Orders And Key Projects: In Q3 2024, TechnipFMC’s (FTI) Subsea segment inbound orders were $2.5 billion. The book-to-bill ratio decreased to 1.2x from 1.4x a quarter earlier. The company’s topline and operating margin stability in Q3 indicates industrialization, standardization, and integrated business models. Some key Subsea project awards in Q3 included the Petrobras flexible pipe and subsea production systems contracts and an iEPCI project in the Gulf of Mexico.

FTI’s management is optimistic about the outlook of the subsea market. In 2025, it expects to see a diversified mix of opportunities, including Subsea 2.0 equipment and iEPCI projects. So, it expects to achieve the three-year Subsea inbound order target of $30 billion by 2025. It also expects FEED (FrontEnd Engineering and Design) pipeline for subsea developments to materialize after 2026.

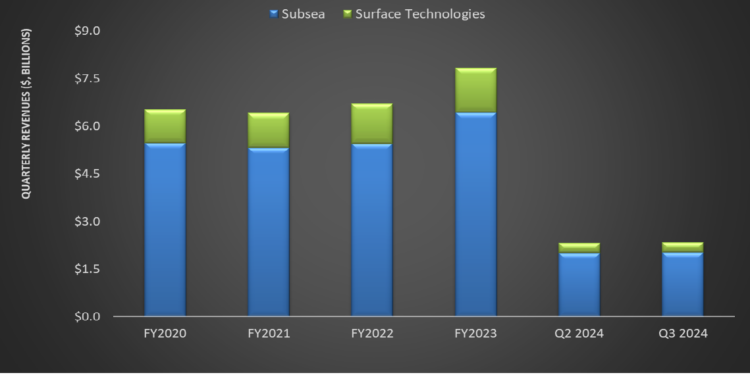

Segment Results Improved Moderately In Q3: Quarter-over-quarter, revenues in the company’s Subsea operating segment rose slightly in Q3. The top line in the Surface Technologies segment increased by 1.3%. Operating income growth in the Subsea segment decelerated to 4% in Q3 after a sharp hike in Q2, due primarily to improved earnings mix from backlog. Operating income in the Surface Technologies segment increased by 10% following robust services activity in the Middle East, although wellhead equipment revenue decreased in North America.

Cash Flows Strengthened, Repurchase Limit Increased: FTI’s cash flow from operations strengthened enormously in 9M 2024 from a negative cash flow a year ago. As a result, its FCF also turned significantly positive. Debt-to-equity (0.29x), as of September 30, also showed an improvement from FY2023. During Q3, it increased share repurchase authorization by $1 billion.

Thanks for reading the FTI take three, designed to give you three critical takeaways from FTI’s earnings report. Soon, we will present a second update on HAL earnings highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-