Hydraulic fracturing and horizontal drilling—collectively known as fracking—have unlocked vast reserves of oil and natural gas that were once considered inaccessible. Today, more than 70% of U.S. oil and over 80% of its natural gas are produced through this technology. Now with some important political appointments also coming from the world of energy, U.S. is stepping into an interesting era. It raises multiple questions: what about the progress of renewables? what will be the direction of U.S oil production? Will the producers continue to practice same fiscal discipline? This update provides you with various perspectives and unique insights into the world of U.S. oil industry while answering the most important question of how is Frac’ing the backbone of U.S. energy security?

1. Frac’ing is the backbone of U.S. Energy Security – Here is why – PREMIUM

Frac’ing has become a cornerstone of U.S. energy security, transforming the nation from a net importer of oil to the world’s largest oil and gas producer. Therefore we should not explore the possibility of banning frac’ing, as it is profoundly linked domestic energy markets and global geopolitical dynamics. To fully appreciate its significance, we need to delve into the numbers and analyze what a ban would truly mean for the U.S. economy, energy independence, and international standing.

Read the article above to learn about this in more detail.

2. MST: Is the Chinese economy improving? – PREMIUM

China’s fiscal stimulus might seem to be doing its job. Beijing and Shanghai’s introduction of tax breaks aims to stabilize the struggling property market. The Eurozone economy is undergoing a slow growth and tempered inflation period. Germany’s two-year yield edged up by one basis point to 2.13%, reflecting market recalibration on future ECB policy expectations. he U.S. economy is giving the most conflicting signals. Consumer spending surged at its fastest pace since Q1 2023, offering a bright spot amid broader uncertainties. Read the article to learn more about where the world is heading?

3. Nabor’s Industry Perspective: Q3 Takeaways – PREMIUM

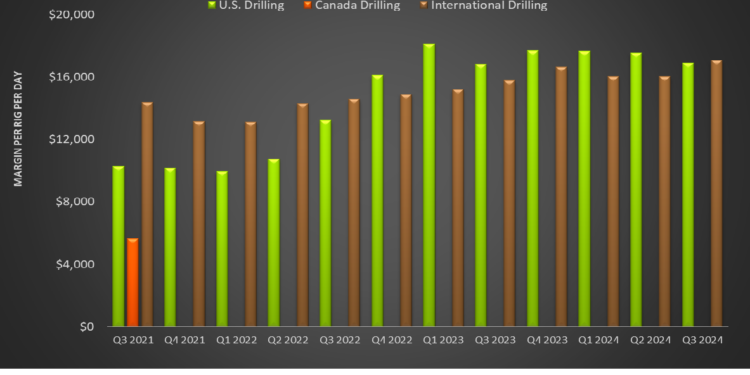

Quarter-over-quarter revenues in the company’s International Drilling operating segment witnessed a 3% rise in Q2. In contrast, the topline in the U.S. Drilling segment declined by 2%. Drilling Solutions and Rig Technologies also witnessed sequential revenue fall. But what is Nabor’s future plans? In this article, Avik Chowdhury presents some exclusive datasets for you to get the inside story!

4. UPDATE: C6 Infrastructure Partners Expanded in Q3 2024 – FREE

Following a strong Q3 performance, C6 Infrastructure Partners’ expanded update sheds light on key economic trends and market challenges shaping the energy and agriculture sectors. This comprehensive analysis highlights how global pressures like inflation, surging energy demand, and rising interest rates are driving up capital costs and creating unique opportunities for C6 to expand its footprint in essential areas.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co