Q4 Order Booking Summary: Baker Hughes’s (BKR) FY 2024 orders totaled $28 billion, led by an impressive order growth in the Industrial & Energy Technology (or IET) segment, while its total book-to-bill ratio was unchanged at 1.0x in Q4 2024 compared to Q3. During Q4, its Gas Technology Equipment continued to secure orders, including gas infrastructure orders for a Jafurah unconventional gas field in Saudi Arabia for Aramco. In LNG, it received multiple project awards. This included a contract to provide a modularized LNG system and power island to Venture Global. Another award includes providing refrigeration compressors and expander compressors. Its Gas Technology Services business signed a 25-year services agreement with a NextDecade affiliate.

In the Oilfield Services & Equipment segment, BKR received a multi-year contract from Eni to utilize its AutoTrak eXact rotary steerable drilling system. In the Middle East, it plans to provide artificial lift services. In Brazil, it received a flexible pipe systems award from Petrobras. In digitalization and artificial intelligence, it signed an agreement to launch the AI Rate of Penetration.

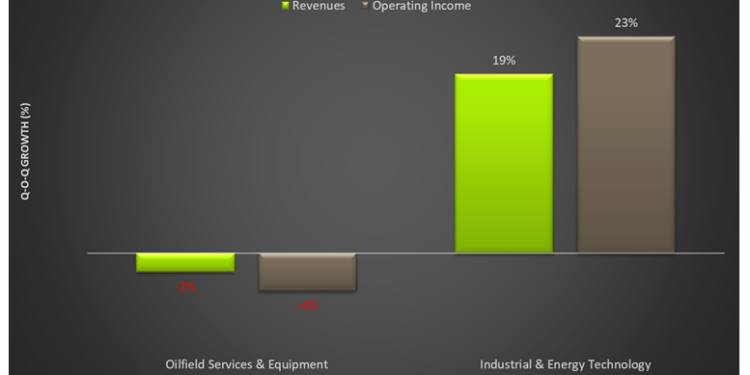

Revenue Strengthened In Q4: In the IET segment, revenues increased by 19% quarter-over-quarter, driven primarily by Gas Technology. Operating profit went up by 23% in Q4. Higher sales volume in the GTE business and a favorable impact on pricing and productivity led to better financial performance in this segment. Revenues in the Oilfield Services & Equipment segment were relatively weak in Q4. In Europe, CIS, and Sub-Saharan Africa, sales declined. Lower volume affected profitability. However, better pricing and productivity from structural cost-out initiatives partially offset the downside.

During Q4, BKR’s EBITDA margin progressed to achieve its 20% target. The company’s management expects to achieve this by 2026. It also expects “2025 to demonstrate another strong year of EBITDA growth, led by our IET segment.”

Cash Flow Stabilized; Leverage Improved: BKR’s cash flow from operations increased by 9% in FY 2024 compared to a year ago. Its FCF increased by 12% during this period. Debt-to-equity (0.35x) improved compared to December 31, 2023. During FY 2024, It repurchased shares worth $484 million. You may read more about the company in our previous article here.

Thanks for reading the BKR Take Three, designed to give you three critical takeaways from BKR’s earnings report. Soon, we will present a second update on BKR earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-