The Eurozone presents a tale of two economies—one that clings to signs of recovery while struggling with entrenched challenges. The PMI’s rise to 49.6 suggests a softening of contraction, but it remains below the critical 50 mark, signaling the region has yet to achieve true expansion. Spain and Ireland’s robust private sector activity highlight the resilience of smaller economies in the bloc, but these gains are overshadowed by sluggish performance in Germany, France, and Italy. Germany’s PMI revision to 48 indicates marginal improvement, yet it reflects underlying industrial malaise in Europe’s economic powerhouse.

On the bearish front, the ECB’s stance on persistently high services inflation underscores the limited effectiveness of current policy tools to tame price pressures. Inflationary concerns and waning business activity in the bloc’s largest economies suggest that growth is uneven, driven more by isolated bright spots than by widespread momentum. The interplay between stubborn inflation and declining business confidence raises questions about how much longer the ECB can maintain its current hawkish stance without stifling the region’s fragile recovery.

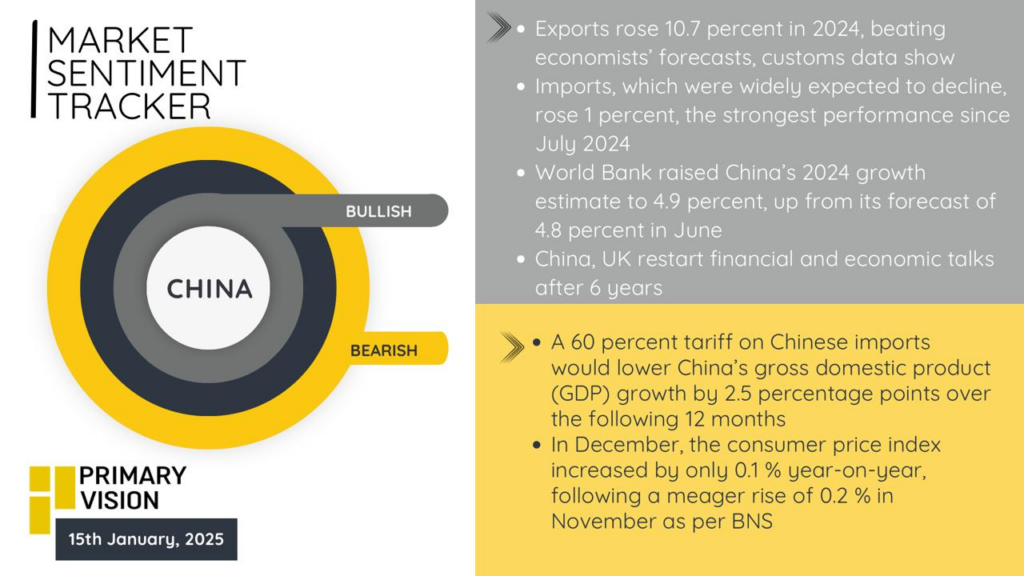

China’s economic narrative showcases resilience and vulnerability in equal measure. The double-digit growth in exports, paired with a rebound in imports, hints at the country’s ability to capitalize on global demand despite a turbulent geopolitical backdrop. The World Bank’s upward revision of China’s growth forecast reflects the broader belief that Beijing can navigate its economic transition, supported by easing COVID policies and a recalibration of fiscal strategies. The revival of economic ties with the UK after a six-year hiatus underscores a thawing of international relationships, bolstering long-term sentiment.

However, beneath these positive developments lies a different picture. The imposition of a 60% tariff on Chinese imports threatens to undercut the growth momentum, shaving GDP projections by a significant margin. The consumer price index’s negligible growth of 0.1% reveals subdued domestic demand, a critical weakness for a country aiming to rebalance its economy towards consumption-led growth. While exports may drive short-term gains, the lack of robust internal demand exposes vulnerabilities to external shocks, leaving the economy in a precarious position if global trade falters.

In the US, the data reflects an economy walking a tightrope between optimism and underlying fragilities. Rising wage inflation and the continued strength in PMI indices signal robust economic activity, while GDP growth revisions to 3.1% further confirm the resilience of the American economy. These bullish indicators suggest that consumer demand and corporate activity remain strong, despite elevated interest rates. The labor market, a cornerstone of US economic health, continues to show resilience, supporting broader growth narratives.

Yet, this optimism is tempered by persistent inflationary concerns. Mortgage rates nearing 7% and climbing Treasury yields point to tightening financial conditions that may eventually dampen spending and investment. The Federal Reserve’s inability to decisively bring inflation under control highlights structural stickiness in prices, particularly in services. Market participants are increasingly wary of the delicate balance between monetary tightening and economic growth, with doubts lingering over whether the Fed can engineer a soft landing without destabilizing key sectors like housing and financial markets.