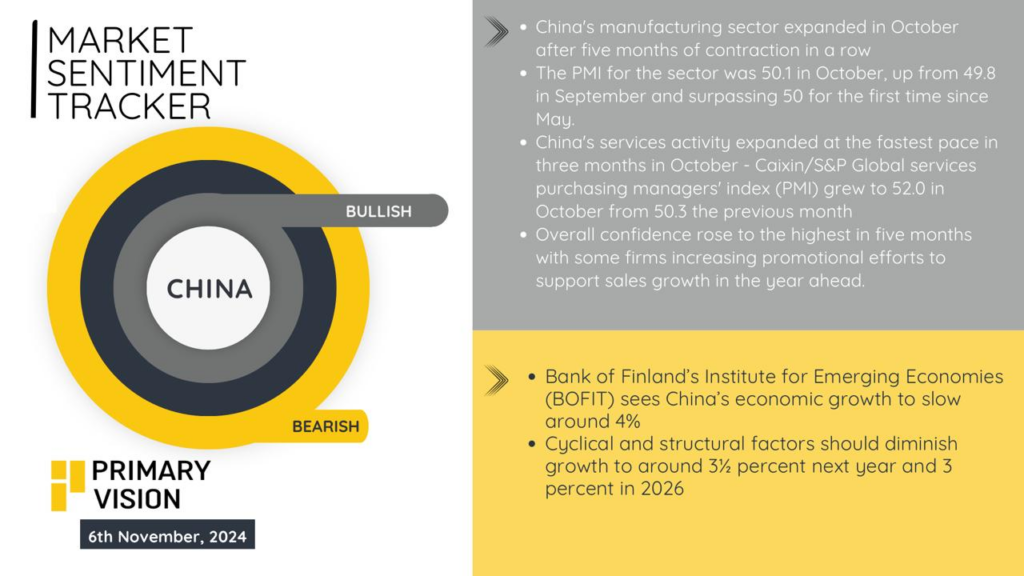

China’s economic indicators show slight optimism, as manufacturing posted expansion for the first time in five months, with the PMI edging up to 50.1 in October, signaling recovery from previous contractions. Services saw notable growth, too, with Caixin’s PMI rising to 52.0 from 50.3, marking the fastest pace in three months, reflecting strengthened consumer demand. Overall confidence reached a five-month high, with firms focusing on promotional efforts to boost future sales. However, longer-term forecasts indicate caution.

The Bank of Finland’s BOFIT projects China’s growth slowing to around 4% this year, with further cooling expected. Structural and cyclical pressures are anticipated to curb growth further, dipping to 3.5% in 2025 and 3% by 2026. Despite short-term gains, these projections suggest a restrained outlook, as China faces balancing economic stimulus with underlying constraints.

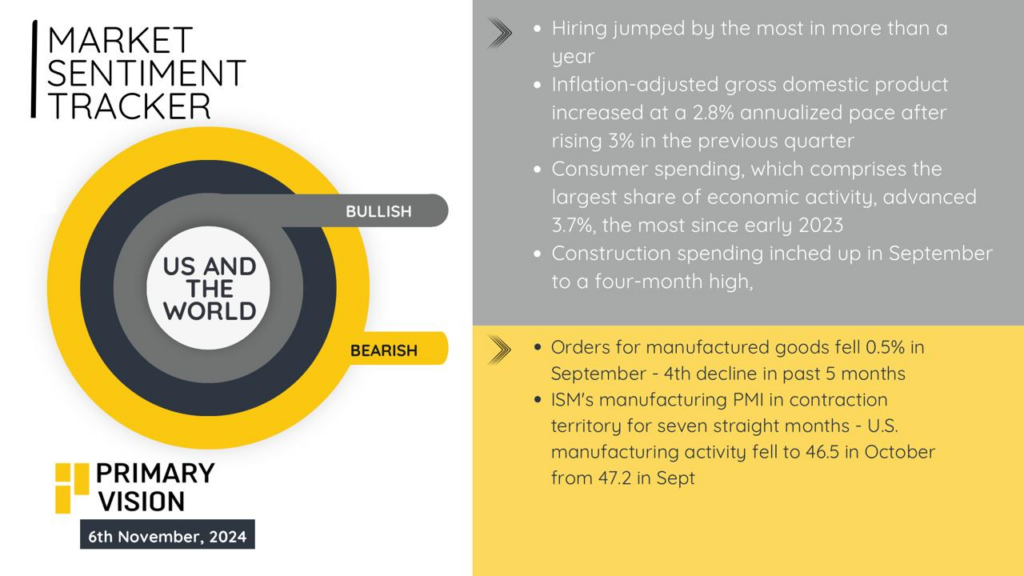

The latest U.S. data shows mixed signals, with consumer spending jumping 3.7% — the strongest pace since early 2023, driven by robust demand and rising wages. However, manufacturing is struggling, with the ISM Manufacturing PMI dropping to 46.5 in October from 47.2, marking the seventh month in contraction territory, and durable goods orders falling by 0.5% in September, the fourth decline in five months. Construction spending climbed modestly to a four-month high, as the sector sees some stabilization amidst overall economic uncertainty. GDP growth is holding steady, advancing at a 2.8% annualized rate, slightly lower than the previous quarter’s 3% but still solid. Labor markets are also showing resilience, with hiring surging at the fastest rate in over a year, suggesting underlying strength in certain sectors even as industrial weaknesses persist.

Both economies are trying to keep momentum, but there’s tension between short-term gains and the longer game. China’s fragile bounce in manufacturing feels almost like a last push before deeper pressures drag it down; structural issues and tightening global demand won’t be easily fixed by brief spurts in consumer confidence. In the U.S., the tug-of-war between robust consumer demand and a struggling industrial sector points to an economy stretched unevenly, where reliance on consumer resilience may only mask underlying vulnerabilities. For both giants, these are gains, yes, but on shifting ground — and the way they navigate these complexities will likely shape not just their own economies but global markets in unpredictable ways.