Discipline has taken precedence over aggressive drilling. With BP having already released its fourth-quarter results and ExxonMobil and Chevron poised to report soon, Primary Vision’s latest Frac Spread Count (FSC) data offer critical insights into the strategies U.S. producers are employing to navigate market volatility. More than just confirming efficiency gains, this data serves as a leading indicator of future trends. This update provides a detailed discussion of the aforementioned issues and delves deeper into the latest macroeconomic developments.

1. MMV: Are Big Oil’s Earnings Telling us the Real Story Behind U.S. Frac’ing Activity? – PREMIUM

BP’s fourth-quarter performance vividly illustrates the market’s challenges and evolving strategies. The company reported a 61% drop in underlying replacement cost profit to $1.2 billion, impacted by weaker refining margins and a higher tax rate. BP’s reduced capital expenditures signal a decreased near-term investment in production growth—a strategy likely echoed by other major oil companies, increasing pressure on independent exploration and production companies to bridge the output gap. The behavior of the Frac Spread Count (FSC) relative to production forecasts provides insights into where drilling activity may actually intensify. Read this article to learn more about the shifting priorities in the shale industry.

2. MST: Global Tug of War: Growth Gains, Inflation Pains, and Fragile Recoveries – PREMIUM

The global economy is advancing, albeit with notable friction. The U.S. continues to push forward, yet inflation remains a persistent challenge. The Eurozone shows signs of improvement; however, Germany’s economic struggles significantly hamper the region’s progress. In China, a surge in post-holiday consumption suggests robust economic activity, but emerging undercurrents indicate potential vulnerabilities. This article captures the current pulse of the market, providing insights into these dynamic conditions.

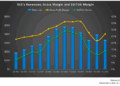

3. NOV’s PERSPECTIVE in Q4 TAKEAWAYS – PREMIUM

From its strong Q4 2024 performance to investments in cutting-edge technology and digital solutions, discover how NOV is positioning itself for sustained growth in a shifting market.

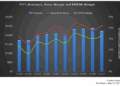

4. NABOR’S INDUSTRIES: Q4 TAKE THREE – PREMIUM

This report not only covers the pivotal developments in NBR’s strategy but also provides a forward-looking perspective on expected market stability and cash flow generation, critical for stakeholders tracking the energy sector’s evolving dynamics.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co