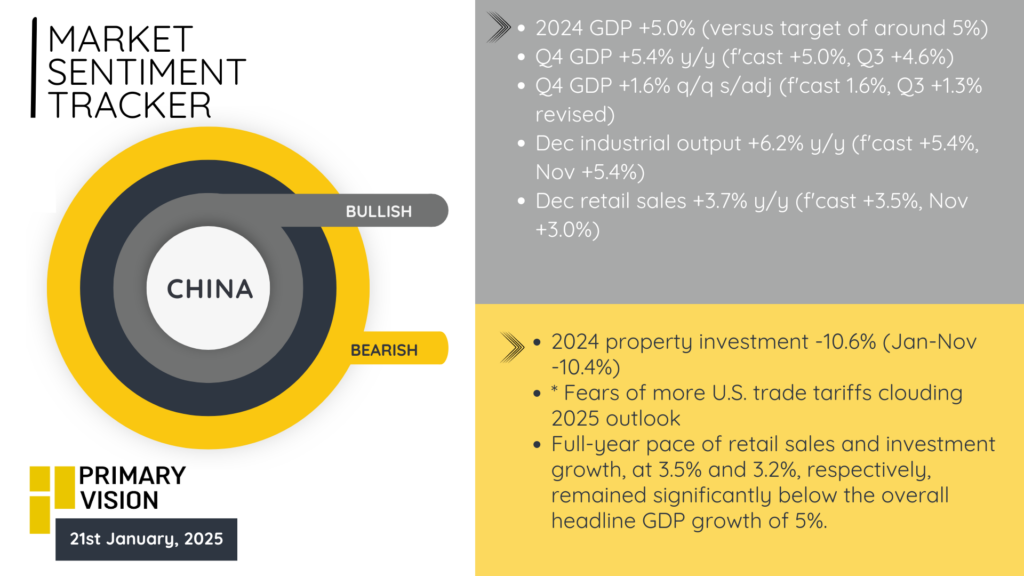

China’s economic performance in 2024 hit its growth target, but the story behind the numbers is more complex. The economy closed the year strong, with Q4 GDP expanding 5.4% year-on-year, outpacing forecasts and building on Q3’s 4.6%. Quarter-on-quarter growth of 1.6% reflected steady momentum, while industrial output in December surged 6.2%, well above expectations.

Retail sales climbed 3.7% in December, continuing their recovery from November’s 3.0%, signaling improving consumer confidence. Yet beneath the surface, there are clear signs of strain. Property investment plummeted 10.6% for the year, highlighting the continued weakness in a critical sector that underpins much of the economy. Even as retail sales and investment improved in December, their full-year growth rates of 3.5% and 3.2% fell far short of overall GDP growth, pointing to imbalances in the recovery. Compounding these challenges is the looming threat of more U.S. trade tariffs in 2025, casting uncertainty over China’s external trade prospects. Despite strong headline growth, the reliance on industrial output and limited domestic demand recovery reflect an uneven rebound. China’s 2024 numbers tell a story of resilience in industrial sectors but expose vulnerabilities in property markets, consumption, and investment. Heading into 2025, the balance between managing these structural challenges and navigating external pressures will define whether the economy can maintain its momentum.

The U.S. economic landscape shows a mix of optimism and underlying challenges as inflation dynamics begin to shift. December’s core CPI rose by just 0.2%, marking its first deceleration in half a year and providing a hopeful signal that inflationary pressures may be cooling. This moderation sparked confidence across financial markets, with stock indices rallying sharply. Lower Treasury yields, which dipped below 4.7%, further buoyed sentiment by easing borrowing costs for businesses and households, offering a supportive backdrop for economic activity. However, the broader picture is less straightforward. Headline CPI rose by 0.4%, driven largely by a 4.4% surge in gasoline prices, which pushed energy costs up 2.6%. This increase underscores the persistent strain on consumer budgets, particularly in essential areas. Annual inflation remains well above the Federal Reserve’s 2% target, restricting the central bank’s ability to adopt a more accommodative policy stance. Compounding these pressures are policy uncertainties, with potential new tariffs and tax cuts on the horizon, which could reignite inflationary risks and complicate the Fed’s efforts to stabilize the economy. The U.S. economy enters 2025 at a crossroads: signs of easing inflation offer hope, but elevated price levels and policy-induced risks create significant hurdles. Whether the economy can strike the right balance between growth and stability will hinge on the interplay between monetary policy, market sentiment, and external shocks.

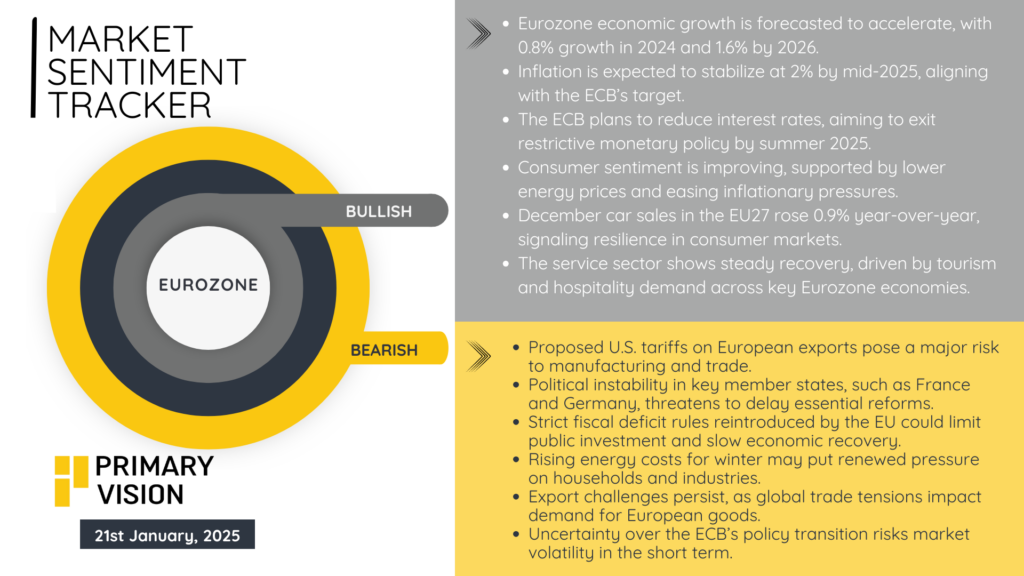

The Eurozone’s economic trajectory reflects cautious optimism tempered by persistent challenges. Growth is on track to accelerate, with forecasts projecting 0.8% in 2024 and 1.6% by 2026, signaling a slow but steady recovery. Inflation is also expected to stabilize at 2% by mid-2025, aligning with the European Central Bank’s target, offering hope for price stability after years of elevated pressures. The ECB’s plans to gradually reduce interest rates and exit restrictive monetary policy by summer 2025 provide further optimism, potentially fostering economic activity. Consumer sentiment shows signs of improvement, driven by easing energy prices and broader inflationary relief. December car sales in the EU27 rose by 0.9% year-over-year, signaling resilience in consumer-driven sectors. Additionally, the service sector continues to recover steadily, with tourism and hospitality providing crucial support across key economies.

Despite these positive indicators, significant risks remain. The threat of U.S. tariffs on European exports poses a major challenge to the Eurozone’s manufacturing and trade-reliant economies. Political instability in core member states like France and Germany risks delaying critical reforms needed for long-term stability. Furthermore, the EU’s reintroduction of strict fiscal deficit rules may curtail public investment, potentially stalling growth. Winter energy costs, although easing in recent months, still present a vulnerability for households and industries, while global trade tensions continue to weigh on export demand. Finally, uncertainty surrounding the ECB’s policy transition adds a layer of market volatility, creating headwinds for businesses and investors. The Eurozone’s outlook is one of fragile recovery, where incremental progress will depend on navigating external risks and internal challenges with careful coordination of fiscal and monetary policies.