The claim that U.S. drillers can still produce oil at $50 per barrel is a bold one, and while it might have held some weight in the past, a closer look at Frac Spread Count (FSC) trends, historical breakevens, and cost inflation paints a different picture. Primary Vision’s FSC data from 2014 to 2025 provides a clear-cut reality check: every time oil prices have dipped near $50, completion activity has significantly contracted. The shale sector isn’t immune to price cycles, and despite efficiency gains, there’s a limit to how low breakevens can go. The question isn’t just “Can oil still be produced at $50?” but rather, “Can production be sustained at $50 without a steep drop in completions?” That’s where the data tells a different story.

The first major test of $50 oil came during the 2015-2016 downturn, when WTI collapsed from over $100 to $30s. FSC plummeted from over 400 spreads in mid-2014. Even when prices rebounded above $50 in 2017, it took nearly two years for FSC to climb back above 300. The pace of completions only recovered when oil stabilized closer to $65-$70 per barrel, confirming that while some operators could drill and complete wells at $50, it wasn’t enough to sustain growth or even maintain completions activity.

A similar trend emerged in late 2018 and early 2019, when WTI briefly dipped toward $50. FSC, which had been hovering near 500 spreads, quickly contracted by nearly 100 spreads within months, reflecting the tightening economics of frac’ing at that price point. It was a clear sign that even as efficiency gains improved well productivity, there was still a threshold below which operators simply wouldn’t justify completions at scale. The real test, however, came in 2020, when the pandemic-driven collapse saw WTI go negative. FSC fell off a cliff, and even after prices recovered to $50-$55 by early 2021, activity didn’t rebound until oil surged past $70 per barrel later that year. This cycle confirmed that the industry’s cost floor had shifted upward, driven by rising service pricing, higher wages, and supply chain constraints.

To investigate the matter further I asked Gaurav Sharma, a senior Energy Market Analyst, to help me out. He said, “in a climate of largely bearish oil prices, the debate always turns to what price level US shale oil can stay in the game. Various figures have been brandished about. Many wonder if US shale production can indeed survive $50/bbl prices. The short answer is yes, but not by much. Different independent US producers have different pain thresholds, but the average based on my modelling of Q4 2024 input prices / costs seems to suggest an average pain threshold of $42/bbl with +/- 5% margin of error. But even if we were to argue that such prices would hurt shale producers, the hurt won’t kick in immediately. That’s because many are hedged 12-18 months out from Q3 2024 at much higher price levels above $70.”

To build on what Gaurav said, we also need to be aware of the evolving context that has only grown more complex. The FSC number, that stands at 212 for this week, witnessed some positive uptick in the last few weeks but on YoY basis it is still down by 57. While the oil prices have remained stable with a few wild swings, the overall drilling environment is now punctuated by multiple factors. The most significant one is that of improving technology and efficiency gains about which we have written before. While efficiency gains have witnessed an exponential surge, they cannot go on forever. Last year the production growth slowed to 0.4 mbpd vs 0.8 mbpd in 2023. Now the prices have started to fall again and the FSC is keeping up with this trend when we see it on YoY basis. If the market truly supported sustainable completions at $50, we wouldn’t be seeing a decline in FSC at oil prices still well above that level. This underscores a crucial shift: while some wells might break even at $50, sustaining production at scale requires higher prices.

Paul Hickin, Chief Economist and Editor in Chief at Petroleum Economist also agreed with the above assessment adding “50/b oil would seriously start to impact US production growth and given the rate at which lost barrels need to be replaced we could see US output even decline this year. Financial discipline is still the mantra of big oil operating in the shale patch so really need a minimum of 60/b to keep pumping and growing oil output and ideally closer to 70.”

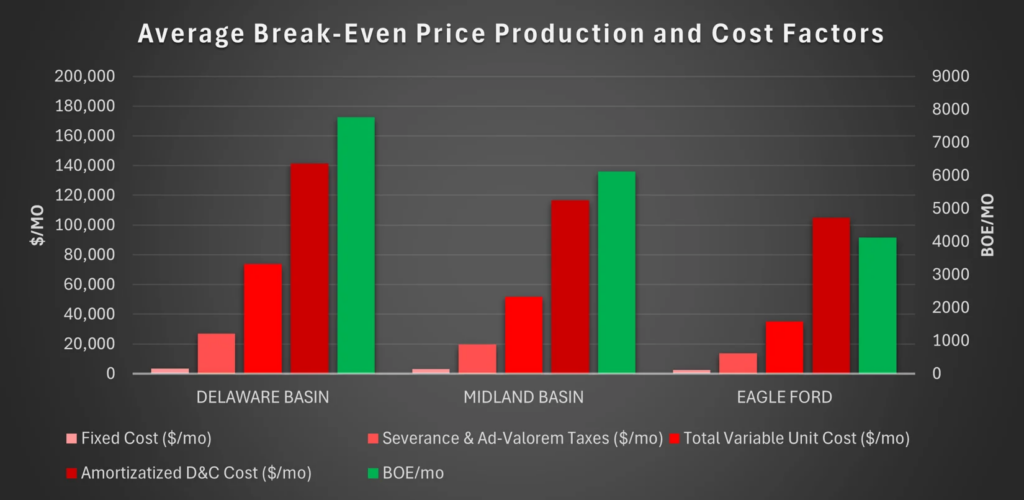

Furthermore, an important point is that breakeven prices vary by region—the Permian remains the most resilient, while higher-cost basins like the Bakken and Eagle Ford struggle at sub-$60 oil. Data from past cycles indicates that when WTI falls below $55, FSC contracts by 5-10% within the next quarter, particularly among private operators who are more price-sensitive. The reason is straightforward: even if some operators can technically complete wells at $50, doing so at scale requires a price cushion to cover operational costs, service pricing, and reinvestment. The notion that drillers will continue completing wells at a high rate with oil stuck at $50 ignores both the financial discipline imposed by investors and the natural cost floor of modern shale development.

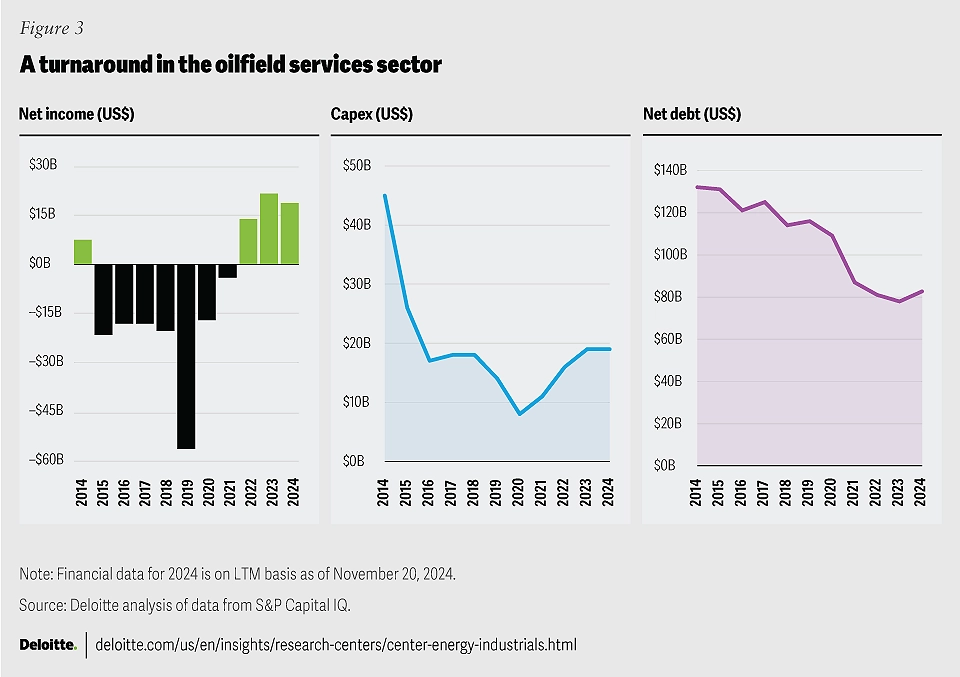

Another overlooked factor is cost inflation in the service sector. The days of ultra-cheap fracking are gone. Diesel costs, proppant pricing, labor shortages, and rising equipment replacement costs have pushed breakevens higher than where they stood in the late 2010s.

a) Diesel costs: Still elevated from pre-2020 levels. Fuel costs account for 15-20% of total frac costs.

b) Labor costs: Ongoing since 2021, with service costs for labor rising ~8% YoY.

c) Equipment Costs: E-frac and DGB fleets require high CAPEX, pushing service pricing higher than 2019 levels.

Even with efficiency gains, service costs today are significantly above pre-pandemic levels, meaning that the price needed to sustain completions has also risen. If oil were to drop to $50 in today’s market, it’s unlikely that operators would maintain current activity levels—they would either scale back or shift toward their absolute best acreage, reducing overall completions.

Finally, in recent years, U.S. shale operators have markedly shifted their focus toward enhancing shareholder value over aggressive drilling expansion. This strategic pivot is evident in the substantial capital returns to investors. For instance, in 2022, cumulative shareholder returns exceeded $1.7 billion, underscoring the industry’s commitment to rewarding investors. This emphasis on fiscal discipline has tempered production growth, with capital expenditures increasing by 53% over the last four years, while net profits rose by nearly 16%, reflecting a balanced approach to investment and returns. Consequently, a decline in oil prices to $50 per barrel could significantly impact this equilibrium, potentially constraining cash flows and challenging operators’ ability to maintain current levels of shareholder distributions without compromising financial stability.

When I asked Marc Ostwald, Chief Economist and Strategist at ADM ISI, about the prospects of sustainability of shale at $50, he said that “the simple answer is no, even at $60 it would be challenging. The fact is we are long past the days where Shale Oil companies were profligate with their spending, and are now much more fiscally responsible these days, and their shareholders will apply pressure to maintain that, given the rollercoaster ride of the startup years. Trump & co will have to dangle considerably larger tax incentives to drive more E&P. Even then many companies in the sector are already suggesting peak oil demand is just above current 13.5 Mln bod output level, which threatens profitability in the longer run.”

Source: Deloitte – Oil and Gas Outlook

This brings us back to the energy secretary’s claim. If the argument is that some U.S. production can still exist at $50, that’s technically true. But if the suggestion is that completions activity and overall U.S. output would hold steady at $50, the data says otherwise. Every historical precedent—from 2016, 2018, 2020, and even today—demonstrates that when oil falls below $55, completions decline, capital budgets tighten, and FSC contracts. Rising service costs in 2025 make it even harder to sustain completions at this price. While some U.S. production could survive, maintaining large-scale growth at $50 oil is a myth. The real test isn’t whether drillers can pump at $50—it’s whether they can sustain completions without collapsing FSC, and history says they cannot