Writing about the global markets, in one way, has only become a repetitive exercise in that the overall message remains the same. What changes is the indicators, some new ones are added or the current ones intensify. Most of it is bad news. It is only a matter of when not if – it never was. Global sentiment is shifting at a very fast pace. It is certainly the worst time to be a trader – or the best (?) given how good you are at sailing in a storm. In this brief article I will focus on three things: 1) future of oil prices 2) recession 3) Chinese demand and additionally I will also give a passing mention to housing markets.

What about oil prices?

Oil markets are extremely volatile at the moment. Although the markets gained a tad this week but mostly remained underpressure with prices set to fall 23 percent this quarter. What is driving a fall in oil prices? Firstly, it is the overall recessionary fears and impending demand destruction that has affected the mood of traders. Secondly, there is certainly some profit taking going on as oil prices continue to rise and fall in the ballpark of $80 to $90. Thridly, a stonger dollar that continues to weigh down on commodities. As I wrote last week, the supply fears were overblown. Infact, supply has outstripped demand with further reduction in consumption in the near offing.

The reason oil prices gained slightly was an announcement by OPEC+ that they might cut output.

As prices have continued to fall the group might want to stabilize the markets. Rumors are it would be less than a million bpd. We will see about that. Recently, OPEC+ managed to produce about 210,000 more than last month making it their highest output since 2020. Despite this the group has not been able to meet its production quota as output from 10 members was 1.32 mbpd short their September target. The shortfall can mainly be attributed to Russia and Nigeria while Libyan production has gained.

A shortfall in OPEC+ production does not mean that the markets are undersupplied rather the opposite. Chinese demand issues can exacerbate this problem.

When will there be a recession?

Nobody knows! But I think we are already in it. Recession isn’t binary in nature that there will be a start and end point to it. It is like a wave (as are most phenomenon in this world) rising and falling but never going away. A quick Google search by anyone without having knowledge about economics can tell that the world economy is not doing well and that future looks scary. Look at UK where inflation has risen to a 40 year high and rising food prices have been the main driver of this increase. Food inflation in the UK has hit the highest on record since the data was started to record (2005). The latest numbers suggest that food prices increased 10.6 percent in September up from 9.3 in August. Pound also fell to its lowest against the dollar.

Nouriel Roubini, the man who forecasted the 2008 market crash, has warned that the world should prepare for a “long and ugly recession“. Other important figures like Paul Krugman has also joined the chorus. A recent survey by World Economic Forum said that 7 out of 10 economists think a recession is somewhat likely in 2023.

Chinese economic demand

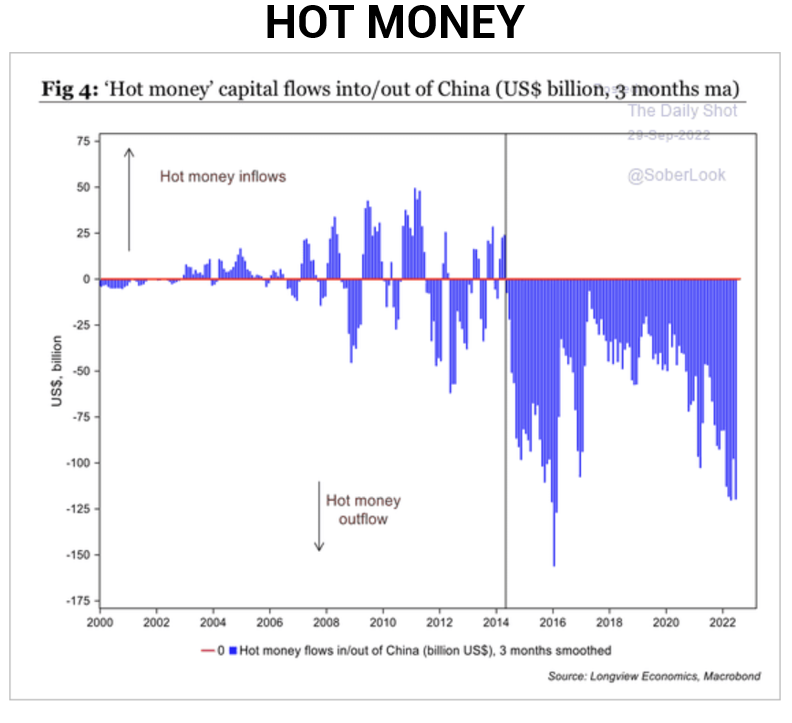

Economic data coming out of China has not been very promising and have traders and policymakers worry about the health of world’s second largest economy. Covid lockdowns has created a sense of uncertainty and led to fall in oil demand amongst other things. Moreover, a falling currency and rising dollar has increased the risk of capital flight futher affecting the economic confidence in the country.

Have a look at this chart that shows a huge outflow of money.

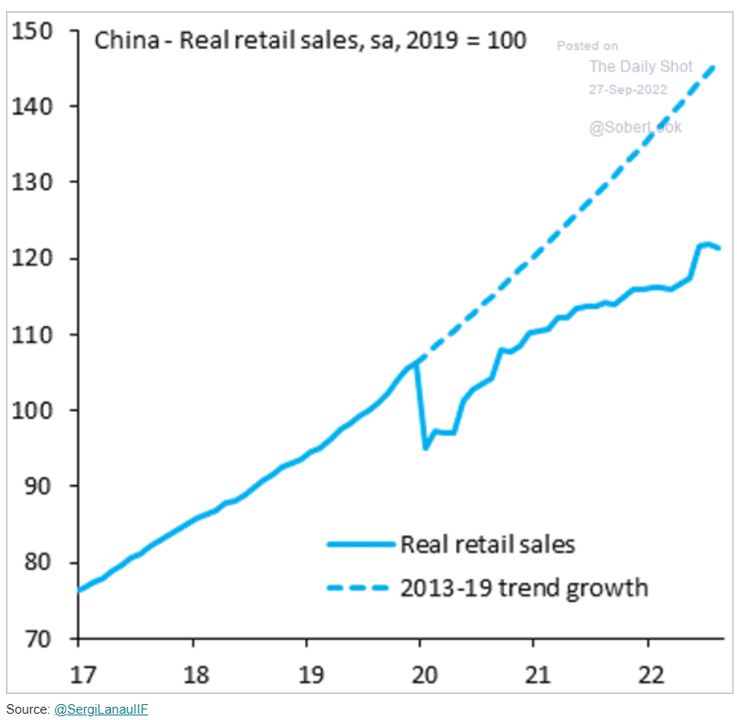

Another interesting one:

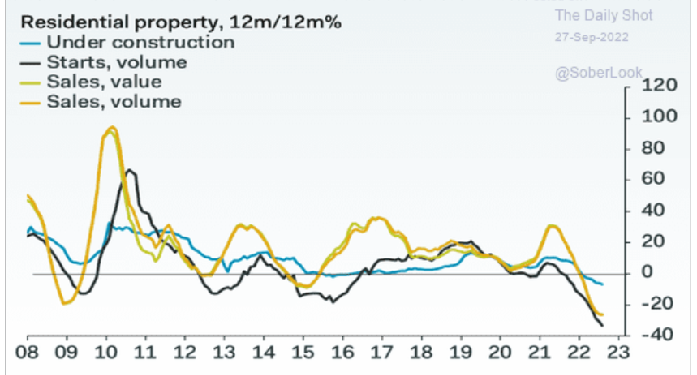

This one shows the trend in property sector. China’s real estate sector accounts for almost 30 percent of its GDP hence anything happening in it has wider implications for the country’s econonmy.

The U.S. housing market recently saw an uptick in home sales but this is not sustainable. The point might be that home inventories are being brought down by constructors by reducing prices. “About 685,000 new single-family houses were sold last month on a seasonally adjusted annual basis, climbing 29% above the July rate of 532,000 and coming in much higher than analyst projections averaging 500,000, the Census Department reported on Tuesday” but this might not be sustainable at all as the current mortgage rates, rising inflation and hawkish stance by Fed makes it clear.

Buckle up for another week of high volatility!