Halliburton’s topline witnessed a slowdown in Q1 as its Middle East/Asia and Latin American operations faced challenges. Also, its net income fell sharply. However, it won integrated offshore project awards extending through 2026 and beyond. Share repurchases continued in Q1.

Key Innovations and Operating Highlights: In Q1 2025, Halliburton (HAL) launched its autonomous hydraulic fracturing technology Octiv Auto Frac service as a part of its ZEUS platform. During the quarter, it received a contract award from Petrobras for integrated drilling services in Brazil, where HAL will provide iCruise intelligent rotary steerable system.

Also, it launched EcoStar electric tubing-retrievable safety valve and deployed an automated on-bottom drilling system. The drilling system integrates Halliburton’s LOGIX automation and remote operations with Sekal AS’s Drilltronics, a rig automation control system.

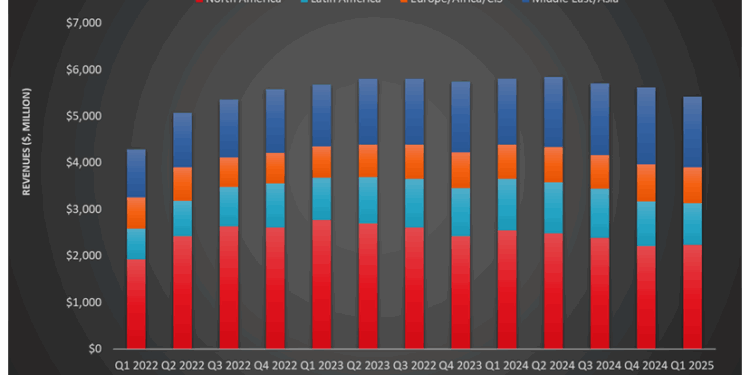

Q1 Performance Indicates Weakness: Quarter-over-quarter, revenues in the company’s Completion and Production operating segment decreased by 1.8% in Q1. The top line in the Drilling and Evaluation segment decreased more sharply, by 5.6%. Geographically, the Middle East/Asia witnessed the steepest fall (8.4% down), followed by Latin America (6% down). North America, in comparison, was relatively resilient from Q4 2024 to Q1 2025.

Decreased drilling services in Mexico and the Middle East, as well as lower wireline activity in the Middle East and Asia, weighed on the Q1 financials. On the other hand, higher artificial lift activity and improved drilling services in the US onshore partially mitigated the fall. However, the US onshore, too, suffered from lower stimulation activity. Quarter-over-quarter, the company’s net income dipped by 67% in Q1 following a $356 million charge related to severance and asset impairment.

Repurchase Continued Despite A Cash Flow Weakness: HAL’s cash flow from operations weakened (22% down) in Q1 2025 compared to a year ago. As a result, its FCF decreased by ~52%. Debt-to-equity (0.72x) also deteriorated from FY2024, due primarily to lower shareholders’ equity. During Q4, it repurchased shares worth $250 million to improve shareholder returns. The share buyback has been a consecutive exercise for the past five quarters.

Thanks for reading the HAL take three, designed to give you three critical takeaways from HAL’s earnings report. Soon, we will present a second update on HAL earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-