• Regression estimates suggest revenue growth in NTM 2023, but the rate can decelerate sharply over the next couple of years

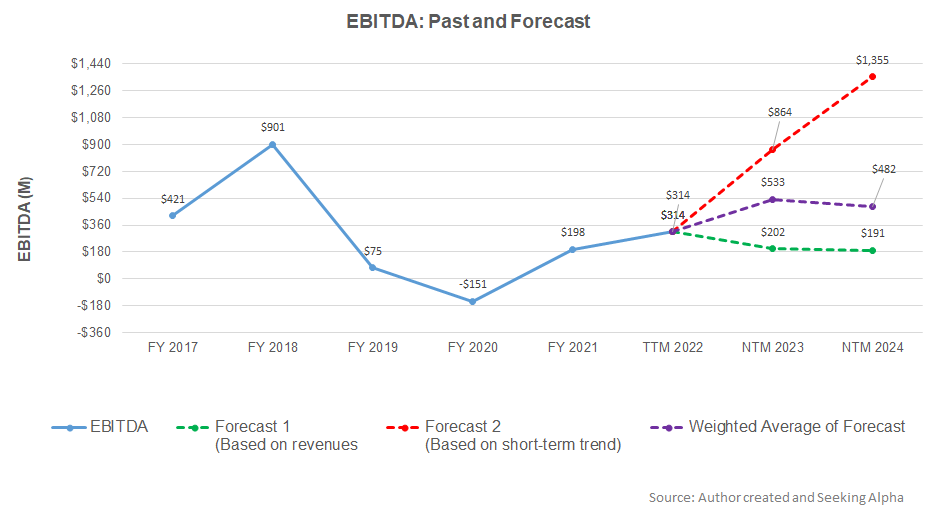

• The EBITDA growth rate is sharp in NTM 2023 but may fall in NTM 2024

• The relative valuation suggests the stock is reasonably valued at this level

Part 1 of this article discussed the NOV’s (NOV) outlook, performance, and financial condition. In this part, we will discuss more.

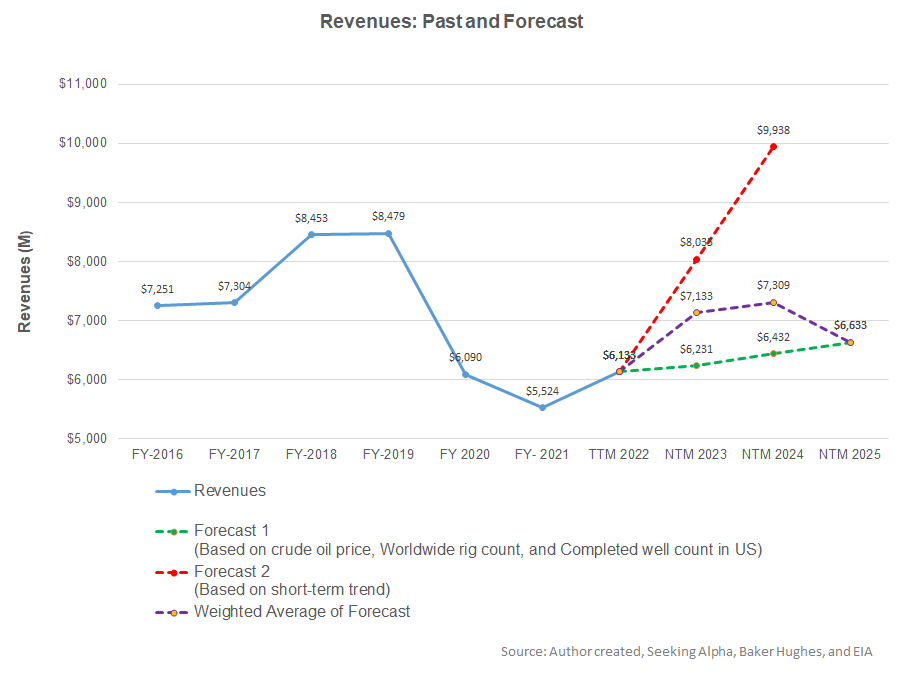

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price, the aggregate rig count in the US and internationally, and the US completed well count) and NOV’s reported revenues for the past seven years and the previous four quarters, I expect its revenues to increase in the next 12 months (or NTM) in 2023. The growth rate can decelerate sharply in NTM 2024 and decline in NTM 2025.

Based on the same regression models and the forecast revenues, I expect the company’s EBITDA to increase steeply in NTM 2023. However, it can decline in NTM 2024.

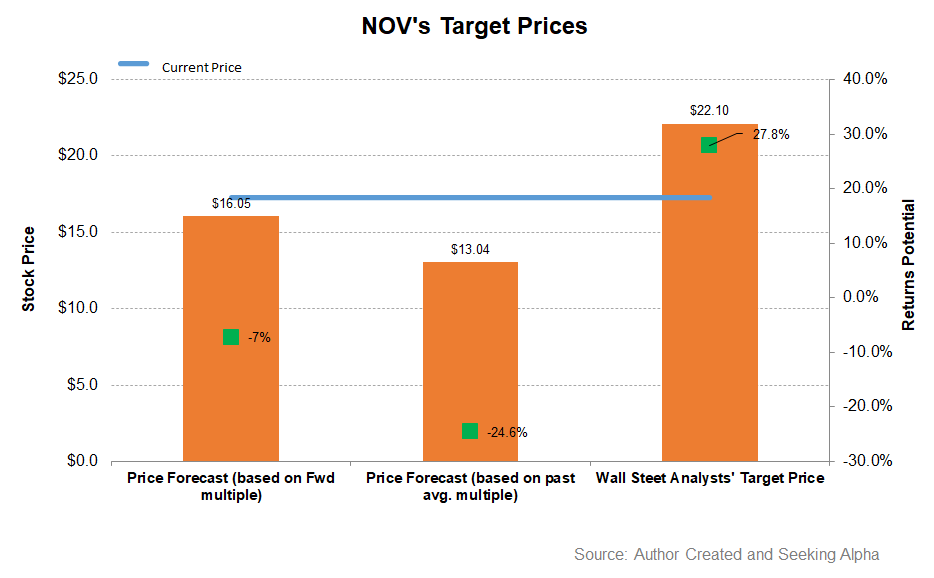

Target Price

Returns potential using the forward EV/EBITDA multiple (13.9x) is higher (7% downside) than the returns potential (25% downside) using the past average EV/ EBITDA multiple (19x). The sell-side analysts’ expected returns (28% upside) from the stock are higher.

What Does The Relative Valuation Imply?

NOV’s current EV/EBITDA multiple is higher than the past five-year average EV/EBITDA multiple of 19.2x. So, it is currently trading at a premium to its past average.

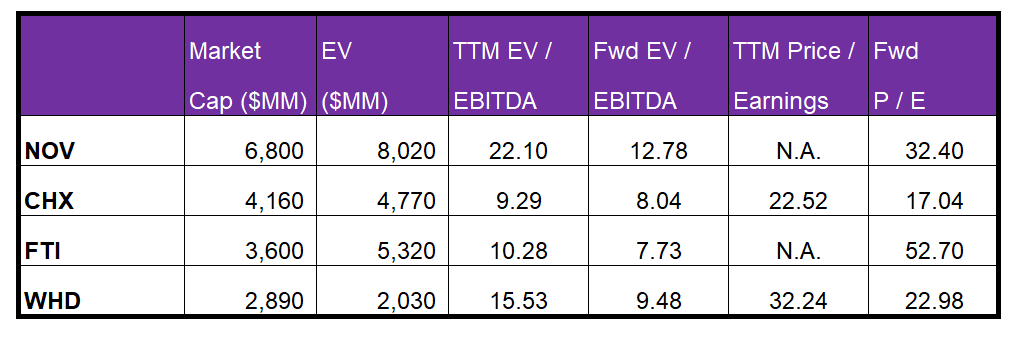

NOV’s EV/EBITDA multiple is higher than its peers’ (CHX, FTI, and WHD) average of 11.7x. Because NOV’s forward EV/EBITDA multiple contraction is steeper than its peers, it typically reflects in a higher EV/EBITDA multiple than its peers. So, the stock is reasonably valued versus its peers at the current level.

What’s The Take On NOV?

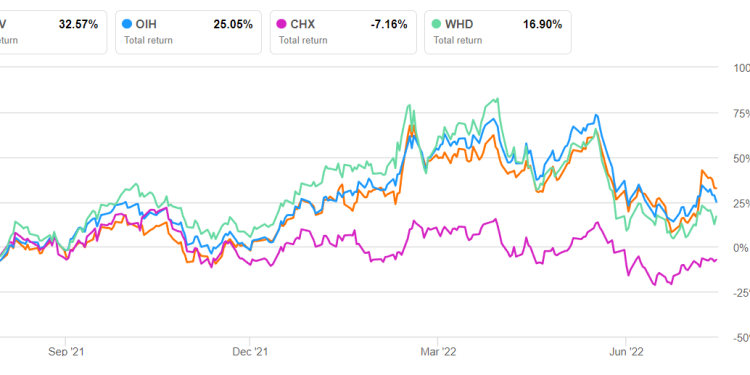

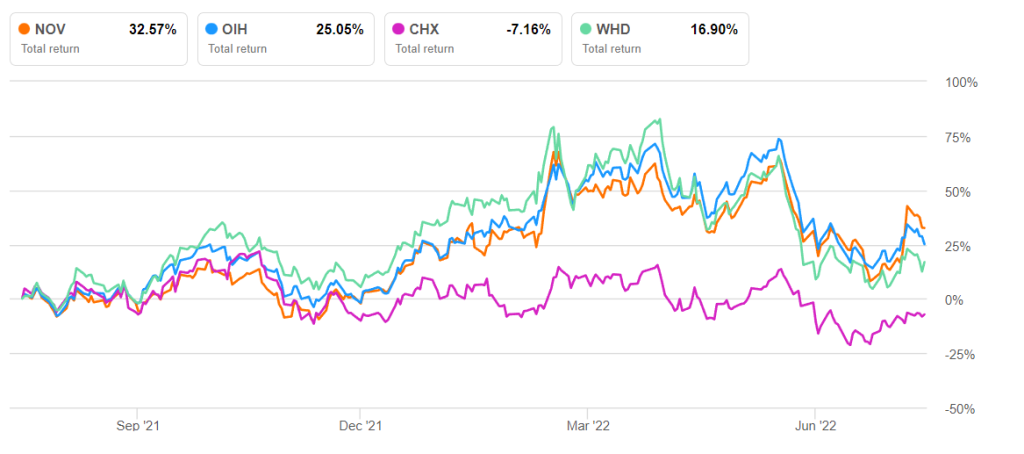

In 2H 2022, we will likely witness the recovery in the marine and offshore sectors and increasing drilling activity in the Eastern Hemisphere. As energy prices and drilling activities rise in the US, leading-edge day rates for super-spec onshore rigs have increased since the 2020 downturn. As a result, rigs, drill pipes, and pumps are seeing demand resurfacing, benefiting NOV’s performance in 2022 and beyond. So, the stock marginally outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

The oilfield services sector is still not free from drivers that partially undermine the growth factors. High labor costs and low-margin contracts signed during the pandemic are such adversities. Also, the North American drilling activity may underperform in 2H 2022. Its cash flows were negative in 1H 2022 because working capital requirements significantly increased in the past year. This, however, will not hurt its balance sheet strength because of the robust liquidity in the system. Given its at-par valuation relative to its peers, the stock is likely to move sideways in the near term, although returns can bulge in the medium to long term.