- Higher demand for pressure pumping fleets, better pricing, and improved utilization augur well for ProPetro’s medium-term outlook.

- Although the total fleet may change little, the share of Tier IV DGB (dynamic gas blending) pumps and electric pumps will increase steadily over the next year.

- The failure to commercialize the DuraStim hydraulic fracturing assets appeared concerning

- PUMP’s zero debt and robust liquidity will address the financial risks borne out of the significant rise in capex

Outlook On Fleet Conversion

ProPetro Holding (PUMP) currently focuses on upgrading its pressure pimping fleets from legacy to natural gas burning engines that can lower completions cost and emissions. It plans to take delivery of more Tier 4 DGB and convert a third Tier 2 conventional fleet into a Tier 4 dual fuel fleet. Meanwhile, at the current rate, it plans to deploy four to five fleets by the end of 2022. By early 2023, the number may reach six Tier 4 DGB fleets.

Overall, the company operated 14 fleets in Q2. Plus, it may add another DGB fleet by the start of 2023. In 2H 2022, the management’s expected effective utilization is 14 to 15 fleets, of which at least nine would be natural gas fleets. Investors may note that earlier, in September 2021, the company had announced its long-term plans to convert 50 Tier II Dynamic Gas Blending (or DGB) pumping units to Tier IV.

Margin Expansion And Portfolio Rebalancing

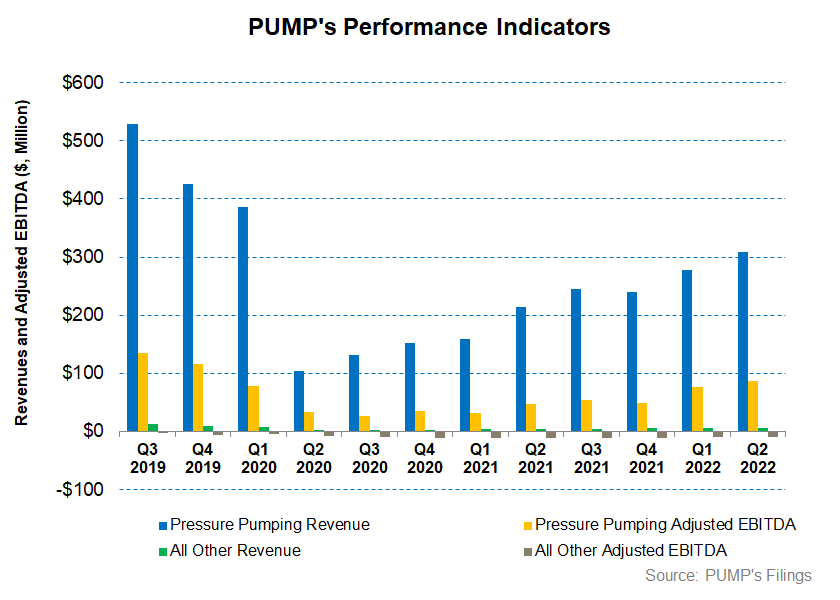

Although the operating margin in the pressure pumping operations remained unchanged in Q2 from Q1 (28%), since Q3 2020, it has made significant progress. The current margin is in line with the pre-pandemic era, which shows that the company’s primary business is in the early stage of a upcycle. Higher demand and prices for pressure-pumping equipment have produced a healthy cash-on-cash return and will likely improve in the coming quarters. It also plans to play a significant role in the electric future of the Permian Basin.

Investors may note that PUMP’s revenues from the coiled tubing business remained unchanged in Q2, while it recorded operating loss in this segment for the past several quarters. In August, the company executed a long-term lease agreement for two electric frac fleets with expected delivery in Q3 2023. On the other hand, it exited the coiled tubing business when it sold this unit to a subsidiary of STEP Energy Services in August. So, the sales would make economic sense for the company.

Analyzing The Industry Scenario

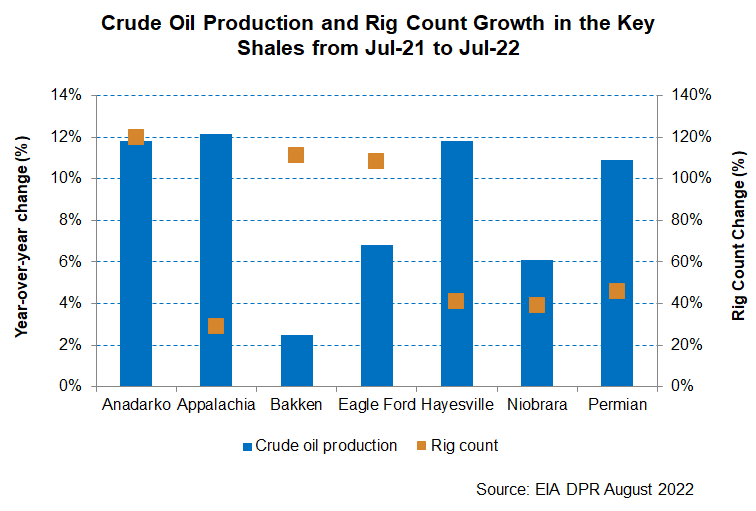

According to the EIA’s estimates, crude oil production will likely increase by 3.3% in the seven critical shales in September 2022 compared to the current output. Crude oil production increased by 9% in the key unconventional shales in the past year. The Permian production increased by 11% during this period, while the rig count went up by 60%. Investors may note that much of PUMP’s assets in operations are Permian-centric, and it wants to further participate in the electrification of pumps (e-fracs) in this region.

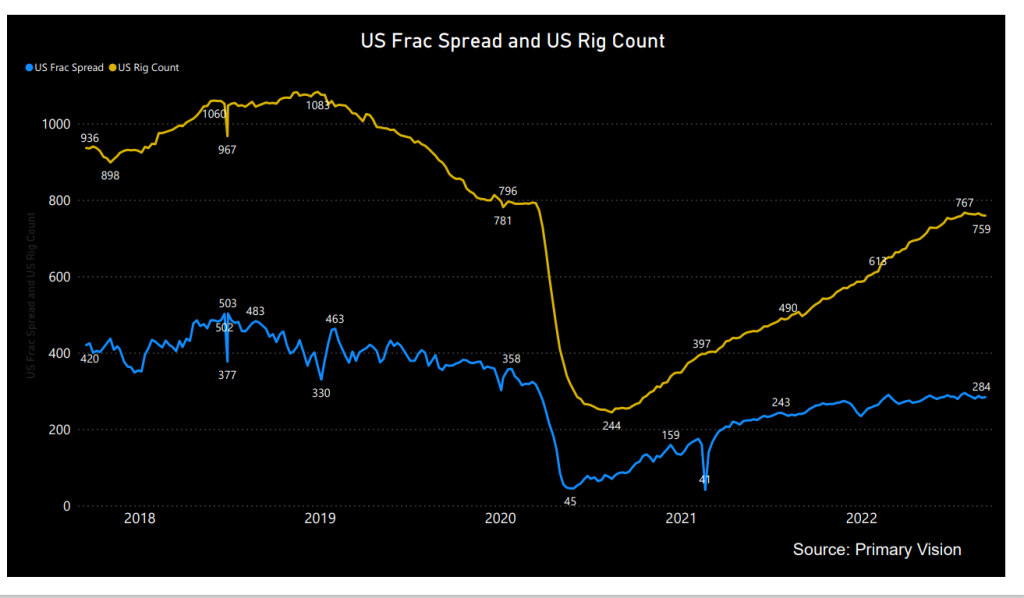

According to Primary Vision, the frac spread count has increased by 21% to 284 compared to the start of the year. The higher frac count can improve PUMP’s topline in 2H 2022. PUMP’s management believes that the global crude oil market is structurally undersupplied, which will draw investment in crude oil production, particularly in the Permian Basin. Although the current energy market is volatile, the demand side has held its ground, while the supply side is still shaky. According to the management, the US pressure-pumping market remains effectively sold out.

The Value Drivers In Q2

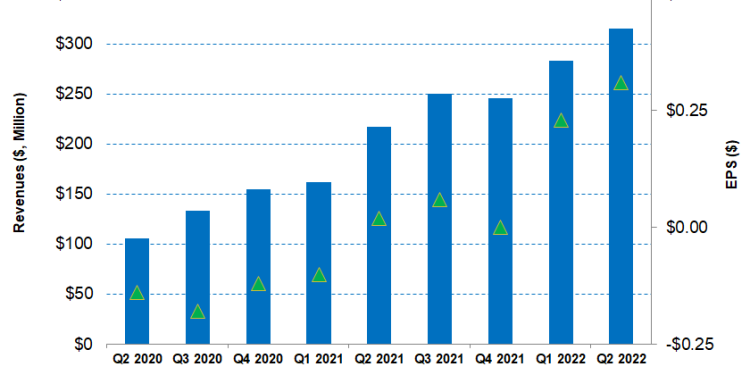

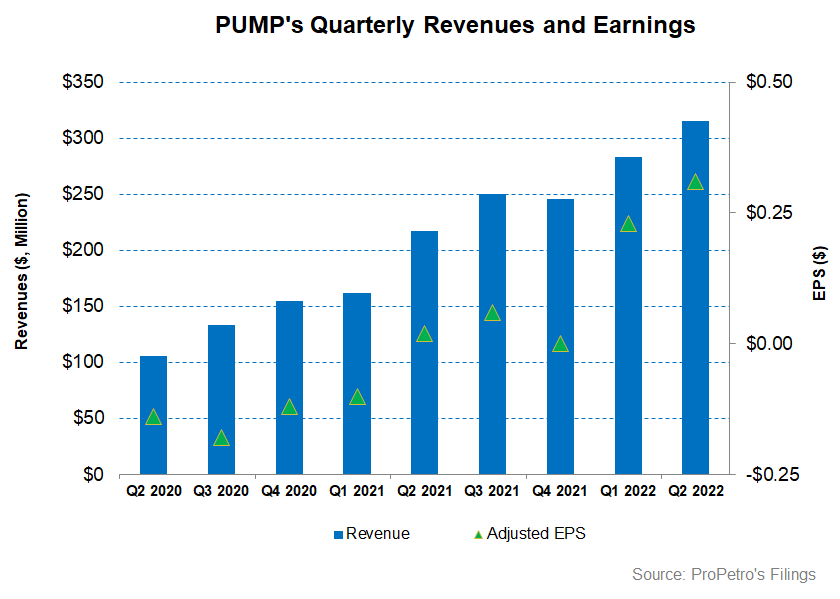

PUMP’s quarter-over-quarter revenue growth was 11.5% in Q2, due primarily to pricing gains and increased fleet utilization. Its effective fleet utilization in Q2 was above the prior guidance of 13.5 to 14.5 fleets coming in at 14.8 fleets.

The adjusted EBITDA margin in the pressure pumping segment remained nearly unchanged in Q2 compared to Q1 despite improved pricing and increased fleet utilization. However, PUMP posted a $0.32 loss per share compared to Q2 net income of $0.11 per share in Q1. In Q2, it recorded a $57 million impairment charge after evaluating the DuraStim equipment. The evaluation revealed that the timely commercialization of its DuraStim hydraulic fracturing assets was uncertain, despite the technology being in place since 2019. So, the company does not expect to deploy the equipment in its current form, which can also adversely impact its margin in the coming quarters.

Balance Sheet and Cash Flow Analysis

In 1H 2022, PUMP’s cash flow from operations (or CFO) increased by 68% compared to a year ago, primarily led by the year-over-year rise in revenues. Despite that, its free cash flow (or FCF) turned negative in 1H 2022 because of a significant capex rise. In FY2022, the company’s capex is projected to increase by 126% versus FY2021 following its decision to purchase additional Tier 4 DGB units as it transitions to more gas-burning and electric offerings. Although this will drag the FCF, which is already strained, improved pricing will effectively increase profitability on the newly converted fleet. In FY2023, however, capex is expected to fall.

PUMP’s total liquidity as of June 30 was $185 million (includes cash and available capacity under an asset-based credit facility). As of that date, it had no debt. This makes it significantly safer than some of its overly leveraged peers (PTEN, LBRT, and NBR).