (by 69%). Its debt-to-equity (5.4x) is high, primarily due to low shareholders’ equity and a high long-term debt.

Thanks for reading the NBR Take Three, designed to give you three critical takeaways from NBR’s earnings report. Soon, we will present a second update on NBR’s earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-