RES’s topline witnessed a mild slowdown in Q1, although its EBITDA margin expanded as operating income in both segments improved. However, it will likely be disciplined with its investments due to uncertainty in the energy sector. In April, RES acquired Pintail Completions.

Outlook and Recent Acquisition: RPC, Inc (RES) observes that the “oilfield services market remains challenged.” It expects uncertainties to arise from the government’s trade policy shift. It also has a slightly bearish view over asset utilization due to intense competition. So, it will likely be disciplined in its investment and capital deployment.

In Q1, pressure pumping pricing remained under pressure. However, the management expects new product launches in downhole tools to see higher demand in 2025. In April 2025, RES acquired Pintail Completions, which provides wireline perforation services in the Permian. In FY2024, Pintail generated ~$400 million in revenues. The acquisition will complement RES’s well completion services portfolio.

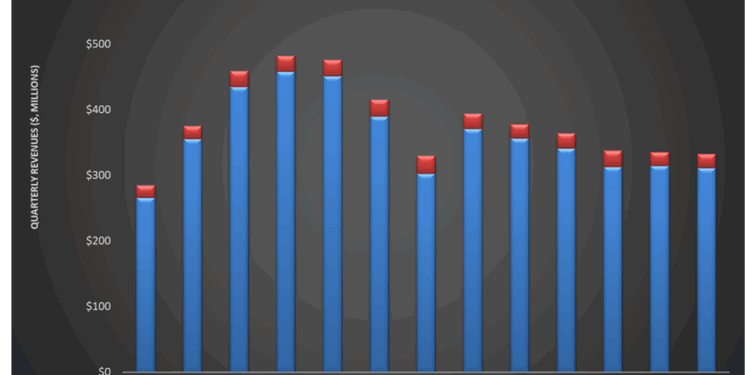

Segment Performance and Margin: Quarter-over-quarter, RPC’s (RES) revenues decreased marginally, by 0.7%, in Q1 due to lower customer activity. Its adjusted EBITDA margin expanded by 100 basis points following a contraction in the previous two quarters. EBITDA margin improved in Q1 due to reduced fleet and lower insurance and transportation costs.

The company’s Technical Services segment operating income increased by 32% quarter-over-quarter, while operating income in the Support Services segment improved by 4% from Q4’24 to Q1’25. Despite that, the company’s net income decreased by 5.7% during the first quarter. Read more about the company in our previous article here.

RES’s FCF Increased: RES maintained a debt-free balance sheet as of March 31. This, along with a cash balance of $327 million and a $100 million revolving credit facility, allowed for maintaining a dividend payment of $0.04 per share. Although cash flow from operations decreased, free cash flow improved in Q1 2025 because capex fell more sharply in the past year.

Thanks for reading the RES Take Three, designed to give you three critical takeaways from RES’s earnings report. Soon, we will present a second update on RES earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-