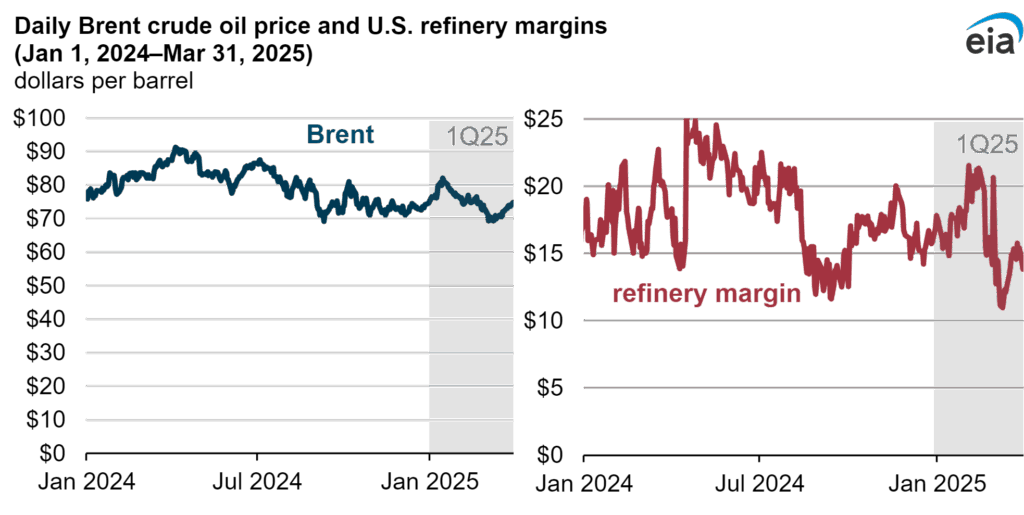

As we enter the mid of May, 2025, global oil markets are still struggling to find a clear direction. Brent crude is hovering around $65.94 per barrel and WTI is trading near $63.31—both down from their January peaks above $82. This persistent weakness reflects a broader recalibration in global crude dynamics, not just a lull in demand. The market is increasingly shaped by opportunistic buying, shifting trade patterns, and uncertain macroeconomic signals rather than any cohesive supply-demand narrative.

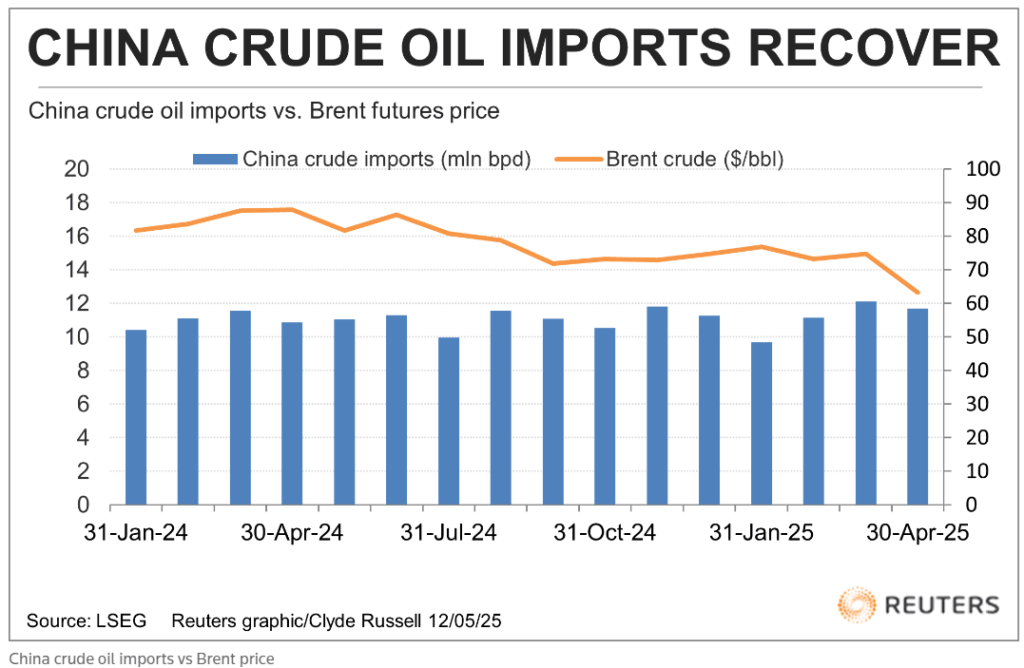

China remains central to this recalibration. The country imported 11.69 million barrels per day of crude oil in April, up 7.5% year-over-year. But this isn’t evidence of a resurgent economy. Instead, state-owned refiners are taking advantage of discounted oil—especially from Iran and Russia—to build inventories while prices remain relatively low. Despite the surge in imports, much of this crude is going into storage. Storage tank utilization stands at just 62%, leaving plenty of capacity for further accumulation. The demand side tells a different story: China’s oil consumption is projected to grow only 1.1% this year, reaching 765 million metric tons. The rise of electric vehicles, weaker industrial activity, and increased LNG adoption in freight are weighing on refined product demand. Refining margins remain thin, especially among independent refiners, many of whom are pulling back due to new U.S. sanctions targeting firms engaged in sanctioned crude trade.

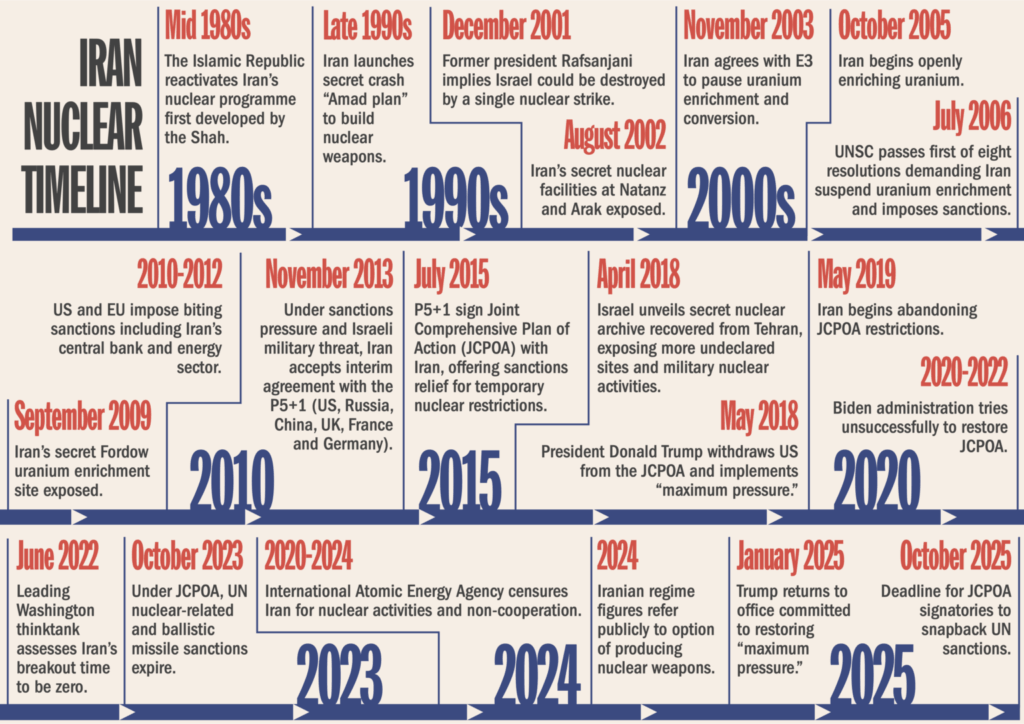

Those sanctions are beginning to bite. Over 20 entities have recently been blacklisted by the U.S. for facilitating Iranian oil shipments, directly impacting several Chinese teapot refiners, particularly in Shandong. This is creating friction in the shadow crude market, reducing flows even as larger state-backed companies continue their buying. The shadow fleet—those untraceable tankers moving sanctioned oil—is still active, but recent enforcement measures are injecting fresh volatility into the informal trade network that has supported China’s buying spree.

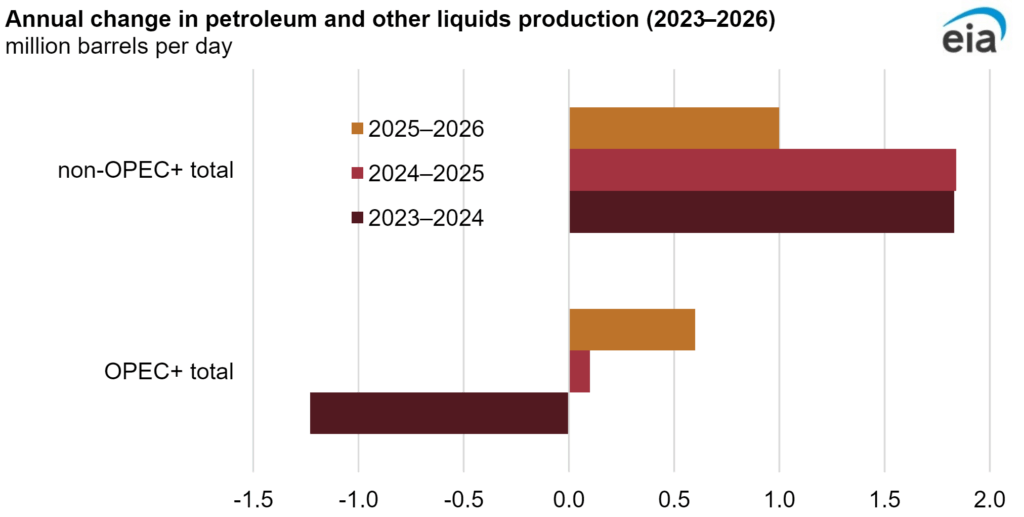

Meanwhile, on the supply front, as OPEC+ has announced a production increase of 411,000 barrels per day for June, following similar adjustments in April and May, this move is intended to gradually unwind previous cuts but comes at a time when demand growth is tepid and inventories are rising. Rather than signaling confidence, the modest hikes underscore the group’s precarious balancing act: defend market share without tanking prices. Market participants aren’t interpreting these increases as bullish signals, particularly given recent price action and tepid forward demand indicators.

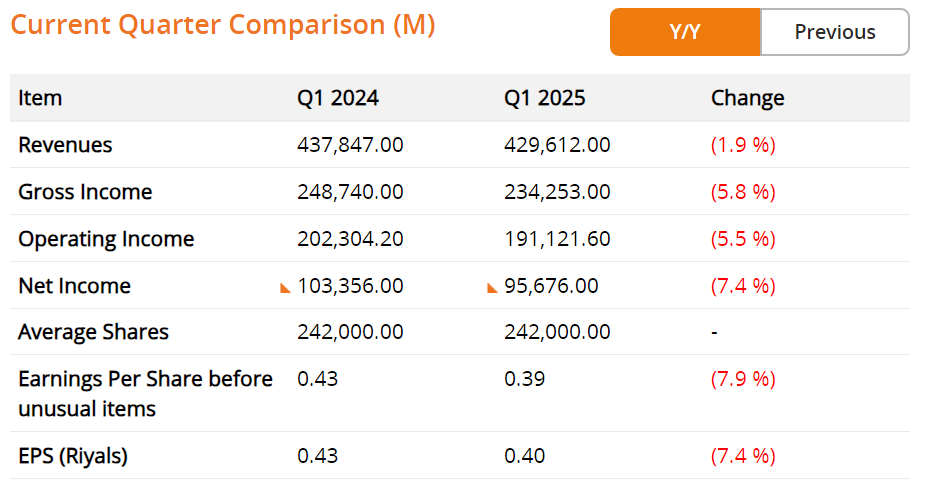

Saudi Aramco, a key bellwether for global oil fundamentals, is also feeling the pinch. First-quarter 2025 profits dropped 4.6% year-on-year to $26 billion, and performance-linked dividends have been slashed by $10 billion. Aramco’s free cash flow has also contracted, as lower prices and persistent cost pressures eat into margins. Yet despite weaker financials, the company is still pressing ahead with diversification, including talks to acquire a stake in an $18 billion U.S.-based LNG project. That kind of strategic pivot suggests long-term concerns about oil’s growth trajectory—even from the world’s lowest-cost producer.

In terms of broader market sentiment, the tone is still hesitant. A temporary truce between the U.S. and China on trade, including mutual tariff rollbacks, provided some relief earlier this month. However, the fundamentals remain cloudy. Traditional linkages—such as those between oil prices and U.S. shale output—have weakened. Geopolitical tensions haven’t gone away, but they no longer move markets with the same force. Instead, oil flows are rerouting, storage is rising, and buyers are more tactical than ever.

Heading into June, the oil market remains rangebound and indecisive. Prices are low enough to invite opportunistic stockpiling but not low enough to force dramatic supply cuts. Inventory levels are building, but they’re not yet at crisis thresholds. Refiners are cautious, and producers are tightening capital discipline.

In short, the market remains stuck in limbo—waiting for a clearer demand recovery, a major policy shift, or a geopolitical spark to break the stalemate. Until that comes, prices are likely to drift sideways, guided more by strategy than sentiment.