Frac Fleets And Pressure Pumping Outlook

In our recent article, we have already discussed RPC’s (RES) Q3 2024 financial performance. Here is an outline of its outlook. RES’s management observes a headwind in the pressure-pumping pricing because the spot and semi-dedicated market remain oversupplied while the company’s peers choose to maintain utilization. The pressure-pumping market has a downward pricing bias because of “white space” in the spot market. Despite that, RES’s topline was relatively resilient because of a diversified customer base, while its other service lines remain stable. As a result, its pressure-pumping revenues declined by 12% versus a 4% fall in other businesses. The company’s Tier 4 DGBs have high demand and higher visibility with dedicated customers. It has sometimes committed to customer contracts through the end of 2025.

RES’s marketed frac spread count has declined from approximately 10-11 a year ago. However, it has rebalanced its portfolio mix and has upgraded its frac spread in the past year. It looks at a long-term plan of frac spread count change versus a quality matrix. It has lowered its frac spread count and reduced headcount to remain competitive in the market. It also does not expect frac pricing to improve significantly in the short term. The management thinks pricing will remain disciplined in 2025 also. In the past few quarters,

New Technologies and M&A

Recently, RES has brought new solutions to reduce reliance on bridge plugs. It can substitute the bridge plugs with a release of pods that plug each perforation. The new technique can be efficient and has cost benefits. It plans to roll out this technology extensively in the coming quarters.

Besides new products and services, RES is aggressively looking at M&A, primarily in non-pressure pumping areas. With diversification, the impact of the swings in the frac market would be less, and more consistent financial results and returns could be delivered. Its management sees “ample opportunities” in the marketplace for such potential transactions.

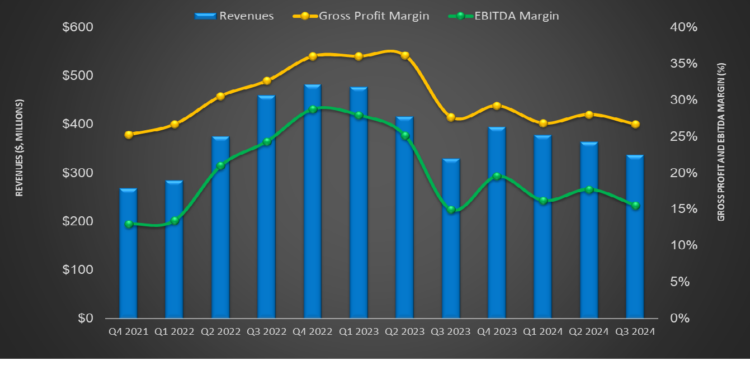

The Q3 Financial Results

Quarter-over-quarter, RPC’s revenues decreased by 7.4% in Q3 due to lower rig count triggered by lower crude oil prices. The company’s pressure pumping operations suffered significantly, dropping by “low double-digits.”. The company’s Technical Services segment operating income decreased by 46% quarter-over-quarter, while operating income in the Support Services segment improved by 21% from Q2 to Q3. However, its tier 4 dual fuel assets were highly utilized in Q3.

RES maintained a debt-free balance sheet as of September 30. This, along with a cash balance of $277 million and a $100 million revolving credit facility, allowed for robust liquidity. Free cash flows, year-over-year, deteriorated by 50% in 9M 2024.

Relative Valuation

RES is currently trading at an EV/EBITDA multiple of 4.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 4.7x. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 28x.

RES’s forward EV/EBITDA multiple is expected to expand less sharply versus its current EV/EBITDA than its peers. This implies that the company’s EBITDA is expected to decrease less steeply than its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple. The stock’s EV/EBITDA multiple is lower than its peers’ (PUMP, NR, and LBRT) average. So, the stock appears to be undervalued versus its peers.

Final Commentary

At the end of Q3, RES sees challenges in the pressure-pumping market due to oversupply and steady utilization of frac assets in the industry. The pressure-pumping market has a downward pricing bias, resulting in a steeper fall in pressure-pumping revenues in Q3 than its other operations. However, the company’s Tier 4 DGBs are in high demand and have committed to customer contracts through the end of 2025. So, it rebalanced its portfolio mix and upgraded its frac spread in the past year.

The company has brought new solutions and products and will look at M&A options to grow inorganically. Its debt-free balance sheet and robust liquidity should be instrumental in its efforts. Free cash flow, however, deteriorated over the past year. The stock appears to be undervalued compared to its peers.

Premium/Monthly

————————————————————————————————————-