Q4 And FY2025 Outlook: During Q3, NOV (NOV) recorded $627 million in order booking, representing a 1.1x book-to-bill ratio. Despite higher orders for capital equipment for Energy Equipment, the company expects Q4 revenues to decline by “three to five percent” compared to Q3 2023 due to adverse conditions in the market and operators’ capex restraint. It also expects Q4 adjusted EBITDA to be between $280 million and $300 million, or nearly unchanged compared to Q3 2024. In FY2024, it expects the adjusted EBITDA to be near the lower end of its prior guidance. In FY2025, the company’s management will maintain a cautious approach as the energy price reflects uncertainty. Some positives, however, will stem from the progress in international and offshore gas projects.

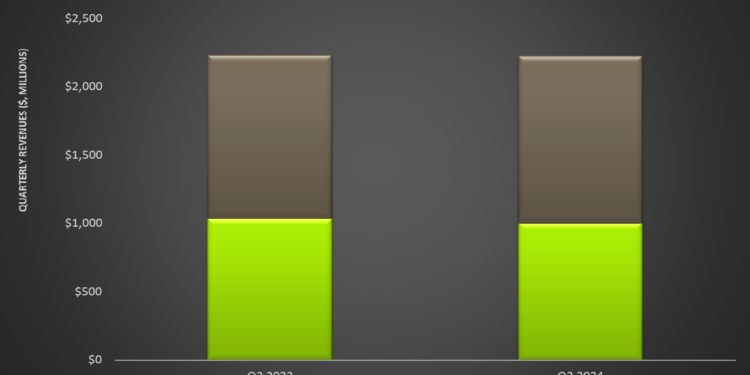

Revenue And Operating Income In Q3: In Q3 2024, the Energy Equipment segment witnessed 2% year-over-year revenue growth, while the Energy Products and Services segment revenue decreased by 3%. The Energy Equipment segment saw operating income rise significantly (32% up) from Q3 2023 to Q3 2024. On the other hand, operating profit in the Energy Products and Services segment decreased by 21%.

Increased demand for aftermarket parts and services, greater business efficiency, and a higher backlog led to moderate growth in some businesses. However, energy operators’ cautious capex approach and lower drilling activity levels in North America caused significant headwinds to the company’s growth. On the other hand, NOV’s acquisition of the artificial lift business (Extract) and better demand for aftermarket parts and services mitigated some of the concerns.

Cash Flows And Repurchases: NOV’s cash flow from operations turned significantly positive in 9M 2024, following a negative cash flow a year earlier. Evidently, FCF turned positive in 9M 2024. Debt-to-equity (0.27x) has remained unchanged since December 31, 2023. The company repurchased 4.6 million shares in Q3.

Thanks for reading the NOV Take Three, designed to give you three critical takeaways from NOV’s earnings report. Soon, we will present a second update on NOV earnings highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-