This week’s newsletter highlights the critical intersection between rising natural gas prices and the future of U.S. energy strategy. As natural gas prices climb towards $6/MMBtu, traders, hedge funds, and producers alike are grappling with the economic forces at play. With global gas inventories tightening and regulatory pressure mounting to reduce flaring, the stakes have never been higher. The decision on whether to flare or capture and transport gas to LNG terminals could reshape the U.S. energy landscape in ways not seen before. Meanwhile, we also look at the latest developments in global markets, with China’s economy showing signs of recovery, and a closer look at Nabors Industries’ and TechnipFMC’s Q4 performance and its outlook for international drilling activity in 2025 and beyond.

1. MMV: If Natural Gas Hits $6, Will More Gas Flow to the Coast or Be Left to Burn? – PREMIUM

As natural gas prices surge towards $6/MMBtu, the energy industry faces a pivotal moment. Will rising prices push more gas to the Gulf Coast for LNG exports, or will pipeline constraints and infrastructure bottlenecks continue to force producers to flare? This article delves into how market forces, regulatory shifts, and infrastructure challenges are reshaping the future of gas monetization. With global inventories tightening and increasing pressure to reduce flaring, the coming months will reveal whether the energy sector adapts quickly enough to capitalize on high prices or if constraints will limit progress. Read on to explore how this price shift could redefine U.S. energy strategy.

2. MST: China’s economy has started to improve – PREMIUM

This week’s global market update covers shifting momentum across key economies. While China’s economy shows signs of recovery with growing domestic demand and improving manufacturing, rising trade tensions with the U.S. threaten to disrupt its progress. Meanwhile, the Eurozone’s manufacturing sector is stabilizing, but weak consumer demand and high unemployment persist, dampening optimism. This article explores how these global trends interact and what they mean for markets, trade, and economic stability. Don’t miss the detailed analysis of how these forces are shaping the global economic landscape.

3. Nabors Industries’ Perspective in Q4: KEY Takeaways – PREMIUM

Nabors Industries is doubling down on international drilling with strong growth prospects in 2025 and 2026, even as U.S. onshore operations face difficulties. Despite rig suspensions in Q4, Nabors’ joint venture with Saudi Aramco (SANAD) is expanding, with several new rigs planned for the next few years. However, U.S. drilling margins are under pressure, and the company is navigating high debt levels. Want to know more about how Nabors plans to tackle these challenges and seize international opportunities? Dive into the article for an in-depth look at its strategy and financial outlook.

4. TechnipFMC: Q4 TAKE THREE – PREMIUM

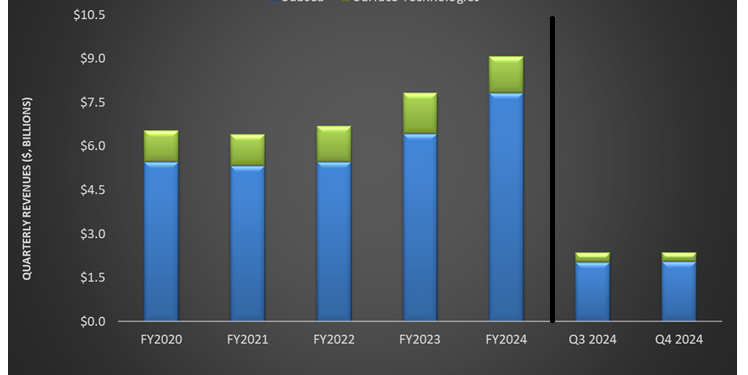

TechnipFMC (FTI) saw a 7% increase in Subsea orders in FY2024, driven by iEPCI projects, though Q4 revenues were flat. Despite a 20% drop in Subsea operating income, overall cash flow surged by 39%, with free cash flow up 45%. The company repurchased 2.4 million shares, and its debt-to-equity ratio improved. Learn more about TechnipFMC’s strategic focus and its pipeline of key projects.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co