NINE is bullish on the dissolvable plug’s prospect following the commercialization of its pincer hybrid frac plug and frac dart. As natural gas prices recover, its revenues will slowly gain momentum in 2025. In Q4, profitability improved through better utilization and cost reduction. However, its finances remain a concern. FCF turned negative in FY2024, while shareholders’ equity remained negative.

Industry Outlook

We discussed our initial thoughts about Nine Energy Service’s (NINE) Q4 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. In 2024, the US rig count declined by 3% due to a decline in the average natural gas price. This led to lower activity levels in Haynesville and Northeast, where NINE Energy draws nearly 30% of its revenue. Crude oil-led activities also declined but were relatively resistant to the fall.

So, the company’s management sees significant consolidation in the upstream industry. As the energy operators grew, efficiency improved. So, despite a 25% drop in the US rig count over the past two years, US crude oil production increased.

Strategic Focus

During 2024, NINE brought multiple new completion tool technologies. As we discussed in our previous article, it commercialized its pincer hybrid frac plug and frac dart. The pincer hybrid frac plug uses ~50% less material and lower plug drill-out time, while Frac Dart allows operators to reinitiate pump-down operations if the guns do not fire in the post-plug setting. The company remains bullish on dissolvable plug’s prospect because these plugs can help operators extend lateral lengths without compromising reliability.

Q1 and FY2025 Outlook

The situation, however, is due for a change in 2025 after natural gas prices started recovering. It has more than doubled since November 2024. The gas-levered operators could likely bring some activity back online. Overall, the 2025 US activity levels are expected to be stable. Based on the current momentum, NINE’s management expects Q1 2025 revenue to fall between $146 million and $152 million, or 5% higher than Q4.

Current Drivers and Q4 Financials

As rig count plateaued, NINE has a two-pronged strategy to drive profitability, which included implementing cost-cutting measures and market share gains across service lines and basins. Cementing became its strongest driver in Q4. In this operation, it exited 2024 with a market share of ~19%, an increase of ~14% over its Q4 2023 average. It also improved profitability through better utilization and cost reduction. In Q4, its cementing jobs saw an increase of ~12%. The average blended revenue per stage decreased by approximately 7%.

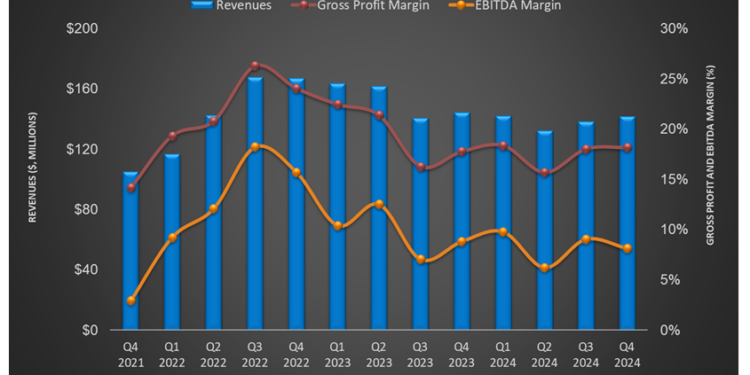

Quarter-over-quarter, NINE’s revenues increased by 2.4% in Q4, while its adjusted EBITDA margin remained nearly unchanged. NINE’s cash flow from operations declined steeply (by 71%) in FY2024 compared to a year ago. As a result, free cash flow turned negative in FY2024. Due to negative shareholders’ equity, its debt-to-equity remained negative as of December 31, 2024.

Quarter-over-quarter, NINE’s revenues increased by 4.3% in Q3, while its adjusted EBITDA margin expanded by ~300 basis points. The cementing business outperformed its other operations, increasing by 12% during Q3. NINE’s cash flows turned negative in Q3 compared to a positive CFO a quarter ago. Due to negative shareholders’ equity, its debt-to-equity remained negative as of December 31, 2024. It had a total liquidity of $52 million as of that date.

Relative Valuation

NINE is currently trading at an EV/EBITDA multiple of 8.3x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is ~6x.

NINE’s forward EV/EBITDA multiple compared to the current EV/EBITDA is expected to contract more steeply than its peers. This implies that its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is significantly higher than peers’ (NBR, PUMP, and OIS) average. So, the stock is reasonably valued, with a negative bias, compared to its peers.

Final Commentary

During 2024, NINE focused on bringing multiple new completion tool technologies, including pincer hybrid frac plug and frac dart. Its dissolvable plug helps operators extend lateral lengths without compromising reliability. In 2025, natural gas prices’ upward momentum has given it encouragement to improve financial results in natural gas-heavy basins in Haynesville and Northeast. The company’s cost-cutting measures and market share gains across service lines and basins should propel it in 2025.

On the other hand, NINE’s FCF turned negative in FY2024. Due to negative shareholders’ equity, its debt-to-equity has remained negative. The stock is reasonably valued compared to its peers.

Premium/Monthly

————————————————————————————————————-