China’s industrial sector demonstrated resilience in October, growing by 5.3% year-on-year, propelled by improved manufacturing activity. Retail sales rose 4.8% in the same period, highlighting a boost in consumer confidence, particularly during major e-commerce events like Singles Day, where sales surged 26.6% to 1.44 trillion yuan. Fixed asset investments grew 3.4% from January to October, signaling ongoing infrastructure and corporate spending.

However, factory output slowed slightly, reflecting mixed recovery momentum. The People’s Bank of China reinforced its commitment to supportive monetary policies into 2025, though concerns linger over weak export demand and structural economic issues. Seasonal record lows in energy-related sectors dampened some of the industrial optimism. The data showcases a cautious but steady rebound, with consumption and investment leading the way, albeit within a landscape of global uncertainties and domestic adjustments.

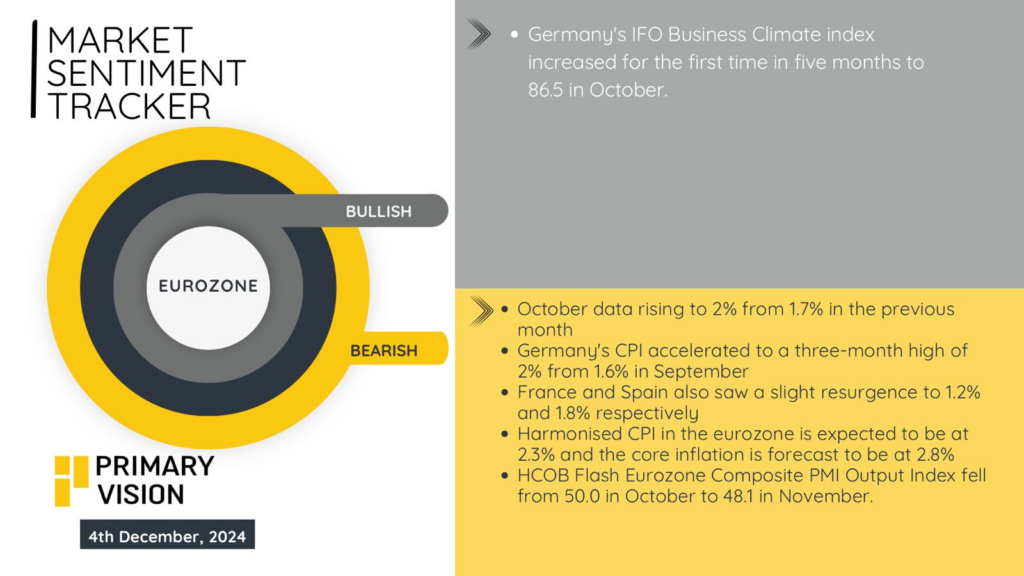

Eurozone’s economy continues to be in a bad shape. Germany’s IFO Business Climate Index rose to 86.5 in October, signaling slight optimism after five months of decline. Inflation, however, accelerated in Germany to a three-month high of 2%, up from 1.6% in September, reflecting lingering cost pressures. France and Spain posted minor CPI gains at 1.2% and 1.8%, respectively. Across the bloc, harmonized inflation is projected to hit 2.3%, with core inflation expected at 2.8%, indicating persistent price stickiness despite falling energy costs. Yet, the HCOB Flash Eurozone Composite PMI Output Index fell below the critical 50 mark, dropping to 48.1 in November from 50.0, highlighting contractionary pressures in the services and manufacturing sectors. While inflation-adjusted growth remains elusive, these dynamics suggest the Eurozone is balancing modest inflationary rebounds with structural economic vulnerabilities, complicating the European Central Bank’s monetary path.

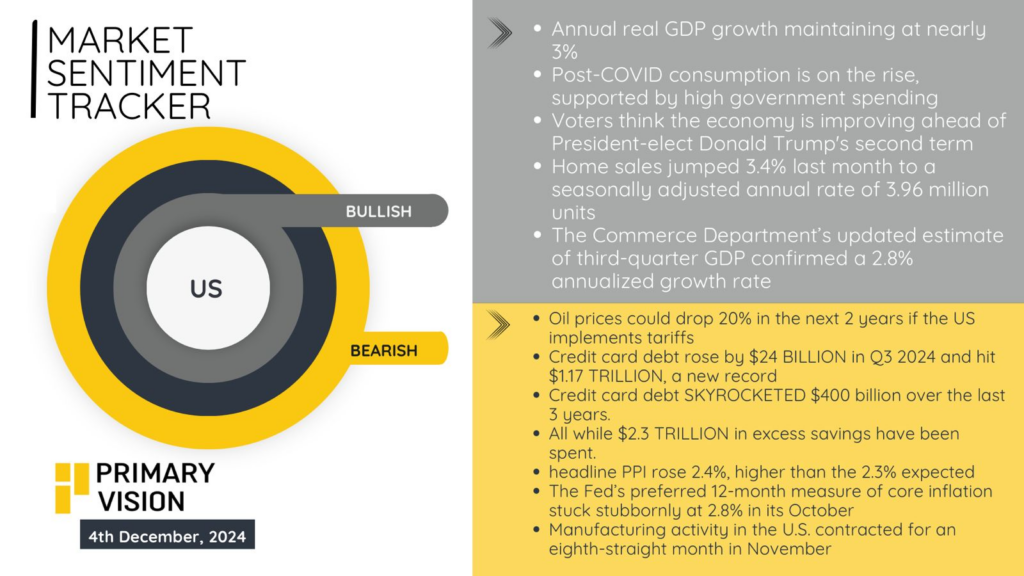

The U.S. economy holds its ground with an annualized GDP growth of 2.8%, bolstered by robust post-pandemic consumption trends and a 3.4% surge in home sales. Yet, not all indicators signal strength: manufacturing activity contracted for the eighth straight month, with the ISM Manufacturing PMI stuck at 46.5. Credit card debt surged $24 billion in Q3, hitting a record $1.17 trillion, signaling consumer resilience but also financial strain. Oil markets face uncertainty as U.S. tariffs loom, threatening to slash global prices by 20% within two years. On the inflation front, producer prices edged up 2.4% in October, slightly above expectations, while the Fed’s preferred core inflation metric held steady at 2.8%. Balancing solid consumption against industrial weakness and growing debt burdens, the U.S. economy appears resilient but increasingly exposed to external risks and internal structural challenges. Job report is due this Friday!