The Strategies Explained

We have already discussed SLB’s (SLB) Q3 2024 financial performance in our recent article. Here is an outline of its strategies. I discussed the outline of its several digital plans, including a collaboration with NVIDIA to develop generative AI solutions for energy. It also partnered with Amazon Web Services to expand access to applications from the Delfi digital platform. It also evaluated decarbonization solutions for Amazon’s digital infrastructure.

I discussed how digital sales have recently boosted SLB’s performance as E&P customers increase their investments in digital technology to reduce cycle times and enhance productivity to lower costs. This also allows for high-margin growth. As energy players accelerate their transition to the cloud, new markets are created by using data and AI. SLB’s new collaborations and partnerships can pave the way for a better sales and margin outlook because it induce higher uptake of new digital solutions and the optimization of digital support and delivery structure. On the other hand, margins in the Reservoir Performance and Well Construction segments contracted in Q3 due to unfavorable technology mix and lower activity.

Recently, it signed an agreement to sell its interests in the Palliser APS project in Canada. The asset sale will fetch $430 million and remove asset retirement obligations from its balance sheet, which should reduce its exposure to commodity prices, capital intensity, and earnings volatility. The sell-off would also allow the elimination of significant future abandonment liabilities of ~$280 million.

Q4 and FY2025 Outlook

SLB expects a “muted” revenue growth based on a favorable mix of year-end digital and product sales. However, E&P budget exhaustion in the US onshore and discretionary spending from a few international customers will partially offset it. It also expects adjusted EBITDA to expand due to cost optimization.

In FY2024, the company plans to deliver adjusted EBITDA margins at or above 25%. Higher EBITDA can trickle down to strong cash flows. This, along with the Palliser asset, would lead to increased returns for shareholders. In 2025, upstream capex in international markets can grow in the “low to mid-single digits” depending on the geopolitical environment and commodity prices.

SLB’s Q3 Performance

Our short article discussed SLB’s revenue drivers for the operating divisions and key geographic regions. SLB’s Digital & Integration and Production Systems segments witnessed a similar quarter-over-quarter revenue rise in Q3. On the other hand, the Well Construction segment saw a revenue fall in Q3 (3% down). Readers may note that the energy activity remained relatively subdued in Q3 as short-cycle activity softened, while a few international producers lowered capex.

SLB’s cash flow from operations increased in 9M2024 compared to a year ago. During Q3, it returned $900 million through stock repurchases and dividends. It brought the total return to shareholders to $2.38 billion for 9M2024.

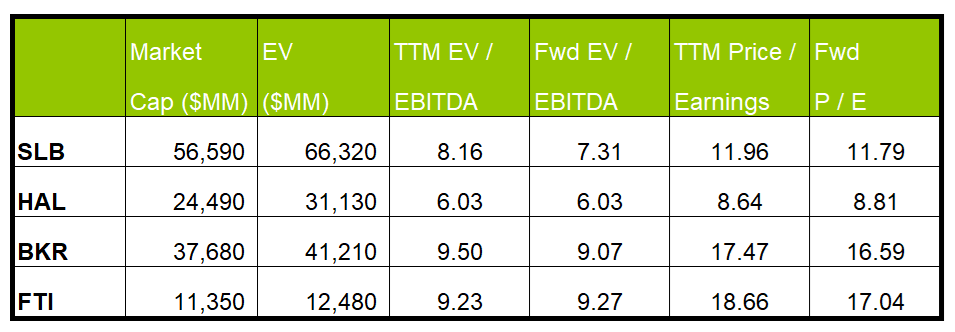

Relative Valuation

SLB is currently trading at an EV/EBITDA multiple of 8.2x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 7.3x. The current multiple falls short of its five-year average EV/EBITDA multiple of 11.8x.

SLB’s forward EV/EBITDA multiple contraction versus the adjusted current EV/EBITDA is steeper than its peers because the company’s EBITDA is expected to increase more steeply than its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is slightly lower than its peers’ (HAL, BKR, and FTI) average. So, the stock is relatively undervalued compared to its peers.

Final Commentary

SLB’s primary focus shifts to digital and technology as it experiences headwinds in the US and some international markets. It forged partnerships and collaborations with technology companies for innovative data and decarbonization solutions. The digital initiatives have also opened new avenues for topline growth and margin improvement. Its recent asset sale in Canada can boost its cash flows while hedging it from volatility. However, E&P budget exhaustion in the US onshore and discretionary spending from a few international customers can partially offset the upside.

In 2024, the management expects plans to deliver adjusted EBITDA margins of ~25%, while in 2025, upstream capex in international markets can grow in the “low to mid-single digits.” It accelerated its share buyback shares in Q3 2024. The stock is relatively undervalued compared to its peers.

Premium/Monthly

————————————————————————————————————-