This update bring you a treasure trove of data and analysis related to oil industry in particular and global economy in general. The key question, when discussing the Non-OPEC supply, is whether the U.S. shale production slow? Therefore, we discuss the level of investment happening in the industry and what is means for the overall oil sector. Along with that we share key insights from Liberty Energy and NOV. There is a FREE article as well and a special update!

1. MMV: Is Shale Investment Peaking? – PREMIUM

The U.S. shale industry continues to evolve in a landscape defined by fluctuating oil prices, investor expectations, and shifting political winds. In recent months, the industry has displayed signs of transformation as major players consolidate their positions and prioritize financial discipline over pure production growth. The latest data, including insights from Primary Vision’s FSC, paint a clear picture of an industry that, while resilient, is recalibrating its strategies to adapt to market realities.

Read the article above to learn about this in more detail.

2. MST: U.S. Job Market Cools Down – PREMIUM

The latest U.S. economic indicators reflect a mixed landscape. Durable goods orders slipped by 0.8% in September, marking a second consecutive monthly decline, hinting at potential softening in capital investments. China’s industrial sector experienced a 5.8% growth, with high-tech manufacturing outperforming at 9.1%, reflecting an intensifying shift toward advanced industries.Eurozone indicators show a slight rebound but remain underwhelming. The factory PMI nudged up to 45.9 from 45.0, outpacing expectations but still deep in contraction territory.

3. Special Announcement: C6 INFRASTRUCTURE PARTNERS UPDATE SUMMARY: Q3, 2024 – FREE

C6 Infrastructure Partners had a strong Q3, securing capital from endowments and family offices to expand hydroelectric assets in New England and the Midwest. The grid is in trouble, and C6 has had the foresight to address these challenges by growing hydroelectric capacity, launching direct power sales to boost margins, and leveraging Sultech’s innovative solutions to meet rising energy and agricultural demands. C6 Infrastructure Partners had a strong Q3, securing capital from endowments and family offices to expand hydroelectric assets in New England and the Midwest. The grid is in trouble, and C6 has had the foresight to address these challenges by growing hydroelectric capacity, launching direct power sales to boost margins, and leveraging Sultech’s innovative solutions to meet rising energy and agricultural demands.

READ MORE TO FIND ABOUT THE DIRECTION OF THE GLOBAL ECONOMY.

4. EXPLAINER: TURKEY AND SOMALIA EXPLORE OIL AND GAS PRODUCTION – FREE

Turkey’s recent decision to explore oil and gas off Somalia’s coast is a strategic maneuver that ties into its larger ambitions in the energy sector and geopolitical sphere. Turkey’s state-owned energy company, TPAO, has dispatched its exploration vessel to Somalia’s offshore blocks, a move that underscores Turkey’s growing urgency to secure new energy sources. Read this article to read about what it means for the global energy markets.

5. Liberty Energy’s Perspective: Key Takeaways – PREMIUM

LBRT anticipates softer-than-usual year-end activity levels and pricing. However, the company expects hydraulic fracturing activity to increase in 2025 because drilling activity appears to have bottomed out in the market. So, Liberty plans to reduce its deployed frac spreads by ~5% temporarily and will reactivate those fleets in the long term in a “disciplined fashion.” Avik Chowdhury has really done a great job in this article in highlighting incredible details about LBRT’s industry outlook.

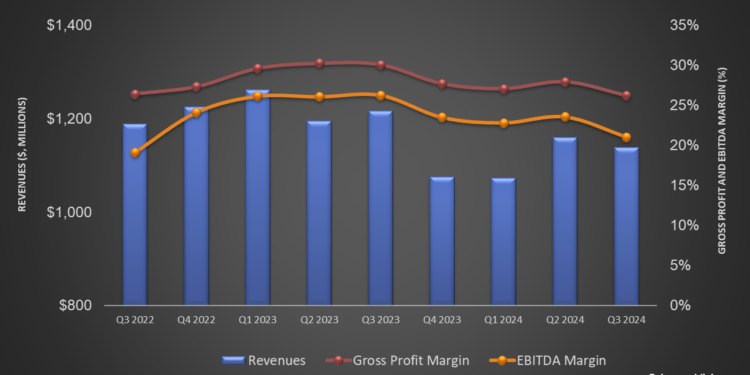

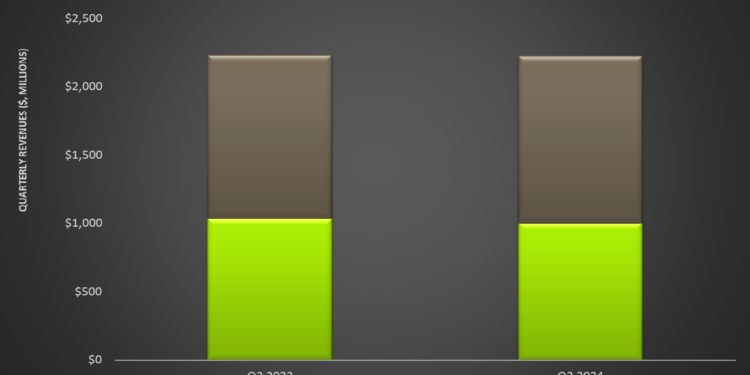

6. NOV: Q3 TAKE THREE – PREMIUM

Despite higher orders for capital equipment for Energy Equipment, the company expects Q4 revenues to decline by “three to five percent” compared to Q3 2023 due to adverse conditions in the market and operators’ capex restraint. It also expects Q4 adjusted EBITDA to be between $280 million and $300 million, or nearly unchanged compared to Q3 2024. But why is this happening? Read this article to learn about the nuances of these recent developments.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co