Q1 And FY2025 Outlook: During Q4, NOV (NOV) recorded $757 million in capital equipment order booking, representing a 1.2x book-to-bill ratio. Despite 21% higher orders from Q3, the company expects Q1 2025 revenues to decline by “one to three percent” compared to Q4 2024. It also expects Q1 adjusted EBITDA to decline by 17% (at the guidance mid-point) compared to Q4 2024. The guidance is based on “known and unknown uncertainties and risk.”

In FY2025, the company’s management expects to face challenges from a “flat-to-lower” global industry activity and geopolitical uncertainty. Positives will stem from the growing backlog of higher-margin offshore production-related capital equipment and the adoption of new technology.

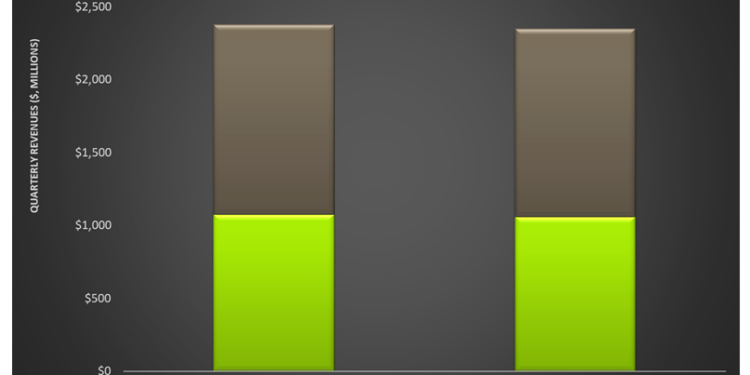

Revenue And Operating Income In Q4: In Q4 2024, the Energy Equipment and Energy Products & Services segments witnessed a 1% year-over-year revenue fall each. The Energy Equipment segment saw operating income rise (19% up) from Q4 2023 to Q4 2024. On the other hand, operating profit in the Energy Products and Services segment increased by 26%.

Strong execution on higher margin projects and increased technologically advanced product offerings reflected higher operating profit in Q4. However, lower global drilling activity, the impact of the divestiture of the Pole Products business, and lower revenue from aftermarket support partially offset the operating profit growth in Q4.

Cash Flows And Repurchases: NOV’s cash flow from operations increased significantly in FY2024 (by 8x) compared to a year earlier. FCF turned significantly positive in FY2024. Debt-to-equity (0.27x) has remained unchanged from a year earlier. The company repurchased 7.4 million shares in Q4, resulting in a total of 14.2 million shares repurchased for $229 million in FY2024.

Thanks for reading the NOV Take Three, designed to give you three critical takeaways from NOV’s earnings report. Soon, we will present a second update on NOV earnings highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-