In Q1 2025, TechnipFMC’s backlog increased following higher iEPCI subsea awards. It is also expected that the majority of revenues from Surface Technologies will come from international markets. Its topline receded in Q1. The company’s cash flows, however, turned significantly positive while it continued to repurchase shares.

Orders and Outlook: By March 31, TechnipFMC’s (FTI) order backlog increased by 10% to $15.8 billion. In Q4, the book-to-bill ratio increased to 1.4x from 1.3x a quarter earlier. Notable iEPCI (integrated Engineering, Procurement, Construction, and Installation) contract awards included a greenfield development offshore Brazil and another in the Norwegian North Sea. Its management identified inbound opportunities worth $26 billion over the next two years. The value of the potential list grew by 20% in the past year. It sees long-term opportunities in Guyana, Suriname, Namibia, Mozambique, and Cyprus.

In Surface Technologies, FTI expects 95% of its FY2025 revenues to be generated from international markets because the US market would remain under pressure due to lower commodity prices and a relatively high cost of development. It also anticipates that only product-related revenues in the US would be exposed to the recently announced tariffs.

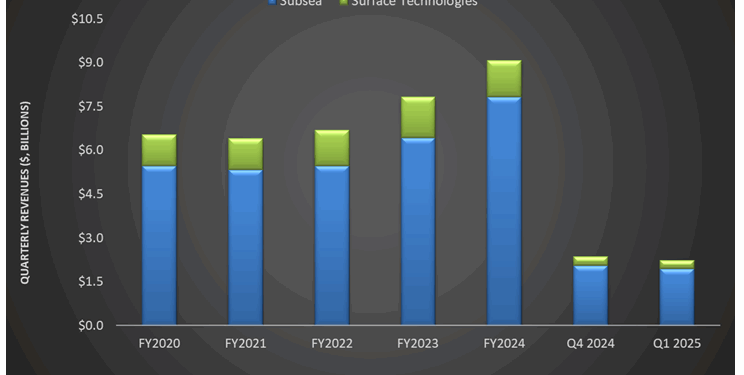

Segment Results Weakened In Q1: Quarter-over-quarter, revenues in the company’s Subsea operating segment declined by 5.5% in Q1. The top line in the Surface Technologies segment decreased more steeply, by 7%. Operating income in the Subsea segment, on the other hand, increased by 8% in Q1, due primarily to improved earnings mix and a reduction in restructuring and impairment charges. Operating income in the Surface Technologies segment decreased by 17% due to lower activity in international markets, including the Middle East, Africa, and Asia Pacific.

Cash Flows Increased and Shares Repurchased: FTI’s cash flow from operations turned significantly positive in Q1 2025 from a negative cash flow a year ago. As a result, its FCF turned positive in Q1. The debt-to-equity ratio (0.29x) marginally deteriorated as of March 31, compared to FY2024. During Q4, it repurchased shares worth $250 million.

Thanks for reading the FTI take three, designed to give you three critical takeaways from FTI’s earnings report. Soon, we will present a second update on HAL earnings highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-