This week we will take stock of the latest developments in the global oil markets in general and US shale in particular. The overall story for oil markets going into 2025 remains the same. There has been consistent concerns regarding a growth in oil demand which closely depends upon the economic recovery. Many indicators continue to flash warning signs – you can read more about them in our weekly coverage known as Market Sentiment Tracker. Inventories are increasing, shale sector face the specter of lower oil prices

U.S. crude oil inventories saw a modest increase of 550,000 barrels to 430.29 million barrels as of mid-November, driven by a dip in refinery utilization to 90.2% of capacity. While this might seem like a small change, it underscores the nuanced interplay of factors in the market. Refinery outages, such as BP’s delayed restart of its Whiting, Indiana refinery, and ongoing maintenance at Marathon and Cenovus facilities, have temporarily slowed operations. Yet exports surged to a robust 4.14 million barrels per day, the highest since September, reflecting strong transatlantic trade incentives. For context, the arbitrage for moving WTI MEH into Northwest Europe jumped to 97 cents per barrel in November, compared to a deficit of 10 cents in October.

At a macro level, the U.S. shale sector continues to adapt to price sensitivities. According to JP Morgan, U.S. oil production growth remains tightly linked to price thresholds. At $60 WTI, production would stagnate, while $50 would prompt declines. Conversely, a stable $70 WTI price could sustain growth, pushing crude and condensate output to a peak of 14.3 million barrels per day by 2031. For now, the Energy Information Administration (EIA) projects U.S. crude oil production will average 13.23 million barrels per day in 2024 and 13.53 million barrels per day in 2025. These projections, however, rely on operators drilling an estimated 10,000 wells in 2024, slightly down from current activity levels, signaling efficiency gains amidst cautious capital deployment.

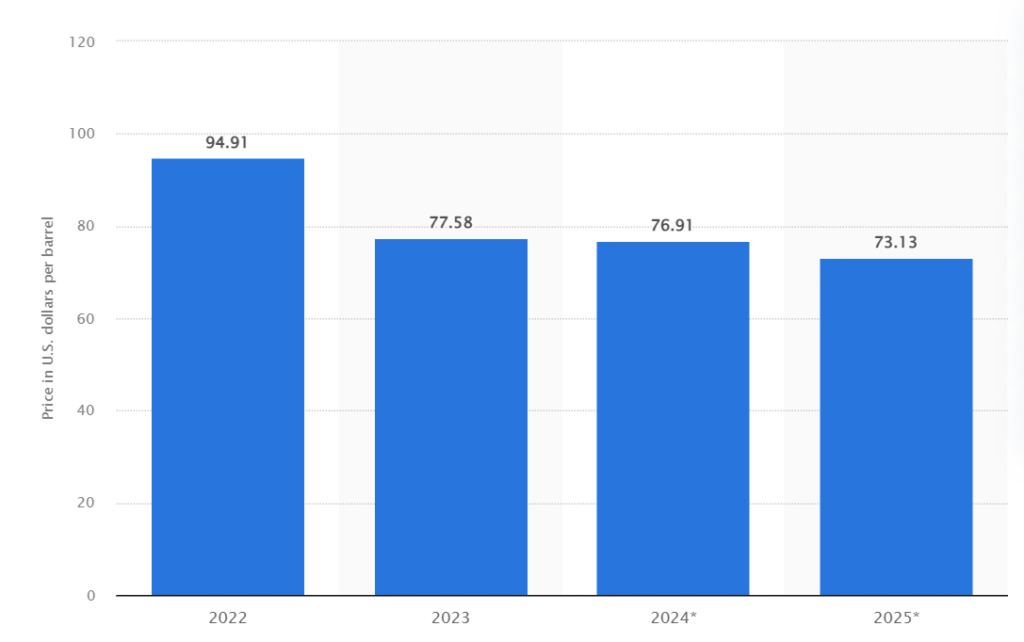

Source: Spot price of West Texas Intermediate (WTI) from 2022 to 2023, with a forecast until 2025

Globally, the oil market is teetering between concerns of oversupply and weak demand. OPEC+’s decision to delay its planned December production increase underscores the group’s pragmatic understanding of the markets amid bearish market signals. Despite Brent crude futures averaging $75.38 per barrel in October, the price trajectory has been anything but stable, swinging by $10 within the month. Speculative positions remain historically low, reflecting broader uncertainty. Hedge funds and money managers sold 35 million barrels of positions and re-established their bearish positions along-with establishing new bearish positions to the tune of -39 million years.

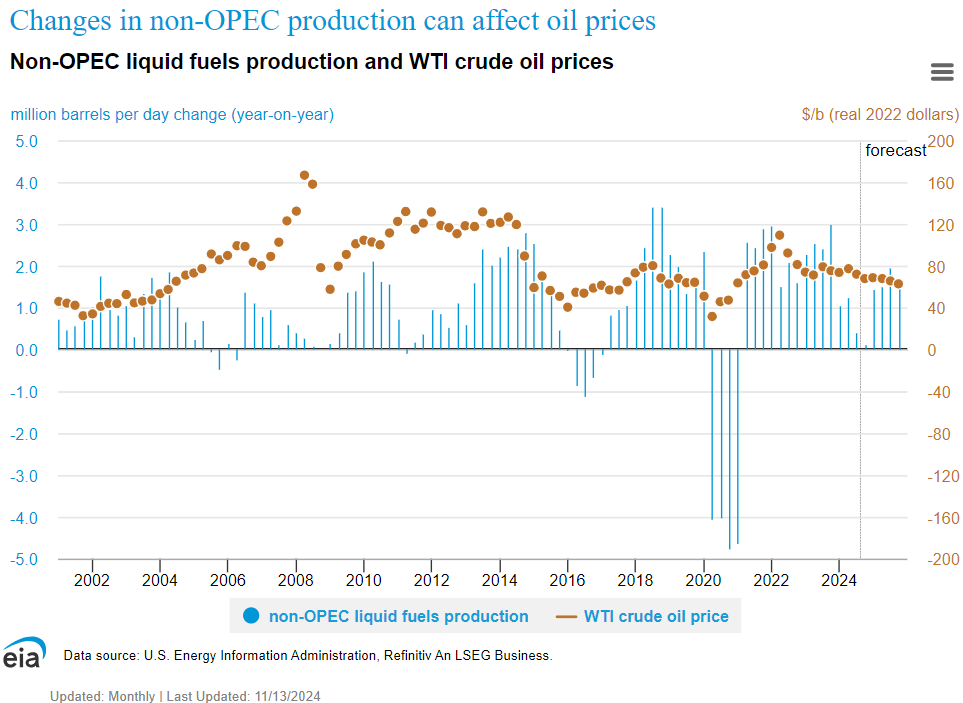

Source: John Kemp Newsletter

Yet, supply growth remains robust. U.S. production, bolstered by shale and enhanced by Canada, Guyana, and Argentina, is projected to lead non-OPEC+ growth of 1.5 million barrels per day in 2024 and 2025. Brazil, with more than 800,000 barrels per day of new capacity coming online, is expected to ramp up supply by 210,000 barrels per day in 2025. These increases, however, are set against a backdrop of sluggish demand growth, forecasted at just under 1 million barrels per day annually through 2025. Rapid clean energy adoption and the fading effects of post-pandemic recovery are increasingly weighing on consumption, particularly in China, where demand contracted for the sixth consecutive month in September.

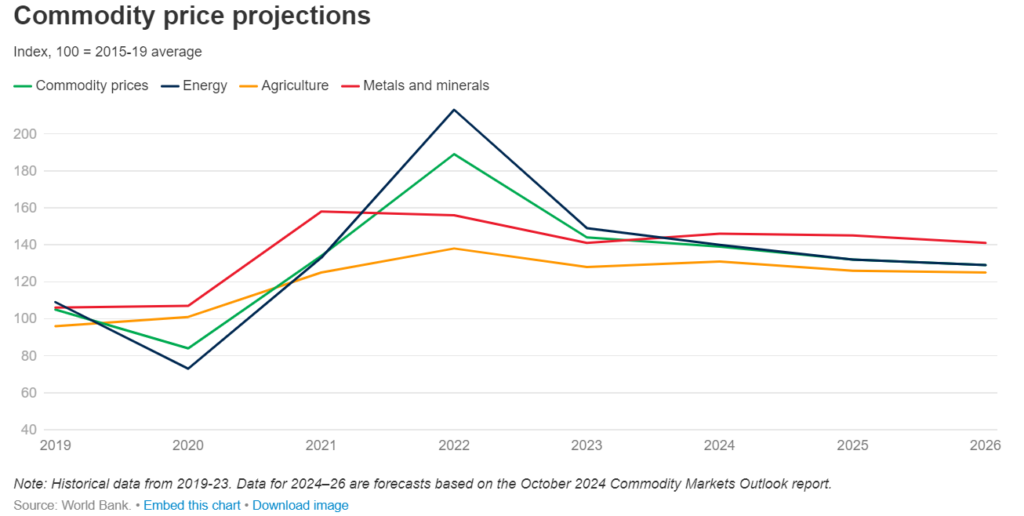

IEA has further added that the world will remain awash in oil supply for 2025. Even if current OPEC+ production cuts remain in place, supply is expected to outstrip demand as non-OPEC+ countries, led by the United States, Canada, Guyana, and Argentina, increase output by 1.5 million barrels per day (bpd). Meanwhile, demand growth is projected to remain modest at 990,000 bpd. This dynamic could challenge OPEC+ efforts to restore output levels, particularly as earlier plans to ease cuts were delayed due to falling prices. The World Bank also anticipates a continued decline in commodity prices, projecting a 5% decrease in 2025 and 2% in 2026, following a 3% drop in 2024. Its aggregate commodity price index is forecasted to reach its lowest point since 2020. Energy prices are set to fall, with the oil-driven energy price index expected to decline by 6% in 2024 and 2025, and 2% in 2026. Conversely, natural gas prices may provide slight upward pressure. Metal prices are expected to dip slightly in 2025–26 after a 6% rise in 2024, reflecting moderate industrial activity growth in key economies, particularly China. Agricultural prices are forecasted to decline by 4% in 2025 due to improved supply conditions.

As we move into 2025, the oil markets are poised at the intersection of supply abundance and demand caution. Navigating this landscape will require a keen understanding of not just the numbers but the broader forces at play—economic, geopolitical, and environmental. The stakes have never been higher, and the opportunities, while immense, come with equally significant challenges.