Drilling Outlook

We have already discussed Nabors Industries’ (NBR) Q3 2024 financial performance in our recent article. Here is an outline of its strategies and outlook. NBR sees progressing rig awards and incremental EBITDA as it starts deploying three more rigs in international markets by 2024-end. In 2025 and beyond, it expects “robust” rig awards as it pursues further rig deployments. During Q3, it completed the rig deployment in Algeria by reactivating four idle rigs in the country. It has another four idle rigs in Algeria, which it can activate in the near term. In Q4, it expects to commence operations with two rig awards in Argentina. The company also expects to expect substantial Drilling Solutions content on these rigs. In Kuwait, NBR started upgrading three rigs that are scheduled to deploy in early 2025.

Saudi Arabia saw rig suspension during Q3. SANAD, NBR’s joint venture with Saudi Aramco, received notice to suspend the operation of three rigs, which saw early suspension in Q4. Despite the suspension, SANAD added eight new build spud in Q3, and the ninth is scheduled to deploy. It expects to add another five in 2025, while more to be added in 2026. In aggregate, it expects to have nine rig awards in 2025.

As I discussed in my short article, on October 15, NBR announced the acquisition of Parker Wellbore, which will help grow its capex-light NDS business. It will expand its international footprint and will provide EBITDA of $180 million in 2024. Parke has low debt, a clean balance sheet, and positive cash flow. The transaction will have targeted annual synergies of $35 million.

Rig Count And Pricing Strategy

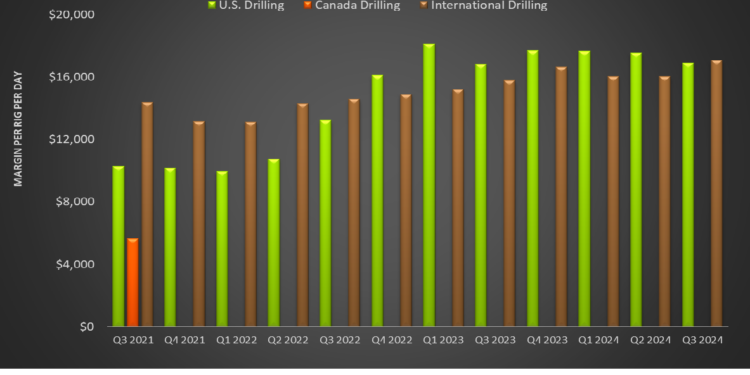

The industry rig count decreased by approximately 3% in the US onshore in Q3. The company sees stable leading-edge pricing for high-performance rigs as the rig margin remains at an “attractive” level. The average rig margin in U.S. Drilling decreased by 4% sequentially in Q3. In International Drilling, the daily rig margin improved by 6%. NDS’s contribution to the margin growth was noteworthy. During Q3, the company increased the penetration of native rigs onshore in the US due to the higher installation of performance software and automation suites. The company’s automation systems include SmartSLIDE directional control, SmartNAV directional guidance, and SmartDRILL drilling process automation.

The company’s leading-edge market pricing was resilient as it remained disciplined because the company’s competitors refrained from pricing discounts in a flat market. Its near-term rig awards are spread across Asia, MENA (Middle East and North Africa), and Latin America. These markets can see 40 potential rig additions. Pricing in the international markets, however, shows an upward trend.

Financial Performance And Balance Sheet

Quarter-over-quarter revenues in the company’s International Drilling operating segment witnessed a 3% rise in Q2. In contrast, the topline in the U.S. Drilling segment declined by 2%. Drilling Solutions and Rig Technologies also witnessed sequential revenue fall.

The company’s FCF decreased significantly (by 69%) from Q2 to Q3. It aims to improve its debt maturity profile by issuing seven-year notes. Currently, it has a weighted average maturity of its notes at 4.5 years. In 9M 2024, it spent $128 million of capex through the SANAD newbuild program. It also expects to retire debt with free cash.

Relative Valuation

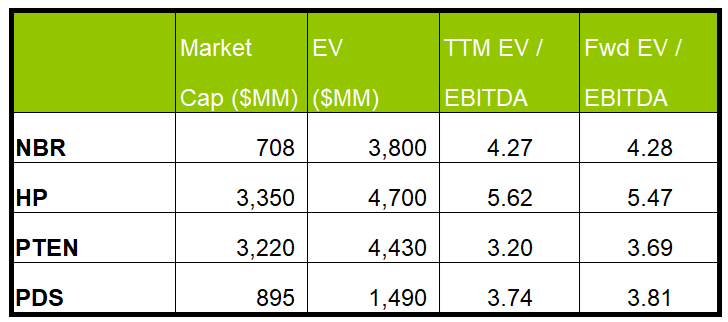

NBR is currently trading at an EV/EBITDA multiple of 4.3x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is nearly unchanged. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of ~6x.

NBR’s forward EV/EBITDA multiple versus the current EV/EBITDA is unchanged compared to the rise in multiple for its peers because the company’s EBITDA is expected to remain unchanged compared to a fall in EBITDA for its peers in the next four quarters. This typically results in higher EV/EBITDA multiple compared to its peers. The stock’s EV/EBITDA multiple is slightly higher than its peers’ (NINE, PUMP, and ACDC) average of 4.2x. So, the stock is reasonably valued versus its peers.

Final Commentary

NBR plans to increase rig deployment in various international operations in 2025 following “robust” rig awards in these geographies. Saudi Arabia, however, has seen rig suspensions in recent times. Leading-edge pricing for high-performance rigs and rig margins remain stable. Higher-performance software and automation suite installations in the US onshore will drive its performance. However, operators’ capex constraints and upstream industry consolidation can put a lid on demand growth. The US onshore rig count was relatively shaky in Q3. The company’s NDS business added another growth driver following the acquisition of Parker Wellbore, which is expected to be earnings-accretive.

The company’s cash flows decreased noticeably in 9M 2024. Although it has high leverage, it aims to improve its debt maturity profile through debt refinancing. The stock is reasonably valued compared to its peers.

Premium/Monthly

————————————————————————————————————-