ProFrac Holding’s fracking activities took a dip in Q4 as the energy operators curtailed completion activities amidst industry consolidation. However, early 2025, ACDC appears to have made a sharp recovery, with six additions to its frac spread count. Its management is also cautiously optimistic about the proppant operations in 2025. In Q4, it launched Livewire Power to cater to power generation solutions in remote locations. However, increased tariffs and labor inflation can continue to affect the company’s margin adversely in the near term.

Fracking And Proppant Operations

Our short article discussed our initial thoughts about ProFrac Holding’s (ACDC) Q4 2024 performance a couple of weeks ago. This article will dive deeper into the industry and its current outlook. After a dip in Q4, ProFrac’s frac spread count increased by six in early 2025. The current count is higher than Q4 2024. Much of the addition took place in West Texas and South Texas. At this point, it is estimated that 80% of its active frac spreads utilize next-generation equipment. In 2025, ACDC anticipates frac efficiency to improve.

In the proppant operation, the company’s management is “cautiously optimistic” in 2025. It expects increased activity in Haynesville due to a recovery in natural gas prices and the region’s proximity to LNG export terminals in the Gulf of America. ACDC has one of the largest Proppant footprints in Haynesville. In the South and West Texas markets, too, results should improve as they optimize their operations and pricing improves modestly in the region.

Opportunities And Challenges

In recent quarters, ProFrac has strengthened its electric frac operations with the new power management venture Livewire Power. It will continue to invest in next-generation technologies. Such strategic initiatives are expected to drive improvement in 2025. In Q4, ACDC launched Livewire Power to cater to power generation solutions in remote locations, following its advances in electric frac technology. An increased demand for power can open up opportunities for pricing improvement.

The traditional power generation market for the energy sector and other high power consuming industries face challenges due to heavy capital requirements, long lead times, and project-based demand. The company’s experience in running electric frac operations and managing power augurs well with the strategic initiative to have an in-house power generation business.

Pricing remained a challenge, as it declined precipitously in 2024. This, combined with higher costs due to increased tariffs and labor inflation, affected the company’s margin adversely. However, its management anticipates the pricing dynamic to improve because the company’s Stimulation services segment sees marginally higher activity in 2025. Average pricing, nonetheless, will remain low.

A Q4 Financial Discussion

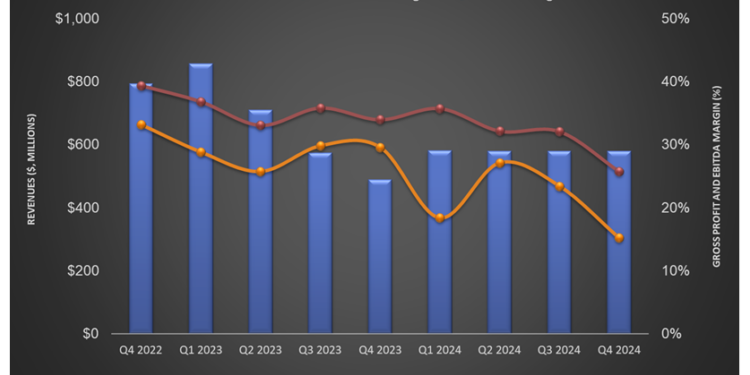

As discussed in our short article, from Q3 to Q4, ACDC’s revenues from the Stimulation Services and Proppant Production segments saw steep declines (24% and 12% down, respectively). The company’s adjusted EBITDA margin contracted by 790 basis points in Q4. Its free cash flow declined by 61% in FY2024 over a year ago. ACDC’s leverage (debt-to-equity) deteriorated to 1.2x as of December 31, 2024, compared to 0.84x a year earlier. It had $81 million of liquidity as of December 31.

Relative Valuation

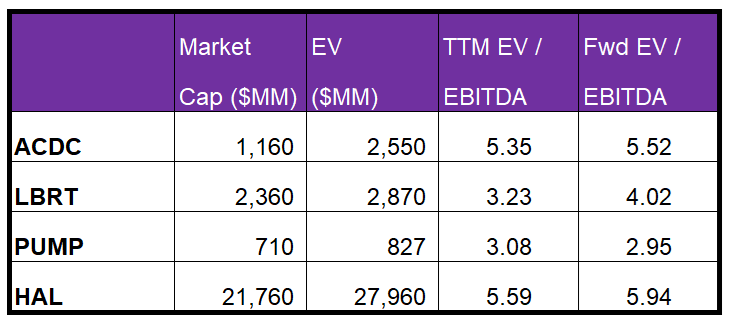

ACDC is currently trading at an EV/EBITDA multiple of 5.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 5.5x.

ACDC’s forward EV/EBITDA multiple expansion versus the current EV/EBITDA is less sharp than its peers because its EBITDA is expected to decrease less sharply than its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is higher than its peers’ (LBRT, PUMP, and HAL) average. So, the stock is relatively overvalued compared to its peers.

Final Commentary

ACDC saw its active frac spread count jump by six in Q1 after a sudden dip in Q4. Much of the recovery took place in West Texas and South Texas, where natural gas prices’ recovery and LNG production ramp-up have encouraged higher completion activities. Currently, the company’s primary focus is on the new power management venture, Livewire Power. The power generation market for the energy sector can diversify its revenue source and boost margins.

However, margin expansion remains challenging due to low pricing and higher costs. Also, free cash flow declined steeply in FY 2024 over a year ago. The company’s debt-to-equity is also high. The stock is relatively overvalued compared to its peers.

Premium/Monthly

————————————————————————————————————-