Before the conflict began in 2011, Syria produced about 383,000 barrels per day (bpd) of oil, contributing roughly 25% of government revenue. By 2023, production had plummeted to an estimated 40,000 bpd, underscoring the immense toll of war, sanctions, and mismanagement. Refineries in Homs and Banias, with respective capacities of 107,100 bpd and 120,000 bpd, struggle to meet domestic demand, which currently averages 100,000 bpd. Despite the sector’s dire state, opportunities exist for revival.

1. MMV: What will happen to Syria’s oil sector post-revolution? – PREMIUM

Syria’s oil and gas sector, once a critical economic pillar, now faces a complicated and uncertain path forward following the fall of Bashar al-Assad’s regime. The energy industry, already decimated by more than a decade of civil war, is confronted with extensive infrastructural damage, fragmented control, and geopolitical complexities. How will this all reshape the country’s future in terms of oil?

Read the article above to learn about this in more detail.

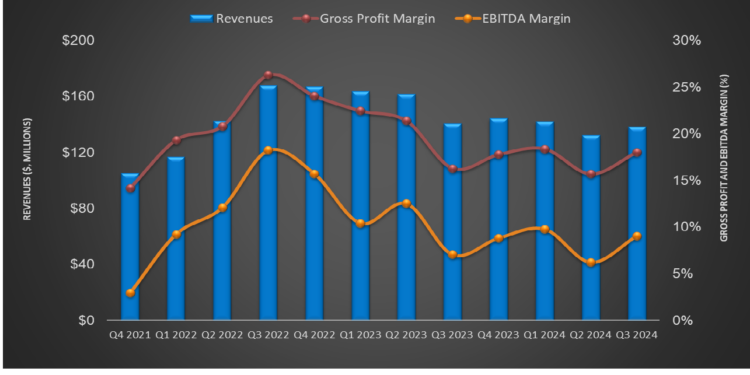

2. NINE ENERGY’S PERSPECTIVE in Q3 – KEY TAKEAWAYS – PREMIUM

This article will dive deeper into the industry and its current outlook. During Q3, the US rig count declined by 3% due to low natural gas prices. This led to lower activity levels in Haynesville and Northeast. On top of that, the US completion activity slowed down. Find out Avik’s brilliant analysis to learn further about the oil field service industry.

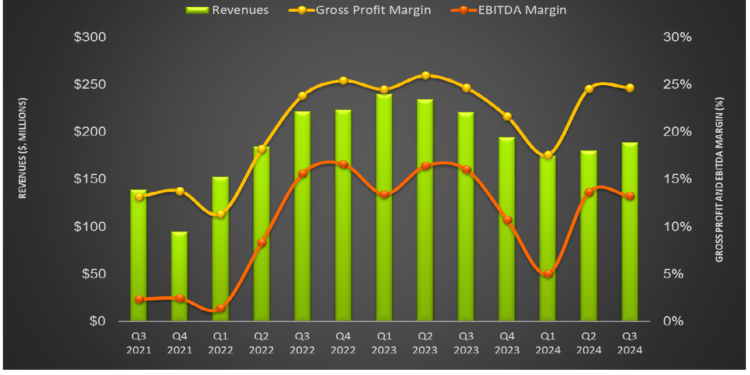

3. KLX Energy Services’ Perspective: Q3 Takeaways – PREMIUM

This article, written by our brilliant analyst Avik Chowdhury, delves deeper into the industry and its current outlook. In 2H 2024, budget exhaustion and seasonality will affect oilfield service companies more severely than previously anticipated, due partly to energy companies’ efficiency gains. Cash flow from operations declined, and free cash flow turned negative in 9M 2024 compared to a year ago.Click the image above to read it in detail.

4. MST: U.S. Economy Poised for a Soft Landing? – PREMIUM

The U.S. economy looks strong. On the positive side, job creation remains solid, with an average of 173,000 new jobs per month since September and a notable 227,000 jobs added in November.China’s exports surged by 6.7% year-on-year in November, with shipments to the U.S. rising 8%, signaling strong external demand. Manufacturing and services PMI data suggest steady activity.The Eurozone’s GDP growth inched up marginally in Q3, with Spain growing by 0.8% and France by 0.4%. However, exports declined 1.5%, reflecting weakening demand. Germany’s GDP eked out a 0.1% gain, missing expectations, while Italy’s manufacturing struggles weigh on sentiment.

Read this article to stay up to date with the latest sentiment tracker.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co