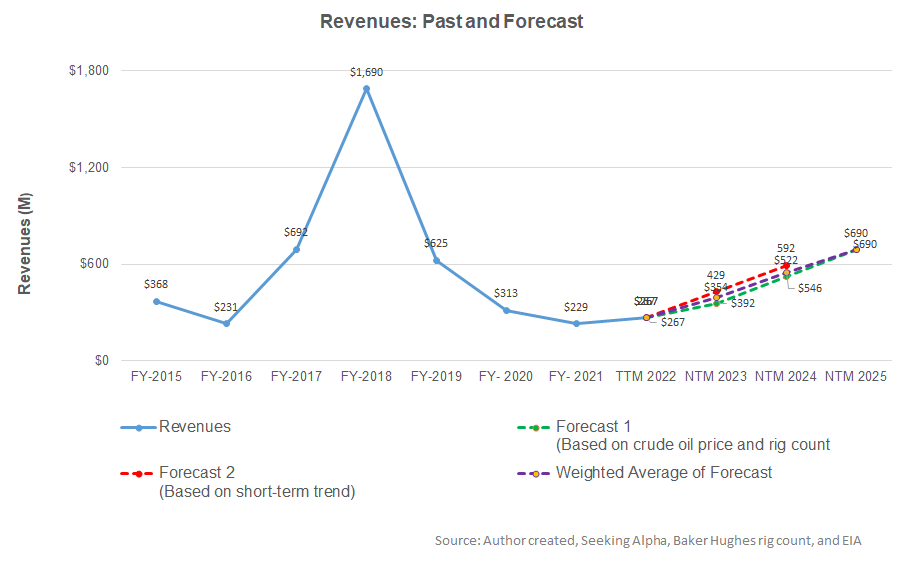

- The regression equation suggests a steady revenue growth for TUSK in the next couple of years.

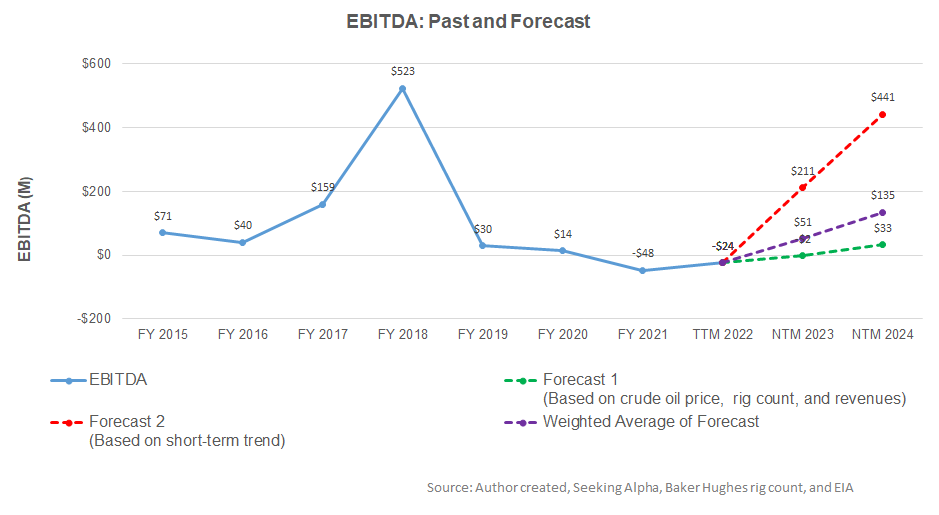

- EBITDA can turn positive in NTM 2023 and continue to move up in NTM 2024.

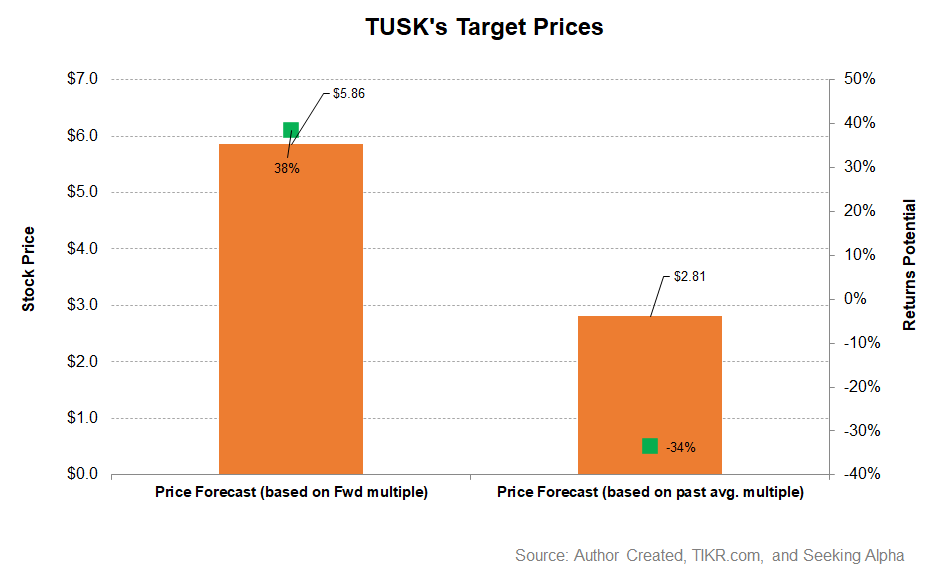

- The model suggests a wide variability in the stock price return potential.

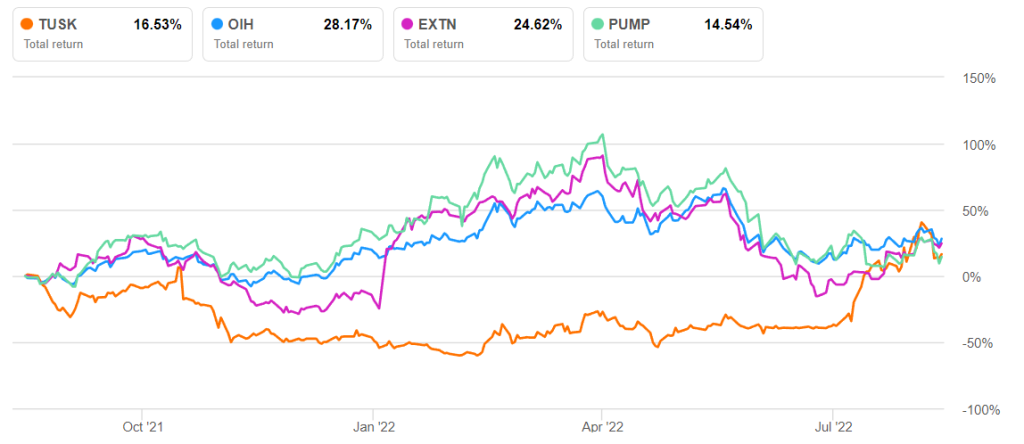

Part 1 of this article discussed Mammoth Energy’s (TUSK) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price and rig count) and TUSK’s reported revenues for the past seven years and the previous four quarters, I expect its revenues to increase handsomely in the next 12 months (or NTM) 2023 and NTM 2024.

Based on the same regression models and the forecast revenues, I expect the company’s EBITDA to turn positive in NTM 2023. The model suggests that the EBITDA will jump in NTM 2024.

Target Price

Returns potential using the forward EV/Revenue multiple (0.88x), as derived from the revenue forecast, is much higher (38% upside) than the returns potential using the past average EV/Revenue multiple (34% downside) from the stock.

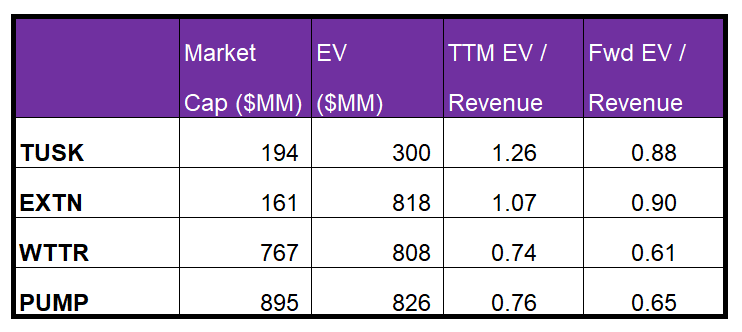

Relative Valuation

Mammoth Energy’s current EV/Revenue multiple is 1.26x. The stock’s past five-year average EV/EBITDA multiple was 0.89x. So, it is currently trading at a premium to its past average.

TUSK’s EV/Revenue multiple is higher than its peers’ (EXTN, WTTR, and PUMP) average of 0.86x. Because TUSK’s forward EV/EBITDA multiple is contracting more steeply than its peers, it typically reflects a higher EV/EBITDA multiple than its peers. So, the stock is reasonably valued at the current level with a negative bias.

What’s The Take On TUSK?

The oilfield services business brought rich dividends as the fracking business went from strength to strength in the US in 2022. It operated four hydraulic fracturing fleets in Q2, up from three in Q1. The number can rise to five in Q3 and six in Q1 2023. By the end of 2023, its fleet count can increase to seven. The sand business has adopted a vertical integration model, enabling it to switch from T&D equipment to refurbishing frac equipment.

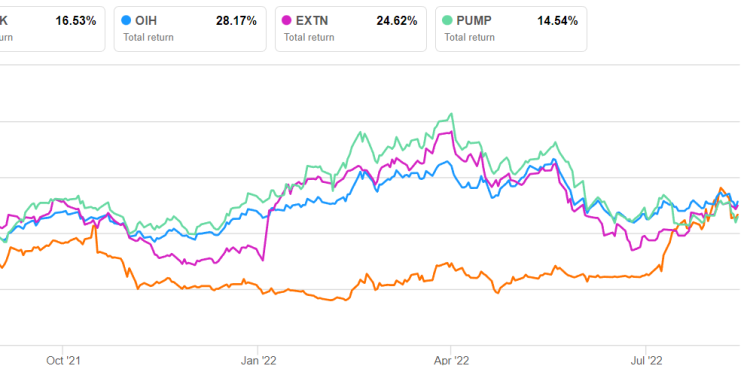

However, the US GDP technically entered a recession in Q2 as the growth rate declined in two successive quarters. Therefore, the company’s infrastructure business faces headwinds, although the government’s increased spending can potentially bring growth back. The PREPA-related matter drags on as the company announced the first appeal response from FEMA. With much of its accounts receivable trapped in the PREPA contracts, negative cash flows in 1H 2022 put some strain on its finances. So, despite the positive drivers, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. The company’s balance sheet is free from any immediate impending risks. Given its reasonably well-placed relative valuation, investors might want to hold the stock in the short term.