Few days ago, President Donald Trump announced a sweeping 10% tariff on imports from numerous countries, with certain nations facing even higher rates—China, for instance, was subjected to a 34% tariff. Notably, crude oil and petroleum products were exempted from these tariffs, a decision aimed at maintaining stable energy prices and protecting U.S. consumers.

Despite this exemption, the global oil market has experienced significant turbulence. As of April 7, 2025, oil prices have plunged by 11%, reaching a three-year low. Contributing to this decline, Saudi Aramco reduced its May official selling price (OSP) for Arab Light crude by $2.30, setting it at $1.20 per barrel above the average of Oman and Dubai prices—the lowest in four months.

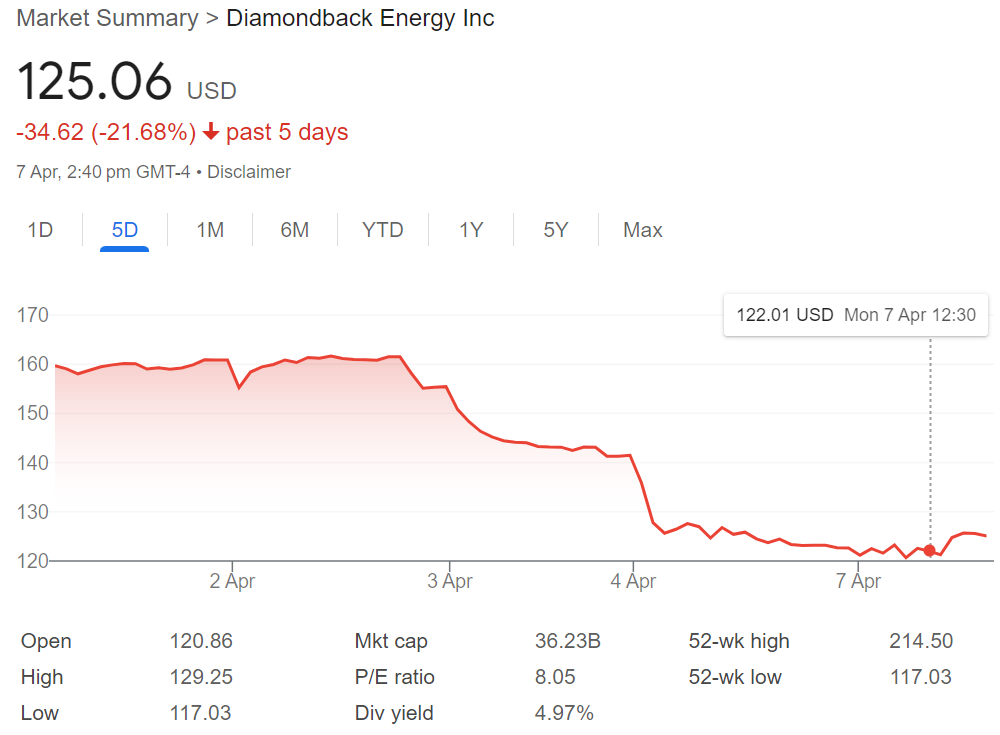

The oil market’s instability has also impacted U.S. oilfield service firms. Companies such as SLB, Halliburton, and Baker Hughes are bracing for revenue declines of 2-3% in 2025 due to the combined effects of new tariffs and falling oil prices. Morningstar estimates that for every dollar lost in revenue, these firms could see $1.25 to $1.35 in lost operating profit. For instance, companies like Liberty Energy have reported that the tariffs are causing a rise in costs for components like perforating guns used in fracking. To mitigate these expenses, Liberty Energy is passing the additional costs onto customers, which could potentially impact drilling activities. The financial strain is also reflected in the stock performance of several key players in the industry. As of April 7, 2025, shares of Matador Resources Co. (MTDR) are trading at $38.38, down 13.87% from the previous close. Similarly, Diamondback Energy Inc. (FANG) shares have declined by 12.71% to $123.37, and Halliburton Co. (HAL) shares have fallen by 10.90% to $19.98. Major oil companies are not immune to this downturn; Exxon Mobil Corp. (XOM) shares have decreased by 7.20% to $104.34, Occidental Petroleum Corp. (OXY) by 7.61% to $40.54, and Chevron Corp. (CVX) by 8.31% to $143.28.

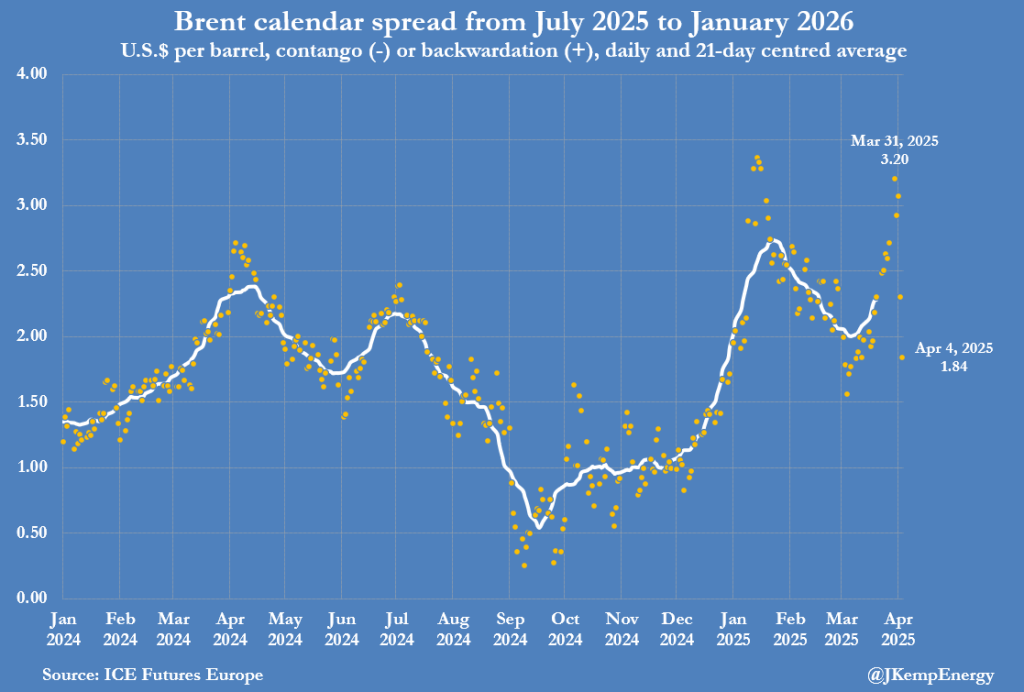

Furthermore, Asia’s crude oil imports have softened, with the first quarter of 2025 seeing imports at 26.44 million barrels per day (bpd), down 640,000 bpd from the same period in 2024. This decline raises concerns about demand growth in the region. Brent crude’s calendar spreads have also narrowed significantly, indicating expectations of increased oil availability in the latter half of the year. The six-month spread has contracted to an average of just under $3 per barrel, reflecting a shift in market sentiment.

The Dallas Federal Reserve’s Energy Survey for the first quarter of 2025 mirrors this market weakness. The survey reported a 21-point jump in uncertainty, with the company outlook index falling to -4.9. Operating margins for oilfield services firms declined to -21.5 from -17.8, underscoring the challenges faced by the sector. Adding to bearish sentiment in the oil market, product inventories in the UAE’s Fujairah Oil Industry Zone saw a sharp rise in the week ending March 31. Total oil product stocks jumped by nearly 5 million barrels to 24.34 million barrels — their highest in months. The build was broad-based, with light distillates rising by 1.3 million barrels to 8.25 million, middle distillates increasing by over 1 million barrels to 3.05 million, and residual fuel oils surging by 2.6 million barrels to 13.04 million. Such a significant increase in inventories suggests weak regional demand and further intensifies concerns of oversupply heading into the second half of 2025.

Amid escalating trade tensions, there is growing concern that retaliatory tariffs may target oil exports. Analysts warn that such measures could exacerbate market volatility and further strain international trade relations.

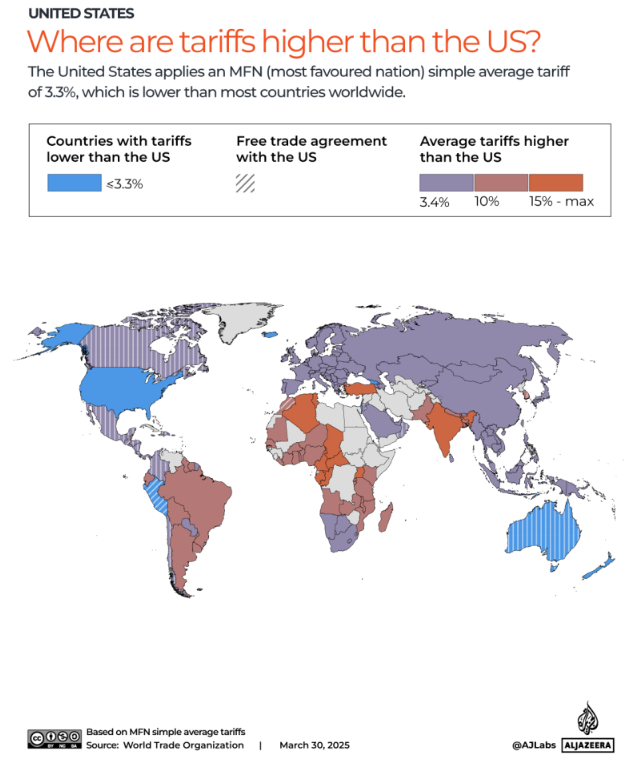

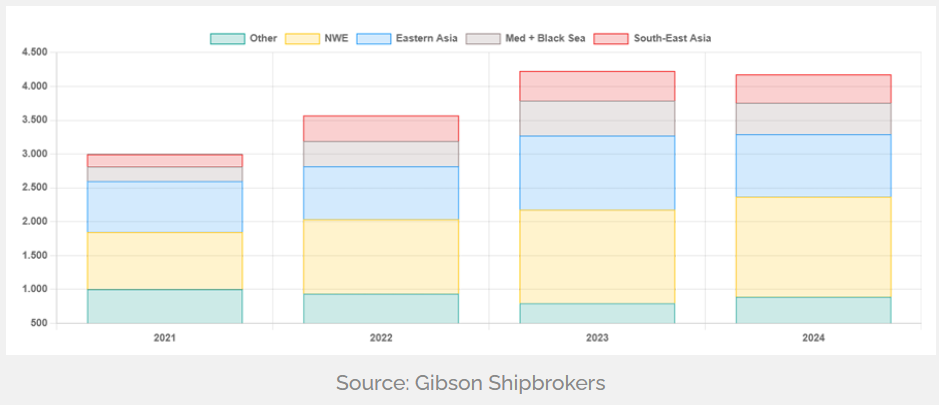

Looking ahead, there is a real possibility that crude oil and refined products—though initially exempted from U.S. tariffs—may become targets of retaliatory trade measures by other countries. The U.S. imported 3.3 million barrels per day (mbd) of seaborne crude and refined products in 2024, mainly from Latin America and the Middle East. Meanwhile, it exported nearly 4.2 mbd, with 46% going to Europe and the Mediterranean, and 32% to East and Far East Asia—regions that could potentially slap tariffs on American oil in response. While some of these countries have limited alternative sources of supply, the situation could shift quickly if OPEC+ accelerates production increases. This growing uncertainty casts a shadow over U.S. oil exporters and could mark the start of a more fractured and protectionist global energy market.

In conclusion, while crude oil and petroleum products have been exempted from the recent U.S. tariffs, the global oil market remains vulnerable to the broader economic impacts of escalating trade disputes. The combination of falling prices, reduced demand, and potential retaliatory measures is creating an environment where oil prices might re-enter the era of lower for longer.