A Shift and International Business Outlook

We have already discussed Halliburton’s (HAL) Q4 2024 financial performance in our recent article. In 2025, HAL expects “flat” or “low to mid-single digits” revenue growth in most international territories. However, growth can remain muted due to reduced activity in Mexico. In the energy business, the company notices a shift in customer activity toward drilling technology, unconventional drilling techniques, well intervention, and artificial lift. Over the medium term, management estimates that these operations can collectively generate an additional $2.5 billion to $3 billion in revenues.

The management plans to focus on technological developments, electrification, automation, and digital solutions outside the traditional oilfield services business. Over the medium term (next five years), two growth engines will drive HAL’s business: international operations and customer alliances. The company has built a growing and profitable business in Norway based on customer alliances, which has led to technological innovations and collaborative work environments.

North America Outlook

Halliburton’s expectation in North America is bearish, with a “low to mid-single digits” revenue decline in FY2025. Compared to 2H 2024, it would remain flat. The company’s frac fleet pricing would decrease. The price revisions in Q1 2025 can adversely impact much of its margin. Despite that, the management is confident of outpacing its competition in 2025.

Irrespective of the slowdown, North America will continue to dominate HAL’s business portfolio due to the development plans of its large customers. The revenue share of North America increased to 61% in Q4 from 58% in Q3. The unconventional shales would provide greater efficiencies and productivity over the next several years. While markets and margins can fluctuate, HAL is poised to improve its financial performance as a result of its strong positioning. Our short article has provided an update on Halliburton’s recent projects and contracts.

Frac Outlook

In electric frac, HAL is extending and renewing contracts for existing fleets. As we discussed in our previous article, it deployed Auto Frac on 20% of its e-fleets and is expected to expand to 50% by 2025-end. The Zeus’ platform, Sensori fracture diagnostics, and an automated real-time environment can allow for higher levels of efficiency and improved recovery. It also expects directional drilling, iCruise rotary steerable, to account for 30% of the North American rotary steerable business in 2025.

One of the key challenges for the US energy market is the power shortage driven by electrification and power demand for AI. HAL’s management believes that electrification powered by natural gas can resolve the problem, leading to increases in LNG exports. Octiv Auto Frac uses over 50% of its Zeus spreads, which can increase even further in Q1 2025. Its Sensori fracture monitoring gives customers the ability to scale and optimize well-completion designs on multi-well pads. In Q4, Sensori is estimated to have been used on more than 2,500 Frac stages in North America.

Segment Forecast

In Q1 2025, the management expects the C&P division revenue to decline by 3%-5% compared to Q4 2024 while operating margins can decrease by 175-225 basis points. The Drilling and Evaluation division expects revenue to increase by 8%-10% and margins by 0-50 basis points in Q1.

Key Q4 Metrics

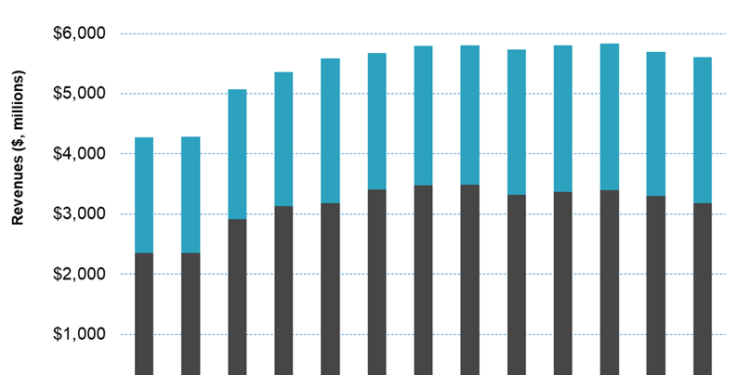

Quarter-over-quarter, revenues in the company’s Completion and Production operating segment decreased by 3.7% in Q4. The top line in the Drilling and Evaluation segment, in comparison, increased by 1.4%.

HAL’s cash flow from operations strengthened (12% up) in FY2024 compared to a year ago. As a result, its FCF increased by ~17%. Debt-to-equity (0.71x) also showed improvement from FY2023. In FY2024, its capex totaled $1.4 billion, or about 6% of its revenue. In FY2025, it expects to remain unchanged at 6% of revenue. During Q3, it repurchased shares worth $309 million to improve shareholder returns.

Relative Valuation

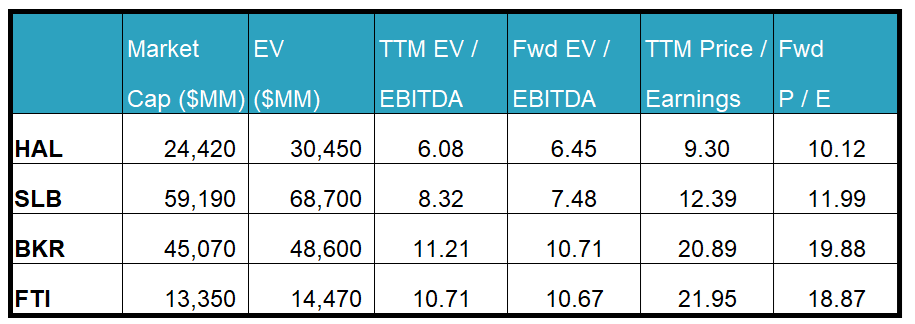

Halliburton is currently trading at an EV/EBITDA multiple of 6.1x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is higher. The current multiple is lower than its five-year average EV/EBITDA multiple of 11x.

HAL’s forward EV/EBITDA multiple expansion versus the adjusted current EV/EBITDA contrasts a decline in the multiple for its peers because the company’s EBITDA is expected to decline versus a rise in EBITDA for its peers in the next four quarters. This typically results in a much lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (SLB, BKR, and FTI) average. So, the stock is reasonably valued versus its peers.

Final Commentary

HAL has a bearish outlook in North America. Lower frac fleet pricing would adversely impact much of its margins. Despite that, North America will remain a dominant region as unconventional shales would provide greater efficiencies and productivity over the next several years. In efrac, it expects Auto Frac’s contribution to expand to 50% by 2025-end. In international business, drilling technology, unconventionals, well intervention, and artificial lift will drive growth in the medium term and add significantly to its revenues.

In North America, lower frac pricing would remain challenging in early 2025. As a result, the company’s sales and EBITDA margin can contract in Q1. Nonetheless, its financial performance is due for an upward turn due to technological adoption, increased efficiency, and customer alliances. The company continues to repurchase shares as cash flows improve, giving it an opportunity to increase shareholders’ returns. The stock is reasonably valued versus its peers at this level.

Premium/Monthly

————————————————————————————————————-