The global economy is at an interesting juncture. While inflation seems to be moderating in some regions, persistent concerns around consumer sentiment, industrial momentum, and fiscal imbalances continue to shape the economic landscape. In the United States, an improving mortgage market contrasts with a record budget deficit and declining consumer confidence. In China, retail sales and industrial output signal resilience, but weak credit growth and a prolonged property slump raise structural concerns. Meanwhile, the Eurozone’s industrial sector is showing signs of stabilization, but inflation in key economies remains a challenge. The big question is whether central banks will feel comfortable staying on their current paths, or if policy adjustments will be needed to mitigate risks on the horizon.

United States: A Market Caught Between Hope and Uncertainty

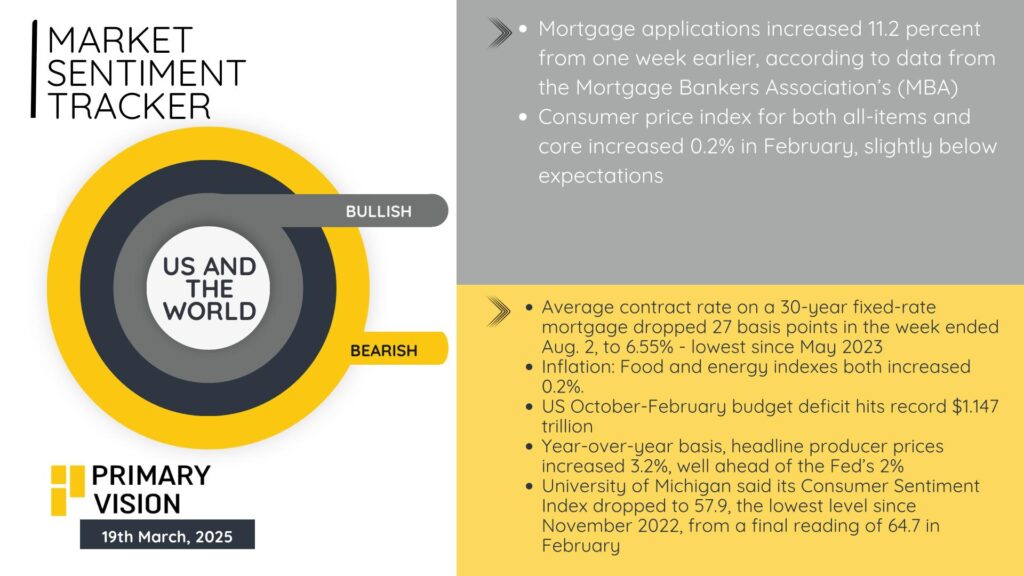

The U.S. economy continues to send mixed signals. Mortgage applications surged by 11.2% last week, a strong indicator that lower rates are stimulating demand. This is in line with a 27-basis point decline in the average contract rate for a 30-year fixed mortgage, now at 6.55%, its lowest level since May 2023. However, while lower mortgage rates typically support housing activity, declining consumer sentiment complicates the picture. The University of Michigan’s Consumer Sentiment Index fell sharply to 57.9, the lowest since November 2022, reflecting growing pessimism about economic conditions.

Meanwhile, inflation data remains a concern. The consumer price index (CPI) increased by 0.2% in February, slightly below expectations, but the breakdown reveals worrying trends: both food and energy prices increased at the same rate, adding pressure on household budgets. The producer price index (PPI) rose by 3.2% year-over-year, well above the Federal Reserve’s 2% inflation target, suggesting that cost pressures are still making their way through the supply chain.

Adding to the headwinds, the U.S. budget deficit reached a staggering $1.147 trillion between October 2024 and February 2025, the largest on record for this period. A deficit of this magnitude limits fiscal flexibility and could push interest rates higher if borrowing needs expand further. With mixed inflation signals, growing fiscal concerns, and weakening consumer confidence, the Federal Reserve will need to tread carefully in assessing its next steps.

China: Growth or Structural Slowdown?

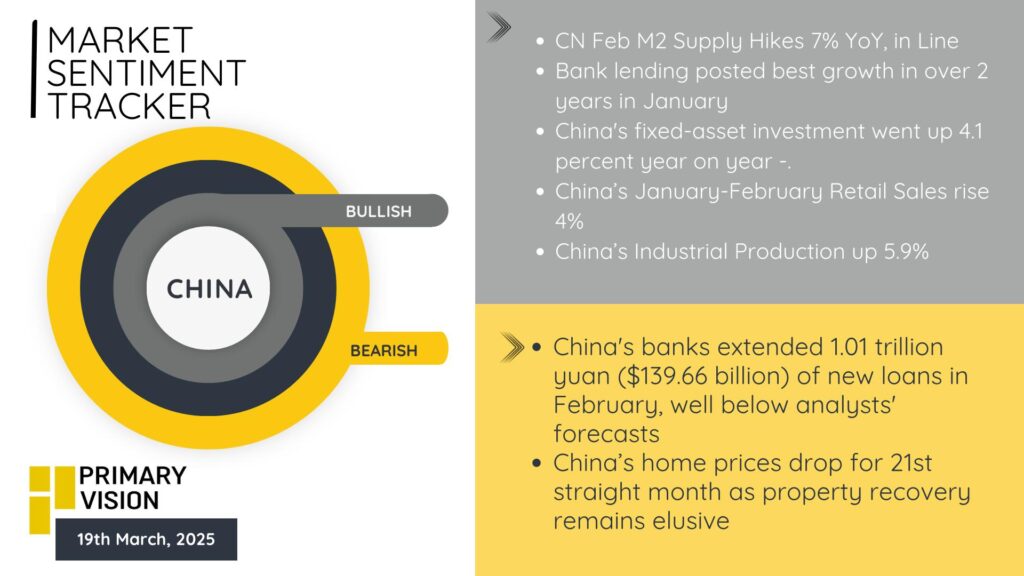

China’s economic story remains one of contradictions. On the surface, the data is promising—retail sales rose 4% in the first two months of 2025, industrial production climbed 5.9%, and fixed-asset investment grew 4.1% year-on-year. Additionally, China’s M2 money supply expanded by 7% in February, a sign that liquidity remains ample in the system. The country’s Caixin Manufacturing PMI rose to 50.8, exceeding expectations and signaling expansion, while services PMI also surprised to the upside at 51.4.

Yet, beneath the surface, warning signs persist. China’s banks extended only 1.01 trillion yuan ($139.66 billion) in new loans in February—well below analyst forecasts—indicating weak credit demand. This suggests that businesses and consumers remain cautious despite policy support. Moreover, the real estate sector continues to struggle, with home prices declining for the 21st consecutive month. The property downturn has been one of the biggest drags on China’s economy, and its persistence raises concerns about a broader slowdown in household wealth and investment.

The Chinese government is clearly trying to engineer a stable recovery, but if credit demand remains weak and the property slump deepens, policymakers may have to deploy stronger stimulus measures to keep growth on track. The market will be closely watching for any additional liquidity injections or targeted support for the real estate sector.

Eurozone: Industrial Recovery vs. Inflation Worries

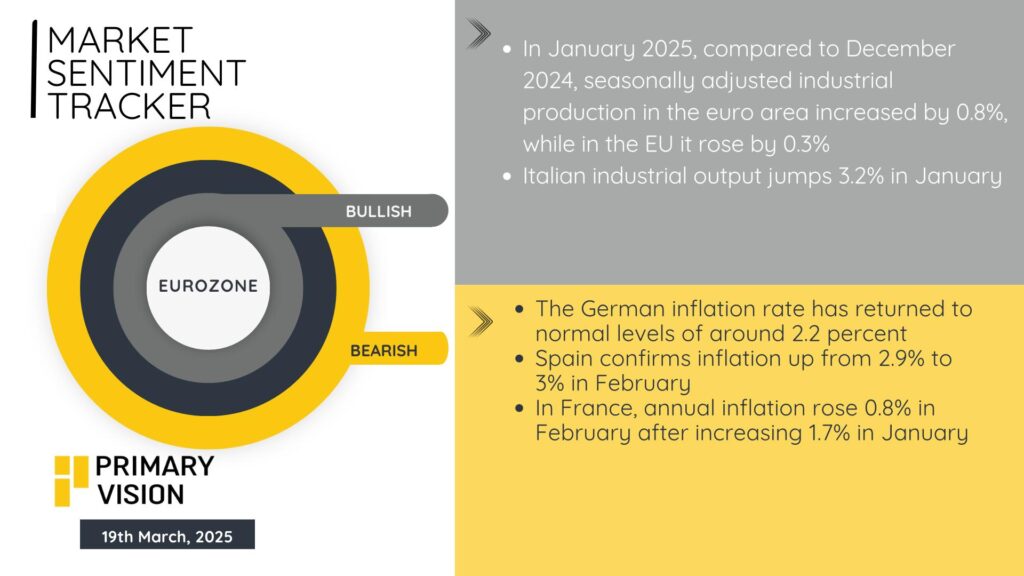

In the Eurozone, industrial production showed signs of life in early 2025. Seasonally adjusted industrial output rose by 0.8% in January, while in the broader EU, it increased by 0.3%. Italy’s industrial output was particularly strong, jumping 3.2% in January—an encouraging sign that manufacturing may be stabilizing after a prolonged period of weakness.

However, inflationary pressures remain a challenge. Germany’s inflation rate has normalized around 2.2%, but other major economies are seeing price growth accelerate. Spain’s inflation rate climbed from 2.9% to 3% in February, while in France, annual inflation increased by 0.8% in February after rising 1.7% in January. If inflation proves stickier than expected, the European Central Bank (ECB) may have to delay any rate cuts, which could weigh on economic recovery prospects.

The ECB’s policy path remains uncertain, as officials weigh the trade-off between supporting growth and ensuring inflation remains under control. With Germany and France struggling to generate meaningful momentum, the broader Eurozone’s recovery remains fragile.

Can Central Banks Stay the Course?

This week’s data suggests that global growth remains intact, but underlying risks are rising. The U.S. economy is holding up, but cracks are appearing in consumer confidence and fiscal stability. China’s numbers show resilience in industrial activity and retail sales, but weak credit growth and a prolonged housing downturn signal deeper structural issues. The Eurozone’s industrial uptick is encouraging, but inflationary pressures could complicate the ECB’s plans for monetary easing.

The big question remains: can central banks continue on their expected policy paths, or will economic pressures force them to reassess? If inflationary pressures persist, policymakers may have little room to cut rates in 2025, leaving economies vulnerable to further slowdowns. Conversely, if growth weakens further, central banks may have to pivot to more aggressive easing to prevent stagnation.

For now, markets will be closely watching upcoming data on inflation trends, labor market performance, and central bank rhetoric. The next few months will be crucial in determining whether the global economy can sustain its current path or if we are heading toward another period of uncertainty.